Answered step by step

Verified Expert Solution

Question

1 Approved Answer

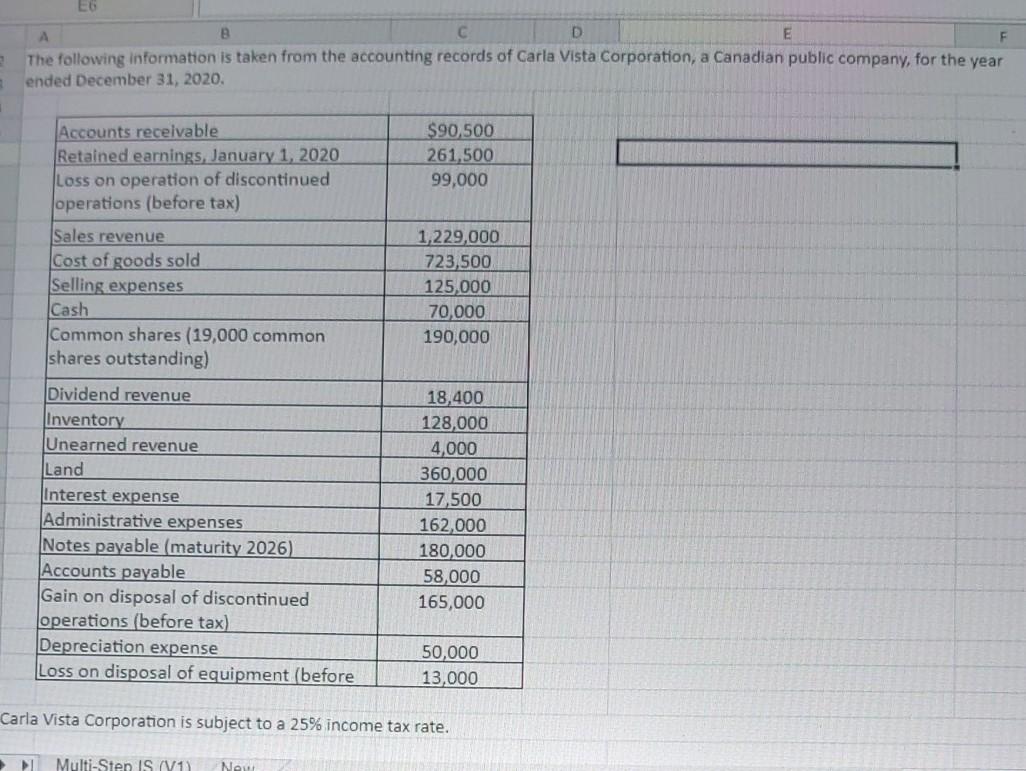

EG C F D The following information is taken from the accounting records of Carla Vista Corporation, a Canadian public company, for the year ended

EG C F D The following information is taken from the accounting records of Carla Vista Corporation, a Canadian public company, for the year ended December 31, 2020. Accounts receivable Retained earnings, January 1, 2020 Loss on operation of discontinued operations (before tax) $90,500 261,500 99,000 Sales revenue Cost of goods sold Selling expenses Cash Common shares (19,000 common shares outstanding) 1,229,000 723,500 125,000 70,000 190,000 Dividend revenue Inventory Unearned revenue Land Interest expense Administrative expenses Notes payable (maturity 2026) Accounts payable Gain on disposal of discontinued operations (before tax) Depreciation expense Loss on disposal of equipment (before 18,400 128,000 4,000 360,000 17,500 162,000 180,000 58,000 165,000 50,000 13,000 Carla Vista Corporation is subject to a 25% income tax rate. Multi-Sten IS (1) New Prepare a multiple-step income statement in good form for Carla Vista Corporation (10 marks) 28 Carla Vista Corporation Income Statement For the Year Ended December 31, 2020 30 31 32 33 34 35 36 37 18 9 o 1 2 3 3 Multi-Step IS (V1) New

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started