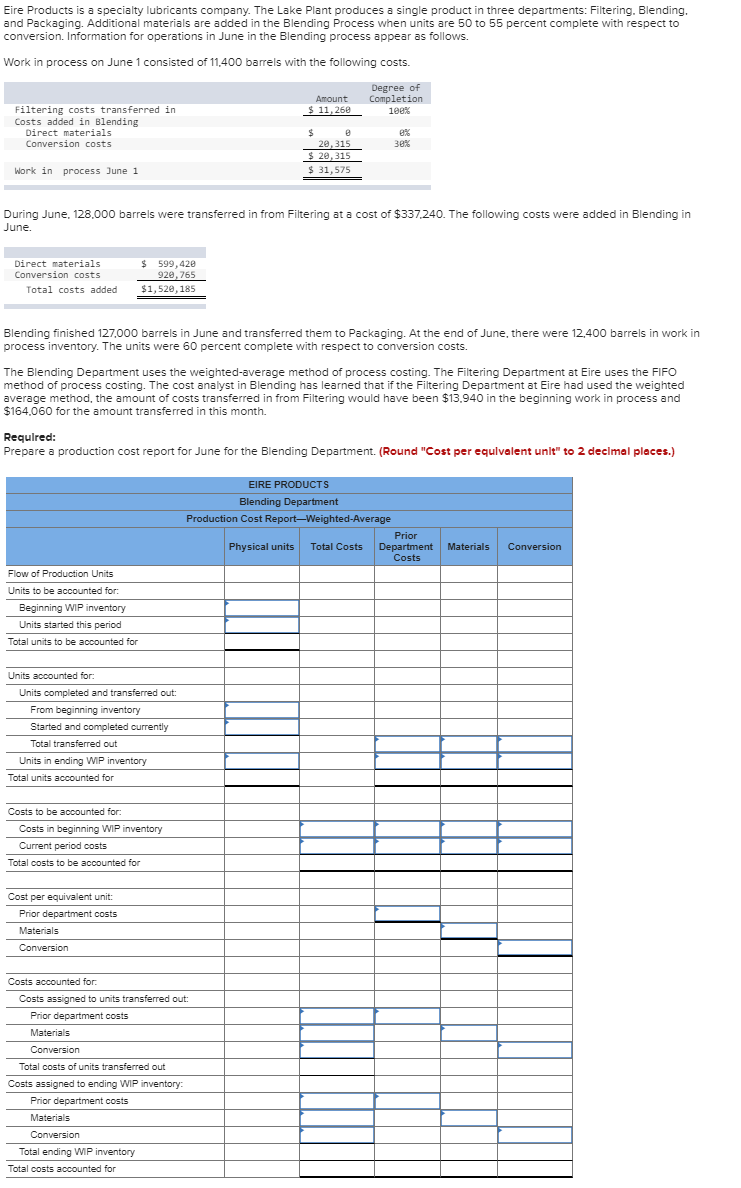

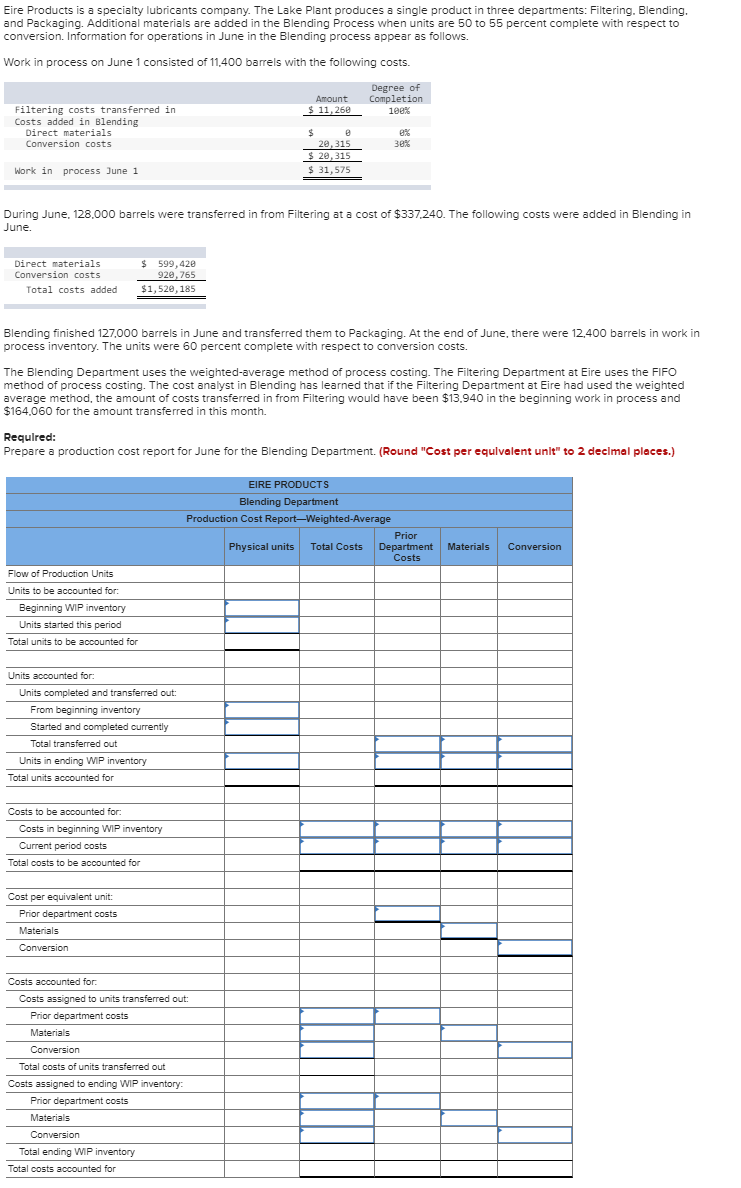

Eire Products is a specialty lubricants company. The Lake Plant produces a single product in three departments: Filtering. Blending. and Packaging. Additional materials are added in the Blending Process when units are 50 to 55 percent complete with respect to conversion. Information for operations in June in the Blending process appear as follows. Work in process on June 1 consisted of 11.400 barrels with the following costs. Amount $ 11,260 Degree of Completion 100% Filtering costs transferred in Costs added in Blending Direct materials Conversion costs 30% 20.315 $ 20,315 $ 31,575 Work in process June 1 During June, 128,000 barrels were transferred in from Filtering at a cost of $337.240. The following costs were added in Blending in June. Direct materials Conversion costs Total costs added $ 599,420 920, 765 $1,520, 185 Blending finished 127.000 barrels in June and transferred them to Packaging. At the end of June, there were 12.400 barrels in work in process inventory. The units were 60 percent complete with respect to conversion costs. The Blending Department uses the weighted average method of process costing. The Filtering Department at Eire uses the FIFO method of process costing. The cost analyst in Blending has learned that if the Filtering Department at Eire had used the weighted average method, the amount of costs transferred in from Filtering would have been $13.940 in the beginning work in process and $164,060 for the amount transferred in this month. Required: Prepare a production cost report for June for the Blending Department. (Round "Cost per equivalent unlt" to 2 decimal places.) EIRE PRODUCTS Blending Department Production Cost Report-Weighted Average Prior Physical units Total Costs Department Costs Materials Conversion Flow of Production Units Units to be accounted for: Beginning WIP inventory Units started this period Total units to be accounted for Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Total transferred out Units in ending WIP inventory Total units accounted for Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for Cost per equivalent unit: Prior department costs Materials Conversion Costs accounted for. Costs assigned to units transferred out: Prior department costs Materials Conversion Total costs of units transferred out Costs assigned to ending WIP inventory Prior department costs Materials Conversion Total ending