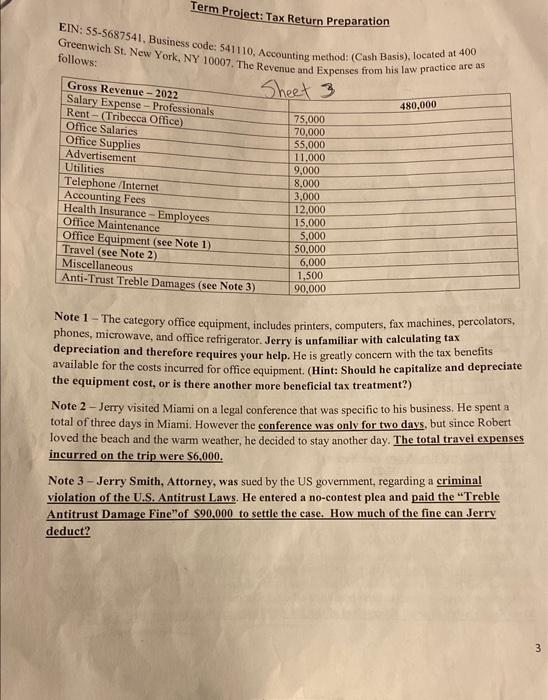

EIN: 55-5687541, Business code: 541110, Accounting method: (Cash Basis), located at 400 Greenwich St. New York, NY 10007. The Revenue and Fxnaneme frmm hie law oractice are as follows: Note 1 - The category office equipment, includes printers, computers, fax machines, percolators, phones, microwave, and office refrigerator. Jerry is unfamiliar with calculating tax depreciation and therefore requires your help. He is greatly concern with the tax benefits available for the costs incurred for office equipment. (Hint: Should he capitalize and depreciate the equipment cost, or is there another more beneficial tax treatment?) Note 2 - Jerry visited Miami on a legal conference that was specific to his business. He spent a total of three days in Miami. However the conference was only for two days, but since Robert loved the beach and the warm weather, he decided to stay another day. The total travel expenses incurred on the trip were $6,000. Note 3 - Jerry Smith, Attorney, was sued by the US government, regarding a criminal violation of the U.S. Antitrust Laws. He entered a no-contest plea and paid the "Treble Antitrust Damage Fine" of 590,000 to settle the case. How much of the fine can Jerry deduct? EIN: 55-5687541, Business code: 541110, Accounting method: (Cash Basis), located at 400 Greenwich St. New York, NY 10007. The Revenue and Fxnaneme frmm hie law oractice are as follows: Note 1 - The category office equipment, includes printers, computers, fax machines, percolators, phones, microwave, and office refrigerator. Jerry is unfamiliar with calculating tax depreciation and therefore requires your help. He is greatly concern with the tax benefits available for the costs incurred for office equipment. (Hint: Should he capitalize and depreciate the equipment cost, or is there another more beneficial tax treatment?) Note 2 - Jerry visited Miami on a legal conference that was specific to his business. He spent a total of three days in Miami. However the conference was only for two days, but since Robert loved the beach and the warm weather, he decided to stay another day. The total travel expenses incurred on the trip were $6,000. Note 3 - Jerry Smith, Attorney, was sued by the US government, regarding a criminal violation of the U.S. Antitrust Laws. He entered a no-contest plea and paid the "Treble Antitrust Damage Fine" of 590,000 to settle the case. How much of the fine can Jerry deduct