Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eileen invested in residential real estate for $200,000 ($170,000 for the building and $30,000 for the land). She financed her purchase with a 25-year mortgage

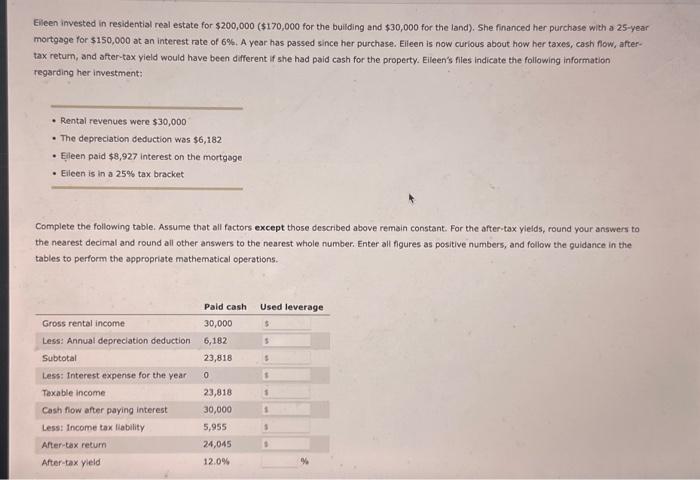

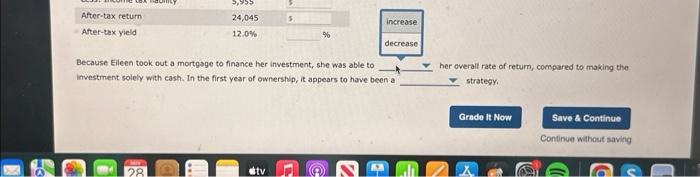

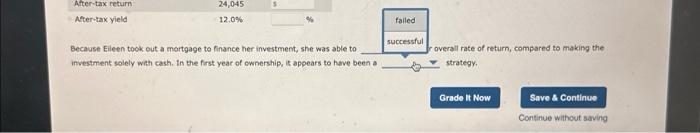

Eileen invested in residential real estate for $200,000 ($170,000 for the building and $30,000 for the land). She financed her purchase with a 25-year mortgage for $150,000 at an interest rate of 6%. A year has passed since her purchase. Eileen is now curious about how her taxes, cash flow, after- tax return, and after-tax yield would have been different if she had paid cash for the property. Eileen's files indicate the following information regarding her investment: Rental revenues were $30,000 The depreciation deduction was $6,182 Eileen paid $8,927 interest on the mortgage Eileen is in a 25% tax bracket Complete the following table. Assume that all factors except those described above remain constant. For the after-tax yields, round your answers to the nearest decimal and round all other answers to the nearest whole number. Enter all figures as positive numbers, and follow the guidance in the tables to perform the appropriate mathematical operations. Gross rental income Less: Annual depreciation deduction Subtotal Less: Interest expense for the year Taxable income Cash flow after paying interest Less: Income tax liability After-tax return After-tax yield Paid cash 30,000 6,182 23,818 0 23,818 30,000 5,955 24,045 12.0% Used leverage $ $ $ $ $ $ $ $ %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started