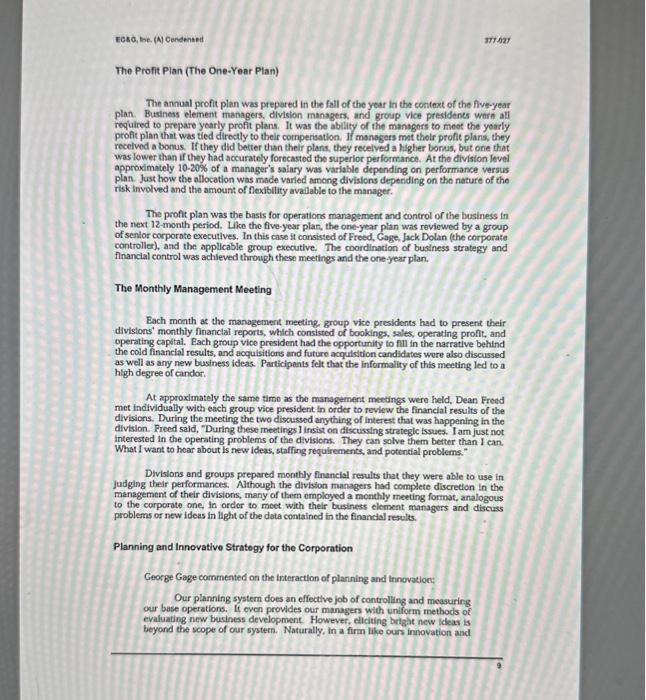

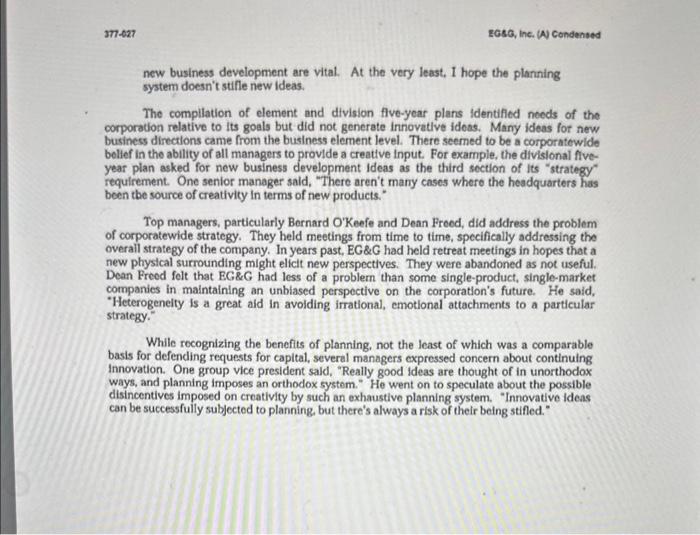

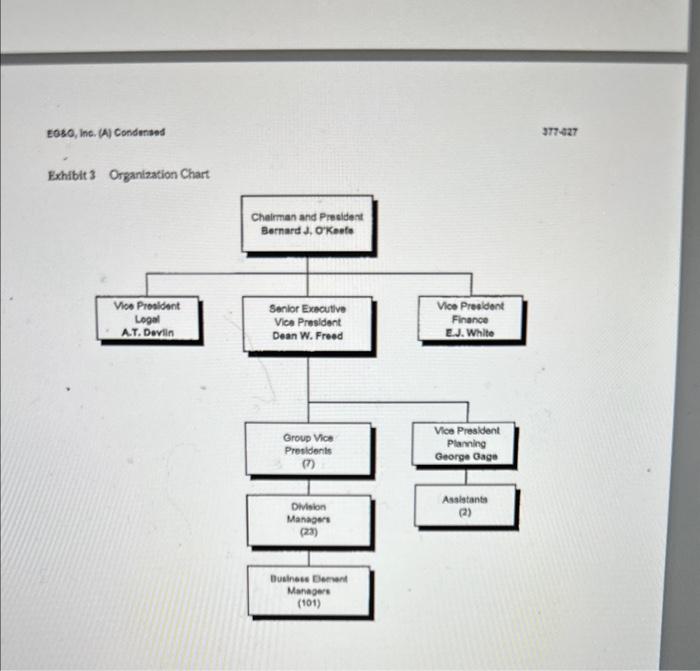

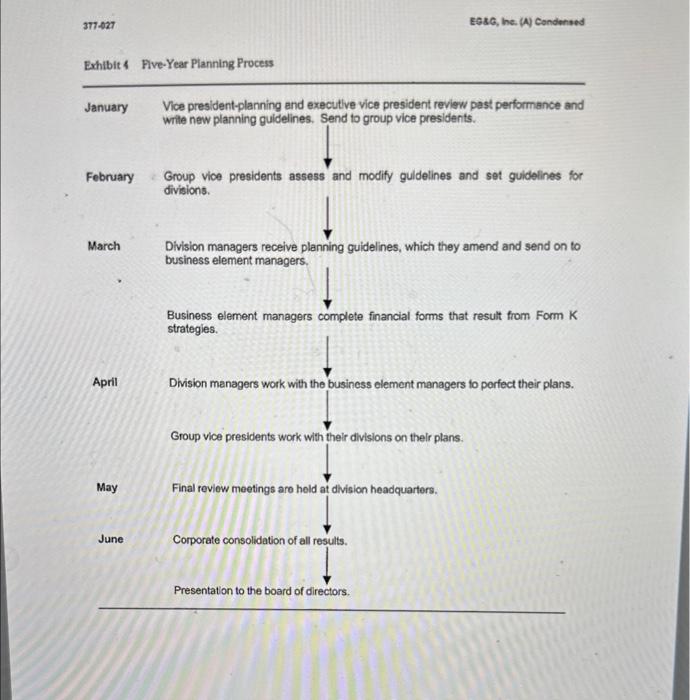

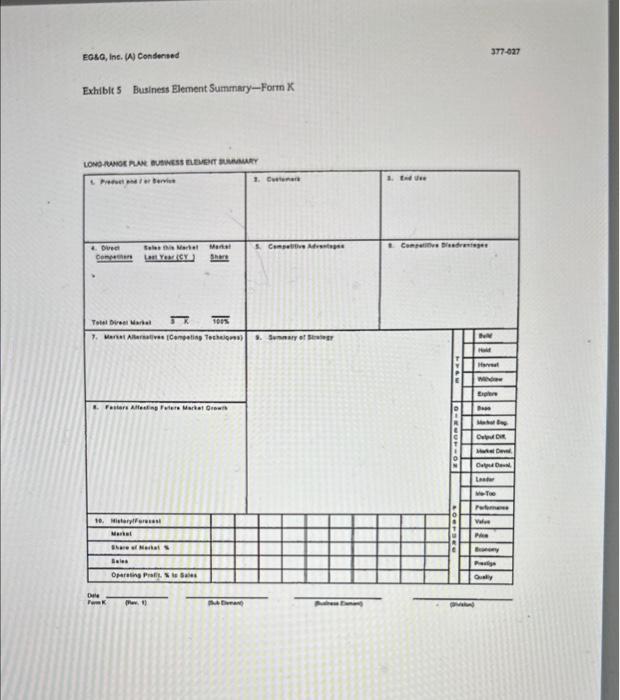

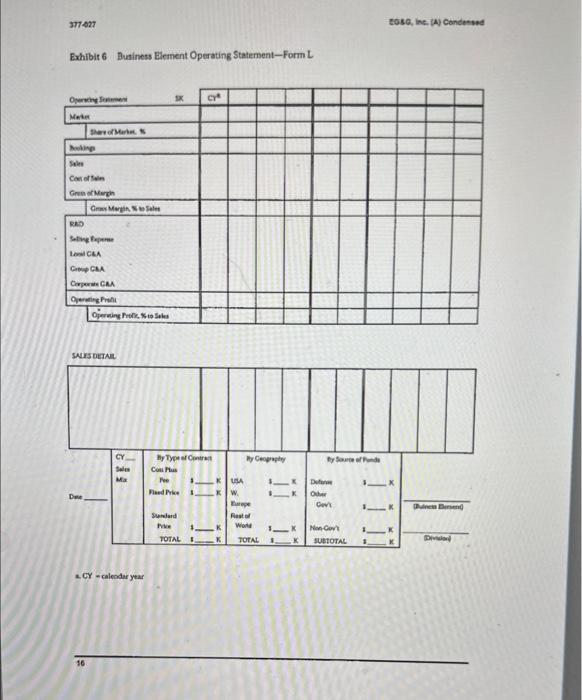

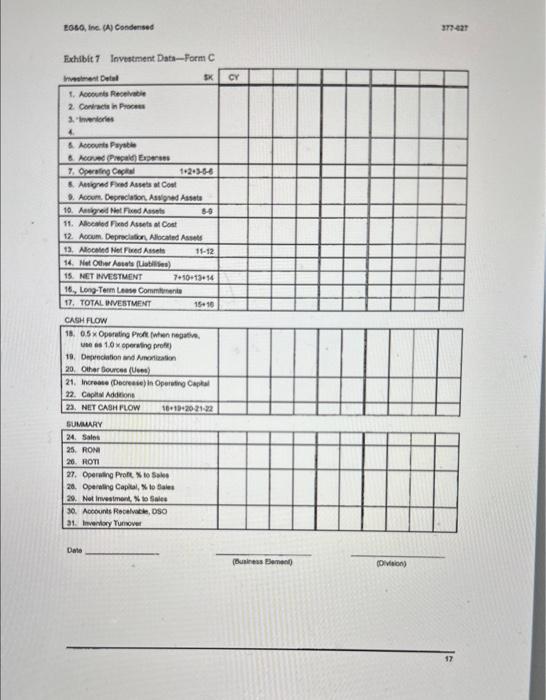

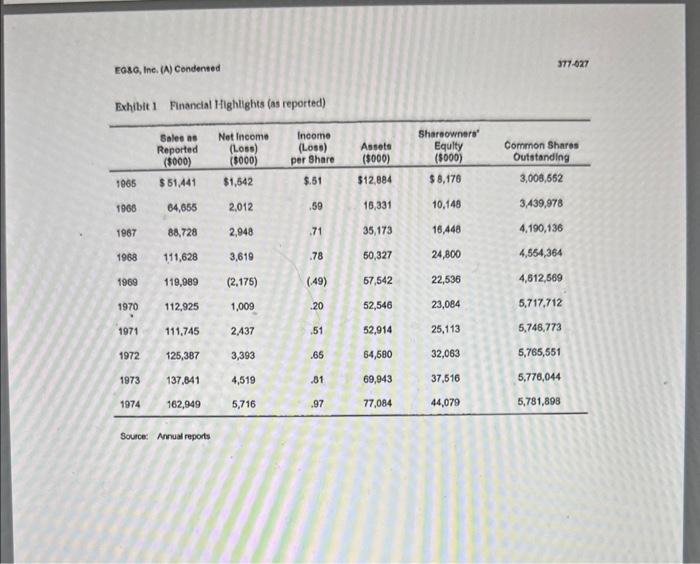

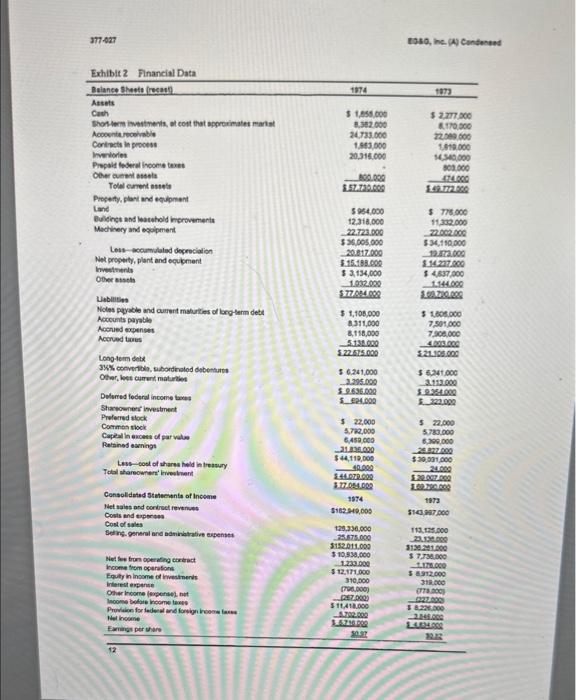

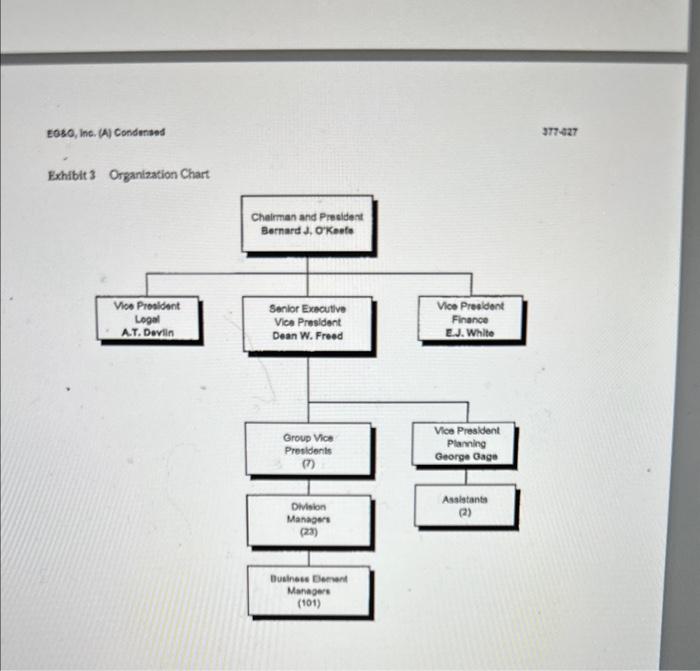

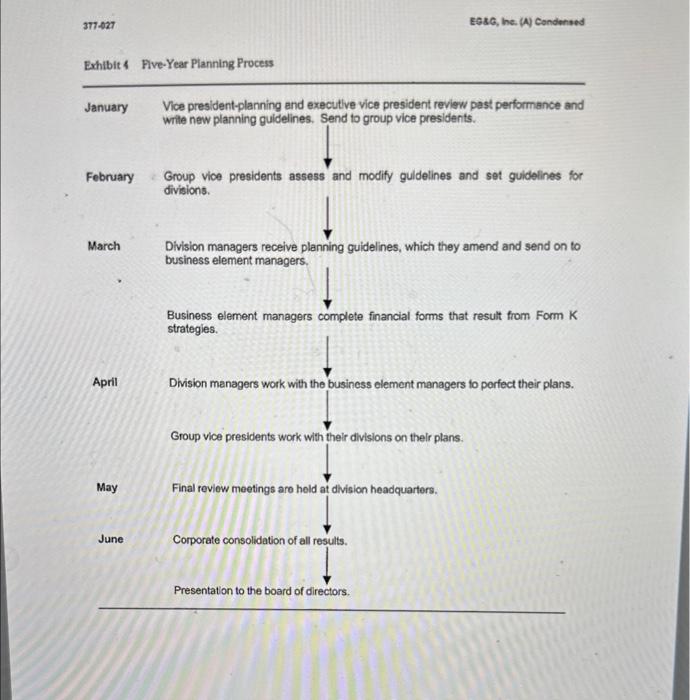

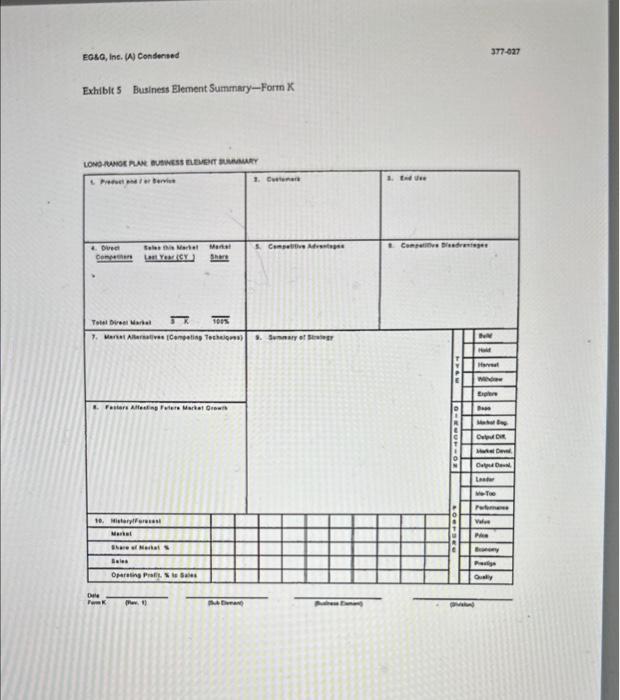

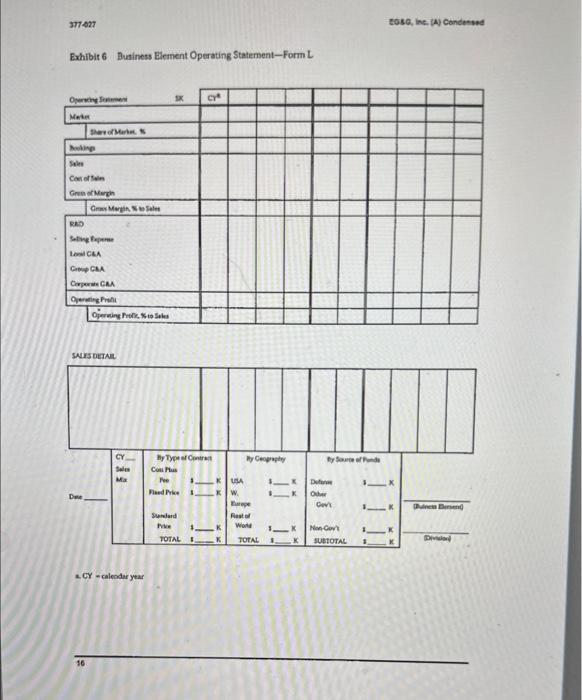

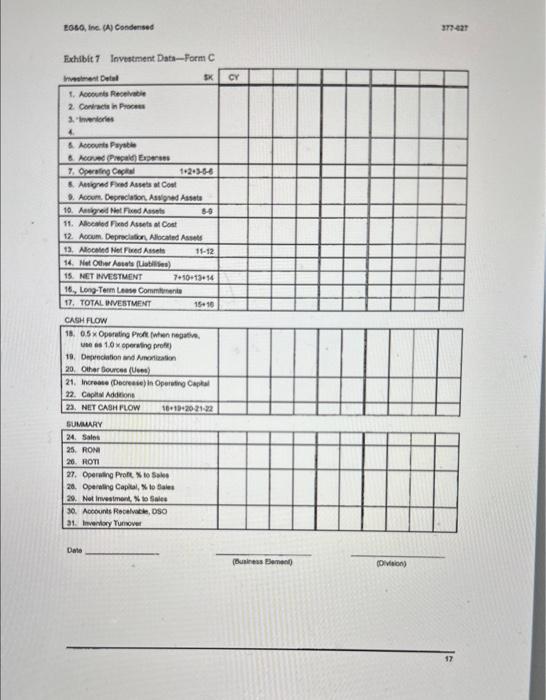

EG\&G, Inc. (A) Condensed In 1974EG8G was enjoying success as the manufacturer and marketer of a wide variety of technically oriented products. EG\&G's operations were international in scope and the fnancial community had recently sized up BGEG's performance very favorably. Merrill Lynch's Institudional Investor stated: EGEG has reported successlvely higher quarterly sales and earnings comparisons with year-earlier results throughout the current economic recossion. We believe that its energy tochnology related activities, successful accuisition, and strong financial management capablitties are chicfly responsible for its excellent earnings performance.... EGBG is uniquely associated with energy research and development and has a reputation for providing the highest quality products and services in its specialized fleld. Fxhibits 1 and 2 give EG\&G's financial history and recent balance shcets and income statements. Background During the course of America's development of nuclear energy, one of the more formidable problem-solving groups was a trlo of MIT professors named Bdgerton, Germeshausen, and Grier. The three worked so well together that in 1997 they decided to form a company, whose name bore their initials, that would serve as a prime contractor to the Atomic Bnergy Commission and other government agencies in furnishing a variety of scientifle and technical services in the electronic and nucleonic flelds. From the beginning, the company was technically oriented, putting the emphasis on invention and entrepreneurship. Durling the 1950 s, revenue came primarily from government contracts. However, under the impetus of Bernard O'Keefo, one of the original employees, EG\&G at this time took its first tentative steps toward diversification into the commercial market, attempting at the same time to become more "hardware" than purely service orlented. for class discussion rather than to Iffextrate either effective or inefietive handiling of an adininistrative stuadion. Copyright 01976 by the President and Fellows of Harvard Colloge. To arder coples or request permiasion to reproduce materials, call 1.600-545-76B5 or write Harvard Buainess School Publishing Beston, MA 02163. No. part of this publication may be reproduced, stored in a retrieval system, used in a spreadiheet, or irarsmined in any form or by any means-electronic, mechanical, photocopying, recording or otherwise-without the pernisulon of Harvard Business 5 chool. 377.427 Faso, he. (A) Cordensed The decade of the 1960s was a period of success for high technology firns, and the government continued lts heavy demand for BGBG-s services. EGE.C went public ln the early 19gos and enjoyed a great reception, with P/E's as high as 100 . In 1955 bermard OrKecle was made president. At about the same time, the environinent in which the cotnparty operated also began to change. Technology for technology's sake was becoming less sacrosanct. and the federal government began to shift Its support from space programs to Vietnam. O'Keele decided it was time to take major dlvensification steps with the equity money then available in order to brosden the still relatively narrow focus of the firm's business. About 20 technically orlented companies were acquired during this period, which more than doubled the business areas in which BGBGG was involved. The mariagernent systems used throughout EGRG at this time were financlal accounting procedures, which sormetines lacked censistency botween bustness areas, and a periodic companywide forecast of stles and profits. Some of the more