Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EFG Hermes Egypt for investment services has reported the following amount for the year ended 31 December 2018: Net Income of $20 million, total

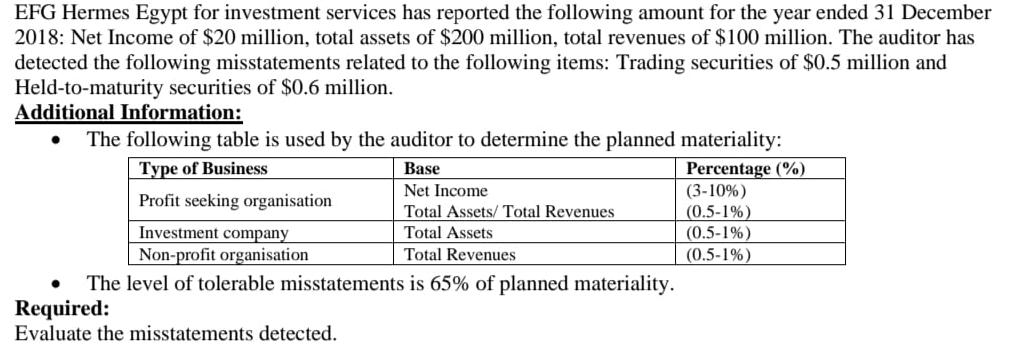

EFG Hermes Egypt for investment services has reported the following amount for the year ended 31 December 2018: Net Income of $20 million, total assets of $200 million, total revenues of $100 million. The auditor has detected the following misstatements related to the following items: Trading securities of $0.5 million and Held-to-maturity securities of $0.6 million. Additional Information: The following table is used by the auditor to determine the planned materiality: Type of Business Percentage (%) (3-10%) Profit seeking organisation (0.5-1%) (0.5-1%) (0.5-1%) Base Net Income Total Assets/ Total Revenues Total Assets Total Revenues Investment company Non-profit organisation The level of tolerable misstatements is 65% of planned materiality. Required: Evaluate the misstatements detected.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the misstatements detected for EFG Hermes Egypt for investment services we need to calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started