WIP inventory Total costs accounted for Eire Products is a specialty lubricants company. The Lake Plant produces a single product in three departments: Filtering. Blending. and Packaging. Additional materials are added in the Blending Process when units are 50 to 55 percent complete with respect to conversion. Information for operations in June in the Blending process appear as follows. Work in process on June 1 consisted of 11.400 barrels with the following costs. Amount $ 11,260 Degree of Completion 100% Filtering costs transferred in Costs added in Blending Direct materials Conversion costs 30% 20.315 $ 20,315 $ 31,575 Work in process June 1 During June, 128,000 barrels were transferred in from Filtering at a cost of $337.240. The following costs were added in Blending in June. Direct materials Conversion costs Total costs added $ 599,420 920, 765 $1,520, 185 Blending finished 127.000 barrels in June and transferred them to Packaging. At the end of June, there were 12.400 barrels in work in process inventory. The units were 60 percent complete with respect to conversion costs. The Blending Department uses the weighted average method of process costing. The Filtering Department at Eire uses the FIFO method of process costing. The cost analyst in Blending has learned that if the Filtering Department at Eire had used the weighted average method, the amount of costs transferred in from Filtering would have been $13.940 in the beginning work in process and $164,060 for the amount transferred in this month. Required: Prepare a production cost report for June for the Blending Department. (Round "Cost per equivalent unlt" to 2 decimal places.) EIRE PRODUCTS Blending Department Production Cost Report-Weighted Average Prior Physical units Total Costs Department Costs Materials Conversion Flow of Production Units Units to be accounted for: Beginning WIP inventory Units started this period Total units to be accounted for Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Total transferred out Units in ending WIP inventory Total units accounted for Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for Cost per equivalent unit: Prior department costs Materials Conversion Costs accounted for. Costs assigned to units transferred out: Prior department costs Materials Conversion Total costs of units transferred out Costs assigned to ending WIP inventory Prior department costs Materials Conversion Total ending WIP inventory Total costs accounted for