commerclally orlented dlvleions were using an early planning system. Until 1969 EC 2 G returned otitanding financlal results, with consistent EPS growth of 15+%6 and return on stockholders' equity of 15+%. The year 1969 brought a number of traumas to BGRG. For the first and only tume during Its exlstence the company lost money (see Fxhibit 1) due to large cost overruns on a fixed price government contract. In addition, tho stock market was no longer enamored of high tochnology companles and thus EGEG's stock price, not to mention the value of senior mantagement's accumulated equity holdings, took a nose dive. Several managers referred to this experience as their first realization that PGEG could make mistakes. Following this experience, which one senior manager referred to as "an ldentity crisis," control became a popular goal at ECRG. Bemazd O'Keefe, In particular. put great stress on plarining and the ability to predict problemt. He believed that managemerit neoded access to Iniformation of which to base decisloca aborat which business units to keep in the company and Which ones to spin off. The company began to pay attenition to limiting the amount of resources thed up in accounis recelvable and inventory. EGEC. which had always valued the lnnovative englneer, began to demand increased management skill w weil. O'Keefe also saw the need for planning throughout the company. The early long-range planning system that had been developed intermstly over the preceding elght years and that had been used primarily in commercially oriented divisions was modifled in order to make it uniform and applicable to all divisions. O'Keefe hired an outsider, Dean Freed, experiencod in the use of planning, to take over the operational managenent of the business. At the same time he hired outside consultants. Arthur D. Little and some academics from the Boston area-to evaluate the compary's plarning system. Having been reassured that the system was a valid and consistent one, he encouraged operating managers to cooperate with the head of planning. George Gage. During the next two to three yoars, Freed and Gage worked with these managers to implement the syatem throughout the company. Coorge Cage sald: When the planning system was being developed, much of my time was spent working on the system itself. Subsequently, as the system began to mature and stabillze. my time was increasingly spent on selling and applying the systern throughout the cotmpany. Our experience indicates that about two years are required from the time a system is first introduced in an organization to the time when that orgarization ls producing good plans. cosa, ine. (A) Condented EG8C ln1974 Alahough BGBG did sell off nome of the acquisitions it had made in the 1960after the loss in 1968, it still produced a wide varlety of products and services. By 1974, EC SC provided scientific and technically orlented products. custorn equipment, 5ystarns and related or specialized services to government and industrial customers. Jts products and services were clatsiffed into six business areas: components for industrial equipment, scientific instruments. environmental testing systems and services, biomedical services, high technology systerns and servioes for the federal government, and Energy Reseasch and Developinent Adininlotration support. Corporate goals were explicitly stated by top management in the Planring Manual developed by George Gage: BGEG is a company dedicated to develop and prosper from the commercial, Industrial, and government application of technological products and services. Since technological progress and its market acceptance are not always predictable, the company strategy is to diversify its resources into a mamber of market areas, a variety of procucts and services, and a judiciocs blend of mature and emerging Industries. Organizationally this translates Into a number of self-sufficient divisional profit centers, grouped by market compatibility, with corporate emphasis on performance measurement, planning. and resource allocation. The corporation is thus uniquely quallfied to fdentify and exploit opportunitles in products