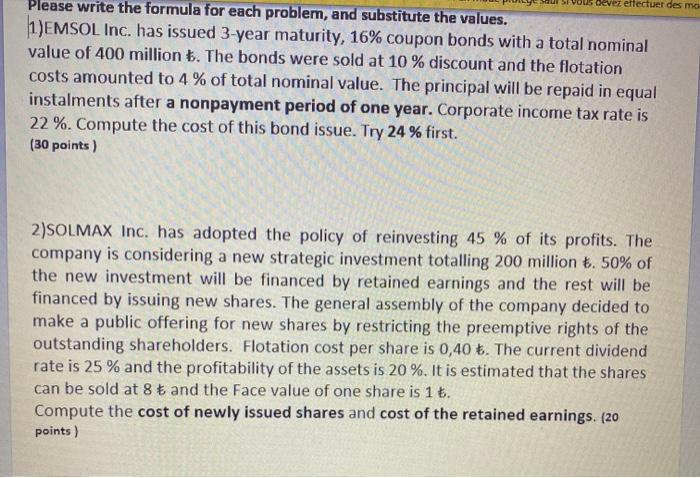

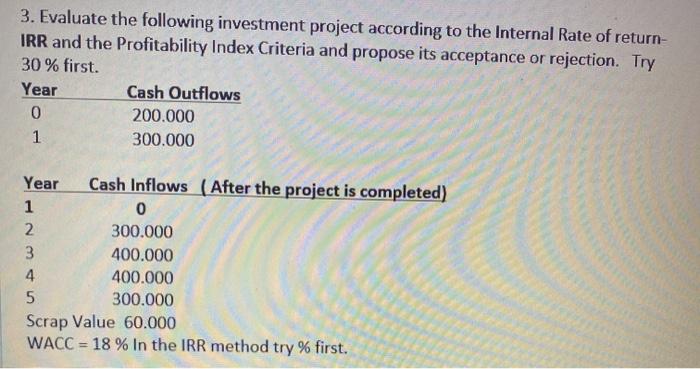

effectuer des mo Please write the formula for each problem, and substitute the values. 1)EMSOL Inc. has issued 3-year maturity, 16% coupon bonds with a total nominal value of 400 million $. The bonds were sold at 10 % discount and the flotation costs amounted to 4% of total nominal value. The principal will be repaid in equal instalments after a nonpayment period of one year. Corporate income tax rate is 22 %. Compute the cost of this bond issue. Try 24% first. (30 points) 2)SOLMAX Inc. has adopted the policy of reinvesting 45 % of its profits. The company is considering a new strategic investment totalling 200 million $. 50% of the new investment will be financed by retained earnings and the rest will be financed by issuing new shares. The general assembly of the company decided to make a public offering for new shares by restricting the preemptive rights of the outstanding shareholders. Flotation cost per share is 0,40 . The current dividend rate is 25 % and the profitability of the assets is 20 %. It is estimated that the shares can be sold at 8 and the Face value of one share is 1. Compute the cost of newly issued shares and cost of the retained earnings. (20 points) 3. Evaluate the following investment project according to the Internal Rate of return- IRR and the Profitability Index Criteria and propose its acceptance or rejection. Try 30 % first. Year Cash Outflows 0 200.000 1 300.000 Year Cash Inflows (After the project is completed) 1 0 2 300.000 3 400.000 4 400.000 5 300.000 Scrap Value 60.000 WACC = 18 % In the IRR method try % first. effectuer des mo Please write the formula for each problem, and substitute the values. 1)EMSOL Inc. has issued 3-year maturity, 16% coupon bonds with a total nominal value of 400 million $. The bonds were sold at 10 % discount and the flotation costs amounted to 4% of total nominal value. The principal will be repaid in equal instalments after a nonpayment period of one year. Corporate income tax rate is 22 %. Compute the cost of this bond issue. Try 24% first. (30 points) 2)SOLMAX Inc. has adopted the policy of reinvesting 45 % of its profits. The company is considering a new strategic investment totalling 200 million $. 50% of the new investment will be financed by retained earnings and the rest will be financed by issuing new shares. The general assembly of the company decided to make a public offering for new shares by restricting the preemptive rights of the outstanding shareholders. Flotation cost per share is 0,40 . The current dividend rate is 25 % and the profitability of the assets is 20 %. It is estimated that the shares can be sold at 8 and the Face value of one share is 1. Compute the cost of newly issued shares and cost of the retained earnings. (20 points) 3. Evaluate the following investment project according to the Internal Rate of return- IRR and the Profitability Index Criteria and propose its acceptance or rejection. Try 30 % first. Year Cash Outflows 0 200.000 1 300.000 Year Cash Inflows (After the project is completed) 1 0 2 300.000 3 400.000 4 400.000 5 300.000 Scrap Value 60.000 WACC = 18 % In the IRR method try % first