Question

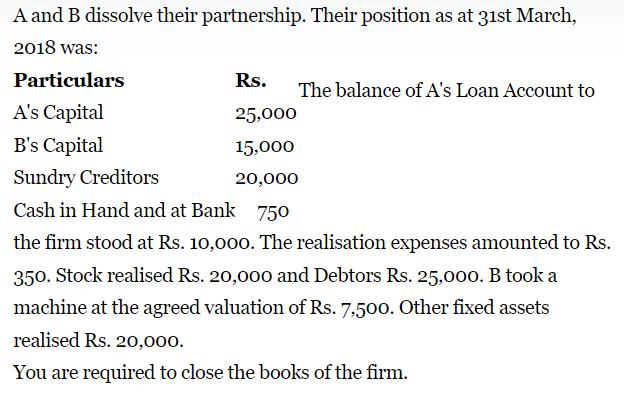

A and B dissolve their partnership. Their position as at 31st March, 2018 was: Particulars A's Capital B's Capital Rs. 25,000 15,000 Sundry Creditors

A and B dissolve their partnership. Their position as at 31st March, 2018 was: Particulars A's Capital B's Capital Rs. 25,000 15,000 Sundry Creditors 20,000 Cash in Hand and at Bank 750 the firm stood at Rs. 10,000. The realisation expenses amounted to Rs. 350. Stock realised Rs. 20,000 and Debtors Rs. 25,000. B took a machine at the agreed valuation of Rs. 7,500. Other fixed assets realised Rs. 20,000. You are required to close the books of the firm. The balance of A's Loan Account to

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Realisation Account Particulars Amount Particulars Amount To Sundry Assets working notes 69250 By Su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting Chapters 1-30

Authors: John Price, M. David Haddock, Michael Farina

15th edition

1259994975, 125999497X, 1259631117, 978-1259631115

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App