and services for a varlety of markecs from mature as well as emerging technologies.... The long-term growth goal we have chosen is an appreciation in earnings per share of 15% per year while maintalning a minimurs arnual retum of 15% on our stockholders' equity. These goals will require performance considerably above average, but are reasonable and achlevable with aboveaverage effort. EG\&G tried to meet these goals by participating in a large number of high technology industrial and government markets. Typically BCRE was, or was striving to be, a leader in its market segments. The Company Milieu EC8C's corporate headquarters was in an industrial developenene in Bedford, Massachusetts, neer Route 128. The area contained many other technical firms, and at any given lunch hour a visitor would see groups of employees jogging around the buildings or playing Frisbee. EGRG's head office, built in the 19600, had simple decorations that attempted to alleviate the cinder-block walls. The company's senior management was located in Bedford. Fee Exhiblt 3 for an organization chart). The president, Bernard) ".Barney" O'Keefe, was a jovial, extroverted man involved in many projects outside the company, such as organiaing private businesses in Massachusetts to fund a Chicago consulting firm's study of the managernent of the state of Massachusetts. He was on the board of directors of 11 compenles. 37.027 Eosa, lec. (W) Consentes Dean Freed, executtive vice president in charge of directing the corporation's operating divisions and subsidiaries, had an office next to O'Reefe. He hid a direct, efflicient manner that quickly revealed a very thorough grasp of all that went on in the company. He hed joined EGEG In 1970, after having worked as a vice president responsfle for thret divlaions at Bunker Ramo and holding executive management positions at TRW, Inc, in manufacturing and marketing. Ho had recelved a B.S. In mechanical engineering from Swarthinore College and an M.S. from Purdue University. His office was decorated with aeritl photographs, and two large. battered briefcases were always kept nearby. In describing Freed, a colletgue said: "Dean ls really a superior manager. He's like a teacher. He knows how to improve an inventory systern or marketing program. When he's dealing with other managers, he is completely straightforward. He likes people to argue back at him and never bears a grudge against thein the ntat day If they do." George Gage was vice president in charge of planning at EGEG and also had an office among the top executives at Bedford. He had joined EGEG in 1982 with the mission to develop and implemerit a meaningful planning system to support long-term goals and had recently been made a vice prestdent. When Dean Freed joined the flrm, Gage switched from reporting to OKecie, to reporting directly to Freed. Gage had two assistants. Otherwise. Freed and Gage had no staff support. "Many of EGEG's managers were rarely at Bedford, since the company's businesses were so geographically dispersed. The company had operations in 20 states and 16 foreign countries. The majority of employees at EGRG had similar backgrounds. When asked about the type of person who worked at EG\&G, George Gage said, "Oh, of course, we're all engincers." Critical to the managernent process of EGEG was the monthly management meeting. It was held at corporate headquarters in Bedford. The meeting was chalred by O'Keefe and consisted of Freed, the seven group vice presidents, and the senior staff. There was a prescribed agenda that typically consisted of, announcements, operations revlew, Investments, acquisitions, and general discussion. O'Keefe used the announcement segment to inform the committee of new fdeas he had galned in his travels around the country. A participant described the meeting as the "chief communication vehicle at BGE.G." A major committee within BGgG was the business development commirtee, which was composed of O'Keefo, Germeshausen (the retired chairman). R.). White (vice president-flnance), Cage, and Freed. O'Kecfe and Germeshausen did not attend every meeting. The major function of this commlttee was to