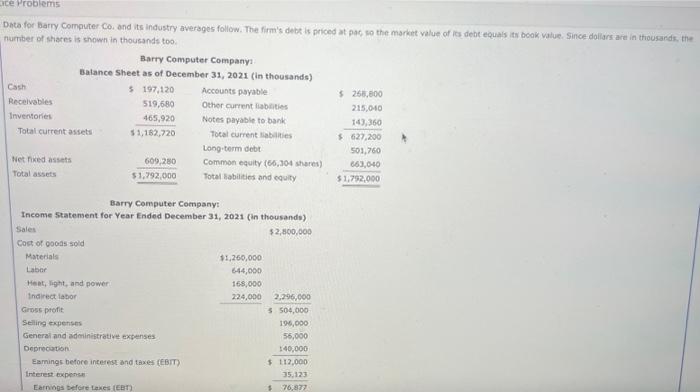

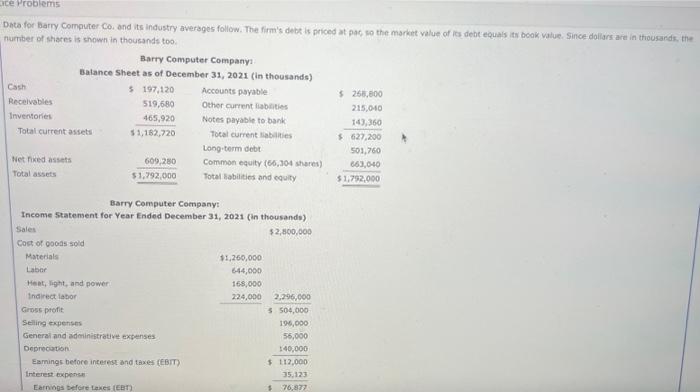

Eice Problems Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, the number of shares is shown in thousands too. Cash Receivables Inventories Barry Computer Company: Balance Sheet as of December 31, 2021 (in thousands) $ 197,120 Accounts payable 519,680 Other current liabilities 465,920 Notes payable to bank $1,182,720 Total current liabilities Long-term debt Common equity (66,304 shares) Total liabilities and equity Total current assets Net fixed assets Total assets Barry Computer Company: Income Statement for Year Ended December 31, 2021 (in thousands) $2,800,000 Sales Cost of goods sold Materials 609,280 $1,792,000 Labor Heat, light, and power Indirect labor Gross profit Selling expenses General and administrative expenses Depreciation Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) $1,260,000 644,000 168,000 224,000 2,296,000 $504,000 196,000 56,000 140,000 $ 112,000 35,123 $ 76,877 $ 268,800 215,040 143,360 $627,200 501,760 663,040 $1,792,000

