Answered step by step

Verified Expert Solution

Question

1 Approved Answer

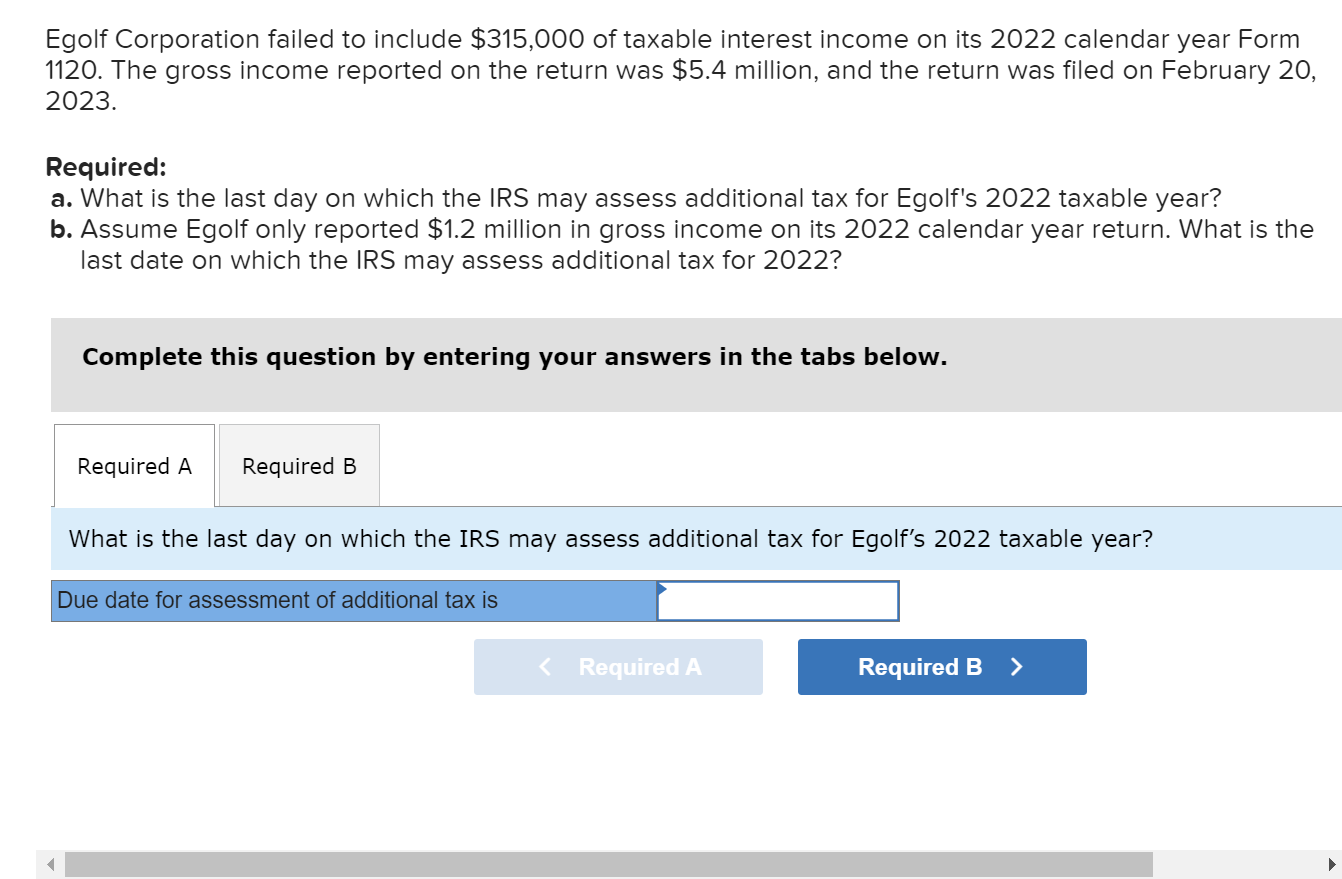

Egolf Corporation failed to include $ 3 1 5 , 0 0 0 of taxable interest income on its 2 0 2 2 calendar year

Egolf Corporation failed to include $ of taxable interest income on its calendar year Form Egolf Corporation failed to include $ of taxable interest income on its calendar year Form

The gross income reported on the return was $ million, and the return was filed on February

Required:

a What is the last day on which the IRS may assess additional tax for Egolf's taxable year?

b Assume Egolf only reported $ million in gross income on its calendar year return. What is the

last date on which the IRS may assess additional tax for

Complete this question by entering your answers in the tabs below.

Required

Required

Assume Egolf only reported $ million in gross income on its calendar year return. What is the last date

IRS may assess additional tax for

Due date for assessment of additional tax is

The gross income reported on the return was $ million, and the return was filed on February

Required:

a What is the last day on which the IRS may assess additional tax for Egolf's taxable year?

b Assume Egolf only reported $ million in gross income on its calendar year return. What is the

last date on which the IRS may assess additional tax for

Complete this question by entering your answers in the tabs below.

Required

What is the last day on which the IRS may assess additional tax for Egolf's taxable year?

Due date for assessment of additional tax is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started