review the five-year plans of the company's divisions. The reviews took place once a year at the divisional headquarters. The Planning Process The planning process at BGKG was divided into two major parts; the five-year plan and the profit plan. The mojor activities related to the two segments took place at different times of the year. The five-year plan focused on strategy setting. The profit plan was a financlally otiented plan covering a 12 -month perlod. Both were described in the BGEG Plannlng Manual. which was provided to all mariagers in both a desk copy and a portable form. Reflecting on his impression of the planning system, Dean Freed said: RG\&Q, Int (A) Condenesd It is a great adventage for division managers to be given a framework of analydis, a wey to test Ideas. Barically, we want pianning to test whether the things which a division manager wants to do with his assets are consistent with the strategy and competitive position of that particular division. In fact. Id say going through our planning process and getting to fully understand ail its fmplications is a magnificent business school. Corporate Structure and the Planning Process The lowest level at whlch EGEG requlred strategic plannlng was the "buriness element." This was defined as a "business system which involves a single product line or a particular service capabtity being supplied to satisfy the needs of a single market segment." George Gage brought the idea of business elements to ECEC when he joined the company in 1962. During the intervening years the idea grew from use only in the commercial products divisions to corporatewide acoeptance. Top management believed that good definition of business elements was important, simoe business elements were homogeneous products or services in a slingle market segment and were therefore particularly well sulted for analysis and fortcasting. As one manager put it, "In many of our businesses RGLG has concentrated on specialized segments which business element managers are able to totally underatand. The kay is to describe the right battlefield, deflne the right business element." BCRG. had 10t separate business elements with total sales of $163 million, each the responsibllity of a business element menager. These ranged in site from 55+ mililon in sales for the largest business element to 23 elements with less than 1800.000 annual sales. In the prevlous two years, BGSG hed added 25 new business elements (16 through acputsition and 9 through internal development, divested 4, and discontinund 4 orther. Above the business element level were 27 divialona, esch directed by a division manager. The division manager had iesponsibitity for the delineatlon of business elements in the divisions and for their profit and loss and rucurn on investment. Division managers were also responsible for developing strategies for their divialons as a whole and were expected to be intimately involved in the development of the strategits of each individual business element within the division. Divisions were grouped under seven group vice presidents. These indlviduals were responsible for the periormance of a number of divisions or one particularly large division. They also were part of the corporate administretion. One group vice president described his job as "an extension of Dean Freed." Therefore, the group vice presidents were closely involved in the development of strategy and also were responsible for aiding top management in evaluating strategic plans. In 1974-top management published the Planning Manual in a permanent form. Previously, a new planning manual and directions had been prepared every year incorporating the changes that had taken place. Management now felt that the system was sufficiently mature and that there would be no big changes in the future. 