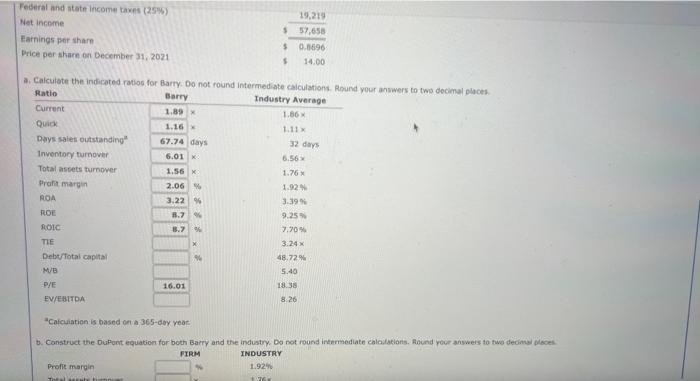

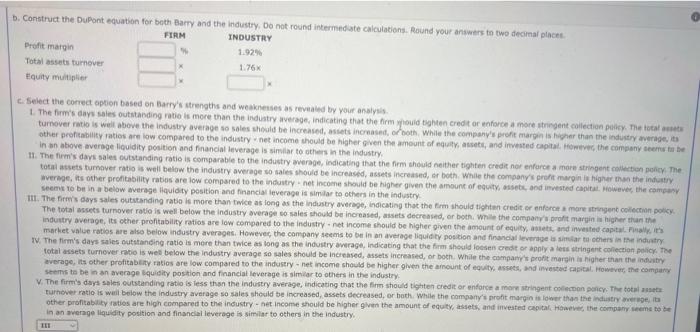

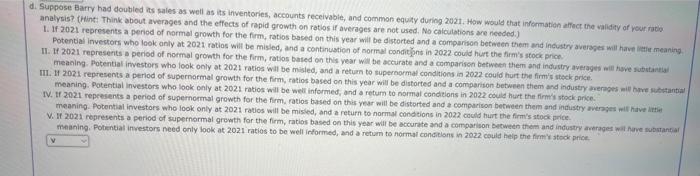

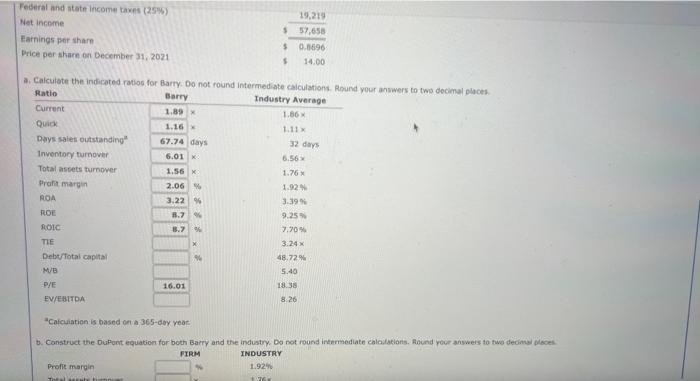

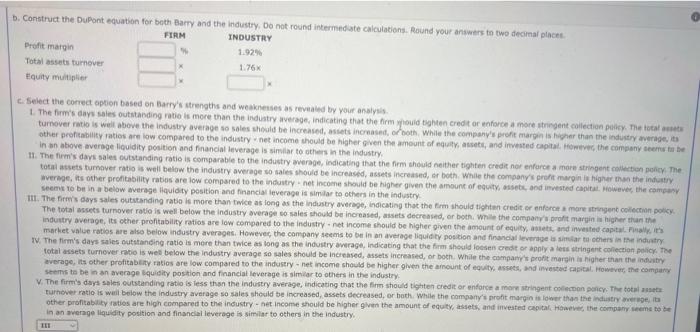

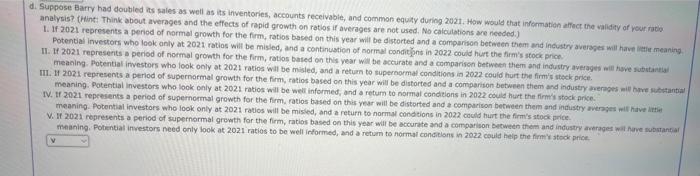

b. Construct the DuPont equation for beth Barry and the industry, Do not round intermedate calculations. Round your answers to two decomal placet. c. Select the correct aption based on barry's strengths and weaknenses as revealed by your analyals. in an atove average liquidity position and financial leverage is similar to othess in the industry. seemu 10 be in a below average Hquidty position and financial leveroge is similar to octhers in the industry. The total assets turnover ratio is well below the industry sverage so sales should be increased, mssets decreased, or both. While the companra proft marpin ia higher than the induitry average, its cher profitability ratios are low compared to the industry - net income should be higher given the amount of equity, absets, and inveited capita. Fualk, in total assets turnever robio is wel below the industry average so sales should be increased, assets increased, or both. While the comparry profit margin ia higher than the induitiy seems to be in an average lquibity postion and financiat leverage is similar to others in the industry. in an average liquidity position and financial leverage is similar to others in the industry. "Calculatien is based on a 365 -dor yeat. Data for barry Computer Co, and its industry averages follow. The firm's debt is priced at pac so the market value of is debt equals its book value. Since dollars are in thousards. the number of shiares is shown in thousands too. Barry Computer Company: Income Statement for Year Ended December 31, 2021 (in thousands) Sales Suppose Barry had doubled its sales as well as its inventories, accounts receivabie, and common equaty during 2021. How would that information affoct the validity of rour ratio analysis? (itint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations ace needed.) 1. If 2021 represents a period of normel growth for the firm, ratios based on this year will be distorted and a comparison betiveen them and incustry averages mill have inefie meaning. Potential investors who look anly at 2021 ratios will be misled, and a continustion of normal condithont in 2022 could hurt the firm's stock price. II. If 2021 represents a period of normal growter for the firm, ratios based on this year will be accurate and a comparison between them and industry averages nil hive sutstantis meaning. Potential investors who look only at 2021 ratios wil be misled, and a return to supernormal conditions in 2022 could hurt the firmis stack price. meaning. Potential investors who look only at 2021 ratios will be weil informed, and a retum to normal conditons in 2022 could hart the firmli stock prike. IV. If 2021 represients a period of supernormal growth for the firm, ratios based on this wear will be distorted and a comparison between them and industry merajes nit have irtie meaning. Potontial investors who look only at 2021 ratios will be misied, and a return to normal condtions in 2022 could hurt the firm's atock price. V. If 2021 represents a period of supernormal growth for the firm, ratios based on this year will be occurate and a comparison betoween them and industry anerages wil huve substantial meaning. Potential investors need only look at 2021 ratios to be well informed, and a retum to normal concielons in 2022 could help the firm'r 3t tock price