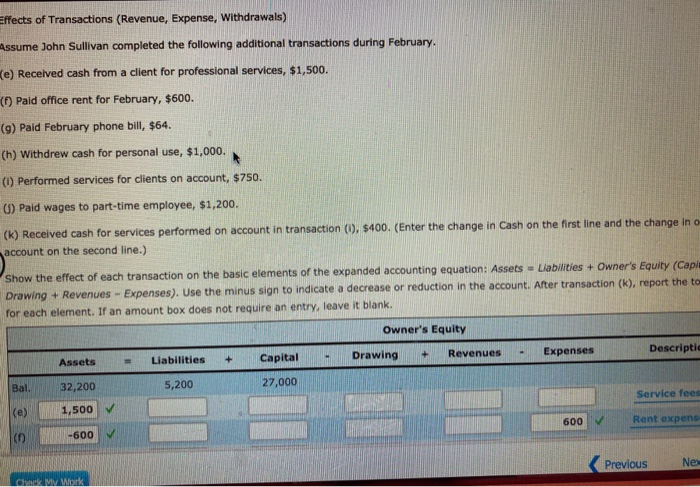

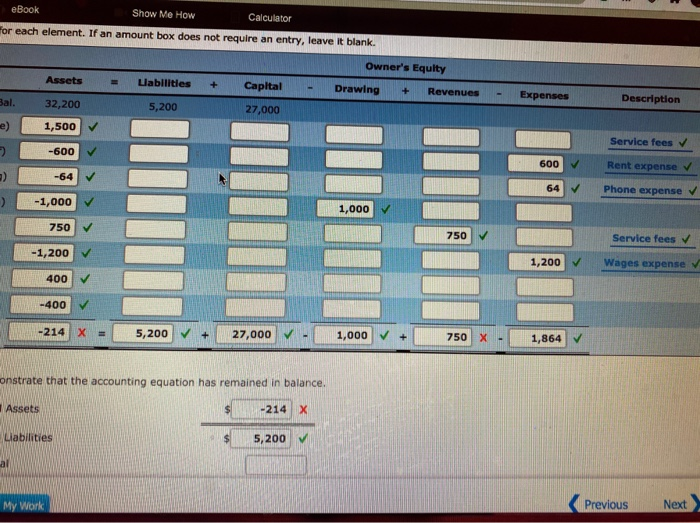

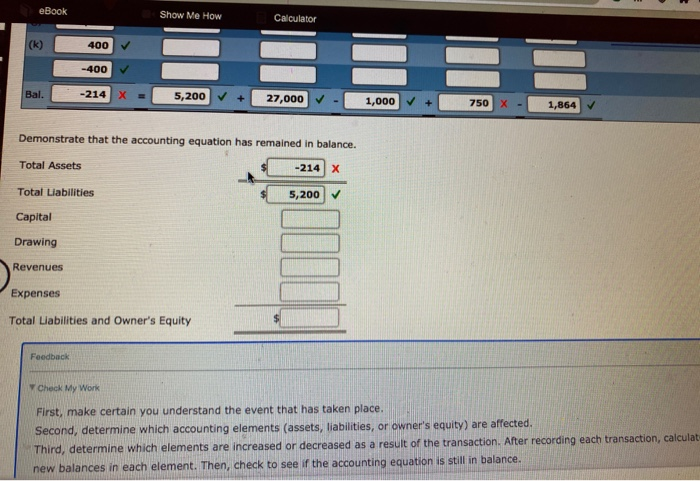

Effects of Transactions (Revenue, Expense, withdrawals) Assume John Sullivan completed the following additional transactions during February. (e) Received cash from a client for professional services, $1,500. (0) Paid office rent for February, $600. (9) Paid February phone bill, $64. (h) Withdrew cash for personal use, $1,000. (1) Performed services for clients on account, $750. (1) Paid wages to part-time employee, $1,200. (k) Received cash for services performed on account in transaction (1), $400. (Enter the change in Cash on the first line and the change in o account on the second line.) Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets - Liabilities + Owner's Equity (Capi Drawing + Revenues - Expenses). Use the minus sign to indicate a decrease or reduction in the account. After transaction (k), report the to for each element. If an amount box does not require an entry, leave it blank. Owner's Equity + Revenues Expenses Descriptid Assets Liabilities + Drawing Capital 27,000 Bal. 32,200 5,200 Service fees (e) 1,500 600 Rent expens ( -600 Previous Nex Chack Mork eBook Show Me How Calculator for each element. If an amount box does not require an entry, leave it blank. Owner's Equity Assets Llabilities + Capital Drawing + Revenues Expenses Bal. Description 32,200 5,200 27,000 e) 1,500 Service fees - -600 600 Rent expense :) -64 64 Phone expense ) -1,000 1,000 750 750 Service fees -1,200 1,200 Wages expense 400 -400 -214 x 5,200 27,000 1,000 + 750X - 1,864 onstrate that the accounting equation has remained in balance, Assets -214 X Liabilities 5,200 al My Work Previous Next eBook Show Me How Calculator (k) 400 -400 Bal. -214 X = 5,200 + 27,000 1,000 + 750 X - 1,864 Demonstrate that the accounting equation has remained in balance. Total Assets -214 X Total Liabilities 5,200 Capital Drawing Revenues Expenses Total Liabilities and Owner's Equity Feedback Check My Work First, make certain you understand the event that has taken place. Second, determine which accounting elements (assets, liabilities, or owner's equity) are affected. Third, determine which elements are increased or decreased as a result of the transaction. After recording each transaction, calculat new balances in each element. Then, check to see if the accounting equation is still in balance