377.027 tase, lhe (A) Condensed The Five-Year Planning Procedure The first half of each year was dedieated to devaloping the company/s five-yaar plan. Exhlbit 4 presents a graphic representation of the system as weil as a timetabie for the different steps involved. Basically, the business development cominitiee provided the kroup vice presidents with planning guldelines, which they In turn modified and passed down through divisioh managers to the business elements. Then the business element, division, and group mansgers created their own detalled five-year plans. These were reviewed by the business development committee. Finelly, the consolidated corporate plan was reviewed by the board of directors. Planning guldelines. The first step of the flve-year planning process took place in January of each year. After reviewing the prevlous five-year plars, George Gage wrote a preliminary dratt of planning guidelines for the group vice presidents. This draft was submitted to the members of the business development committee, who modified it. In Gage's oplnlon it was Freed who had the malor input into the flinal contents of the planning guldelines. These guldelines were on one-page forms and contained both quantitative and qualitative goals for the groups. The group vice presidents then began the cascadting process that eventually would create guldelines for each business element, based on the corporate guidelines that were modifjed by intervening levels of management. Top management expected to have its planning guidelines modified and Gage described the procedure as 2 an opportunity to get all the ground rules and assumptions sorted out before the managers began the five-year plan." Soon after the planning guldelines were recetved, the business development committee sent out a notice of the date on which each division would be reviewed. Accompanying this notice were any modifications in the planning procedure for that yoar and oceasionally Instructions to ald the unlformity of calculation such as forelgn currency exchange rates. The corporate planning staff did not provide the business element managers with ary forecasts or environmental assumptions. Freed was skeptical about long-range economic forecasts: "After about one yoar's time, I'd just as soon use astrology." Business element managers were expected to do their own environmental assesments appropriate for their units. "After all," sald George Gage, "Inflation is good for some of our businesses and bad for others. We don't want to provide our managers with pronouncements which will keep them from analyzing their own situations." Flve-year plan-the business elemente After receiving the division manager's planning guidellnes, business element managers set to work developing the Information for Form K, the "Long-Range Plan: Business Element Summary" (see Exhibit 5). This was the only form that was devoted to strategy ttself. The Planning Manual described Form K as follows: "The purpose of Form K is to provide a convenlent one-page summary of its major strategic factnrs, a succinct statement of the buisiness strategy, and a forecast of performance expected. The use of Form K greatly facilitates communlcation and discussion regarding the business element." Once a business element manager was satisfled with the overall strategy of the element, there were several other forms to be completed in order to express the strategy in financial terms. The first was Form L-the "Business Element Operating Statement" (sce Exhibit 6 ). This was an income statement that isolated certain expense items, the form also roquired actual results for previous years to be compared with those forecasted. Investment also had fits own EOso, inc. ( ( ) Condented 7- forms with which the business element manager had to contend. Form C, the "irvestment Data" form (seo Exhiblt 7), focused attention on the balonce sheot and cash ratios. Flve-year plan-the divielon Division menegers were also responalble for a strategic five-year plan. First, they worked with their business element manegers in order to perfect the individual plans. After the division managers were satishied wth these individual plans, they were required to develop five-year plans for thelr divisions as a whole. Exch contlsted of: (D) divisional goals, (2) divisional strategy, and (3) divislonal summaries. Divisional strategy involved the direction and emphasis of the division as a whole and provided a summary statement of the Form K for each eadsting