Question

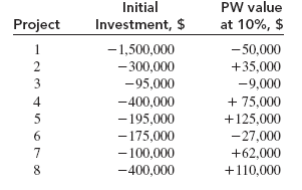

Eight projects are available for selection at Hum-Vee Motors. The listed PW values are determined at the corporate MARR of 10% per year and rounded

Eight projects are available for selection at Hum-Vee Motors. The listed PW values are determined at the corporate MARR of 10% per year and rounded to the nearest $1000. Project lives vary from 5 to 15 years.

Project selection guidelines: 1. No more than $400,000 in investment capital is available. 2. No negative PW project may be selected. 3. At least one project, but no more than three, must be selected. 4. The following selection restrictions apply to specific projects: Project 4 can be selected only if project 1 is selected. Projects 1 and 2 are duplicative; dont select both. Projects 8 and 4 are also duplicative. Project 7 requires that project 2 also be selected. (a) Identify the viable project bundles and select the best economically justified projects. What is the investment assumption for any remaining capital funds? (b) If as much of the $400,000 as possible must be invested, use the same restrictions and determine the project(s) to select. Is this a viable second choice for investing the $400,000? Why?

Initial PW value Project Investment, S at 10%, -50,000 -1,500,000 +35,000 300,000 95,000 9,000 400.000 75,000 125,000 195.000 175.000 27.000 100.000 +62,000 400.000 110,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started