besiness element and a summary statement of the strategy for any new business development and/or acquisition. The divisional summaries were provided on forms similar to the ones completed by the beasiness elements. Flve-year plan-groups Once the business elcments and divisions completed their plans, the group vice presidents consolidated them. Thelr job, more than the other two levels, contisted mainly of summing the results of their subardinates. They needed to verify consistency and worked with any of their managers whose plans did not meet expectations. Also, if the overall financial results were inadoquate when compared to the expectations of the plarning guldelines previously negotiated, the group vice president would work on improvements both in terms of existing operations and in developing new business ideas. At times, group vice presidents became aware of a weak plan among their clements. Although they would do their best to improve that plan, they might inform the business development comrmittec about the problem in advance of the reviews. Corporate review Prior to tho corporate review, the business develogment committee received and revlewed copies of the five-year plan as submilted. 'The reviews themsclves took place at the divisions' own headquarters. Bach review considered all the business elements for which the division manager was responsible. Each division was represenced by four or five people consisting of the division manager, his principel managers (inclading the controller), and possibly a divisional staff assistant. Depending on the preference of the division manager involved and the need to explain a recent change that might be affecting a particular market, there was sometimes a brief presentation. One civision manager sald he used this presentarioc as an opportunity to give some visibility to an impressive manager in his division. The question-and-answer period that followed was the heart of the review, bowever, and often irvolved heated arguments. As one group vice president sald: The business development committee is sometimes wrong, and specifically, sametimes Dean Freed is wrong. Hits strength is his ability to comprehend the masses of detalls which make up the operations of this company. But he tends to get fixated on one little point which doein't fit or bothers him in some wily. Another perspective on Freed at revlew meetings was: "He's a very irvolved manager. He likes to understand all the facts of the bustiness. And sometimes the operatling managers know better than he does. I guess if you had to fault him, it would be that he over-mimages. Of course, that's easy to say about anyone until something goes wrong.... and that doesn't happen very often around here." The resalt of the question-and-answer period was eldher approval of the plan as presented or a consensus to do the plan again along the lines suggested by ithe buisincas 7.-027 Foso, lre. (A) Condensed development committee. Every year there were three or four signlficant rovisions of the 27 divisional plans presented. The five-year plan was not directly linked with a manoger's compensation. It did come into consideration when a manager was being considered for advancement. Althoxigh EG. C. had a personnel department, it was Dean Freed and the group vice presidents who rnade docisions about managers advancing to the dtvision level. A couple of division managers had been removed for not belng able to come to grips with the planning expectations at EGRE. Dean Freed reflected on the seriousness with which the inablity to plan strategically was viewed: "It is a serious problem if a division manager has one business element whose flve-year plan is not rigorous and consistent. If succeeding flveyear plans exhibited the same problems, that division manager's carcer is in trouble. After all, if it's easy for me to see the fallacy of the strategy In the time I spend studying the plan, why didn't the manager?' When the commlttee was at a location evaluating a plan, It started by trying to understand the market involved. as described In Form K. From an unclerstanding of the market, the committee then tried to evaluate whether the strategy was conststent with that market. Freed said, "If a business element has had 5% of a market and forecasted that it would have 30% of the market in flve years, they need a more creatlve strategy than 'trying harder," Once the business development committee approved a business element and division plan, the division and business element managers were finished with the formal preparation of the flveyear plan for that yoar. Although the planning process involved a great deal of time and effort on the part of EGaG managers, thcy scemed to appreciate the information it provided. One division manager said: It really takes a lot of work to complete the requirements but once you learn the system, with the ald of George Gage, it becomes an extremely useful management ald. All the other managers have the same frame of reference so it makes communlcation easier. It's important to be forced to take a long look at what you're trying to do rather than constantly dealing with the day-to-day problems. Without the requirement, I know I would postpone it in favor of the operating problems at hand. Beyond that, it is a great reference during the year with which to judge your progress. Consolidation and presentation to the board After careful review of the divisional five-year plans, Gage and Freed were chiefly responsible for producing the forecasts of sales and earnings on which corporatewide planning was based. Bernard O'Keefe used these forecasts as part of his presentation to the board of directors of the consolidated five-year plans. Top management expected financial results to vary in forecasts due to unforeseen and uncontrollable events, but. BG8G had an excellent record in forecasting the performance of its ongoing businesses. The board had never relected a corporate flve-year plan but did offer suggestions, such as an adjustment in the procedure for treating inflation, which were used in planning the following year. Eesc, he. (A) Condeneet 37.028. The Profit Plan (The One-Year Plan) The annual profit plan was prepared in the fall of the year in the context of the fiveyear plan. Business element managers, division managers, and group vice presidenes were all required to prepare yoarly profit plans. It was the ability of the mansgars to meot the yoarly profit plan that was tied directly to their compersation. If manogers mat their proft plans, they recelved a bomus. If they did better than their plans, they received a higher bonus, but one that was lower than if they had accurately forecastod the superior performance. At the division level approximately 10-20\% of a manager's salary was varfable depending on performance versus plan. Just how the allocation was made varied arnong divisions depending on the nature of the risk involved and the amount of flexibility available to the manager. The profit plan was the basis for operations management and control of the business fn the next 12-month period. Liloe the five-year plan, the one-year plan was reviewed by a group of senior corporate executlves. In this case it consisted of Freed, Gage, Jack Dolan (the corporate controller), and the applicable group executive. The coordination of business strategy and financial control was achleved through these meetings and the one year plan. The Monthly Management Meeting Pach moath at the manogement meeting, group vice presldents had to present their divisions" monthly financial reports, which consisted of bookings, sales, operating pront, and operating capital. Each group vice prosident had the opportunity to fill in the narrative behind the cold financial results, and acquisitions and future acquisidion candidates wore also discussed as well as any new business ideas. Participants felt that the informality of this meeting led to a high degree of candor. At approximately the same timo as the managernent meetings were held, Dean Freed met individually with each group vice president in order to review the financial results of the divisions. During the meeting the two discussed anything of interest that was happening in the division. Froed sald, "During these meetings 1 insist on discussing strategic issues. I am just not interested in the operating problems of the divisions. They can solve them befter than I can. What I want to hoar about is new ideas, staffing requirements, and potential problems." Divislons and groups prepared monthly financial results that they were able to use in judging their performances. Although the division managers had complete discretion in the management of their divisions, many of them employed a monthly meeting format, analogous to the corporate one, in order to meet with their business element managers and discuss problems or new ideas in light of the dota contained in the financial results. Planning and Innovative Strategy for the Corporation George Gage cornmented on the interaction of planning and Innovation: Our planning system does an effectlve job of controlling and measuring our base operations. It even provides our managers with uniform methods of evaluating new business development. However, eliciting belght new ideas is beyond the scope of our systern. Naturally, in a firm like ours innovation and new business development are vital. At the very least, I hope the planning system doesn't stifle new ideas. The compilation of element and division flve-year plans Identified noeds of the corporation relative to Its goals but did not generate innovative idoas. Many ideas for new business directons came from the business element level. There seemed to be a corporatowide bellef in the ability of all managers to provide a creative input. For example, the divisional fiveyear plan asked for new business development Ideas as the third section of Its "strategy" requirement. One senior manager said, "There aren't many cases where the headquarters has been tbe source of creativity in terms of new products." Top managers, particularly Bernard O'Keefe and Dean Freed, did address the problem of corporatewide strategy. They held meetings from time to time, specifically addressing the overail strategy of the company. In years past, EG\&G had held retreat meetings in hopes that a new physical surrounding might elicit new perspectives. They were abandoned as not useful. Dean Frced felt that EG\&G had less of a problem than some single-product, single-market companies in maintaining an unbiased perspective on the corporation's future. He said, "Heterogenelty is a great aid in avolding irrational, emotional attachments to a particular strategy." While rocognizing the benefits of planning, not the least of which was a comparable basis for defending requests for capital, several managers expressed concern about continuing Innovation. One group vice president sald, "Really good Ideas are thought of in unorthodox ways, and planning imposes an orthodox system." He went on to speculate about the possible disincentives imposed on creativity by such an exhaustive planning system. "Innovative ideas can be successfully subjected to planning, but there's always a risk of their being stifled." Exhibit 1 Financial lfighilghts (as reported) Source: Annual reports 1yso, he. (A) Condented Exhibit 4 Flve-Year Planning Process January Vice president-planning and executlie vice president review past performance and write new planning guidelines. Send to group vice presidents. February Group vice presidents assess and modify guidelines and set guidelines for divisions. March Division managers receive planning guidelines, which they amend and send on to business element managers. Business element managers complete financial forms that result from Form K strategies. April Division managers work with the business element managers fo perfect their plans. Group vice presidents work with their divisions on their plans. May Final reviow meetings aro hold at division headquarters. June Corporate consolidation of all Presentation to the board of directors. EQsQ, ine. W Consensed 377.027 Exhiblt 5 Business Element Summary-Form X Exhibit 6 Buainess Blement Operating Statement-Form L Exhiblt 7 Invostment Data-Form C Describe EG\&G's Corporate Level Strategy Describe EG\&G's Business Level (Competitive) Strategy EG\&G Planning System Evaluation Recommendations/Updates for TODAY? 1. 2. 3. 4. 5. 6