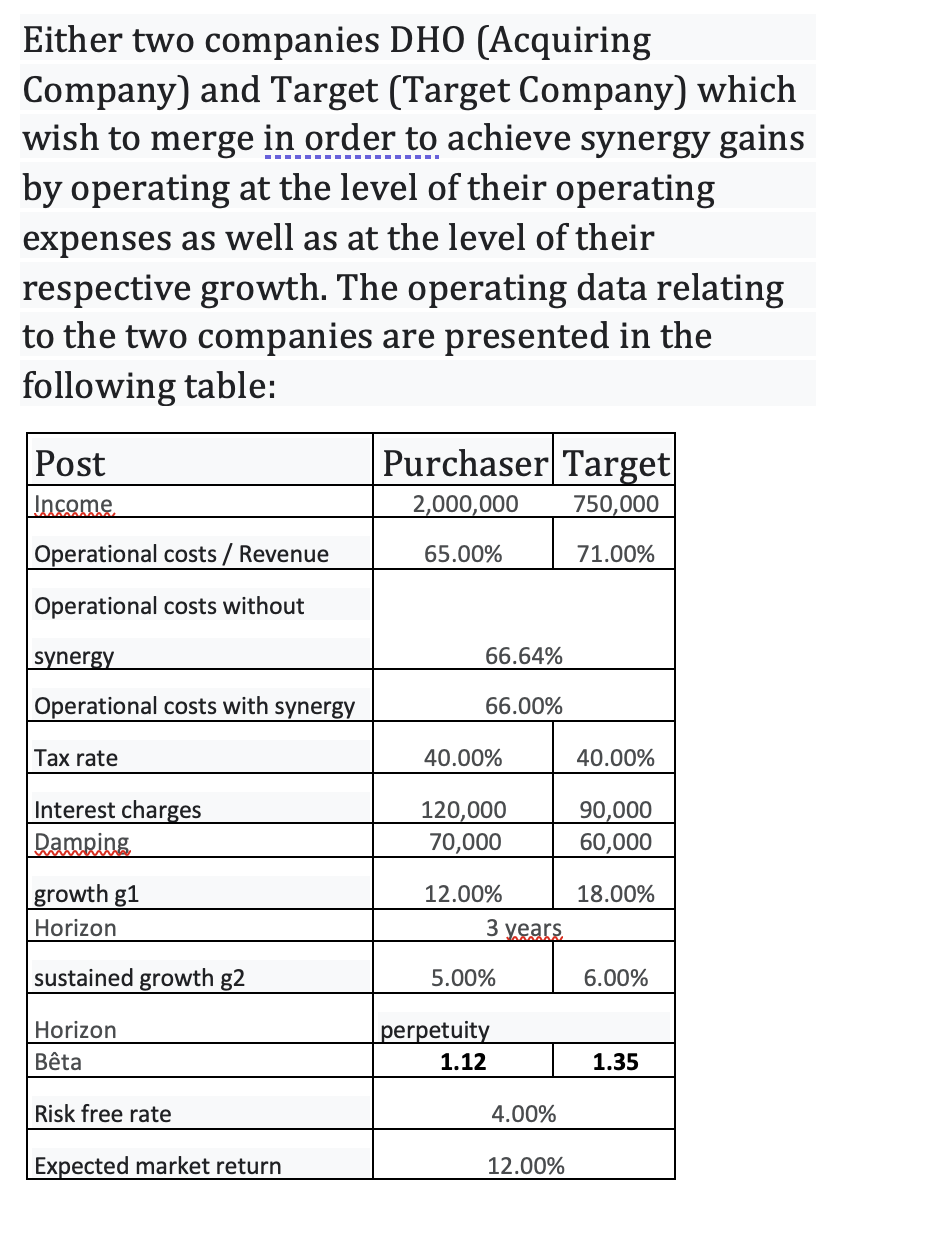

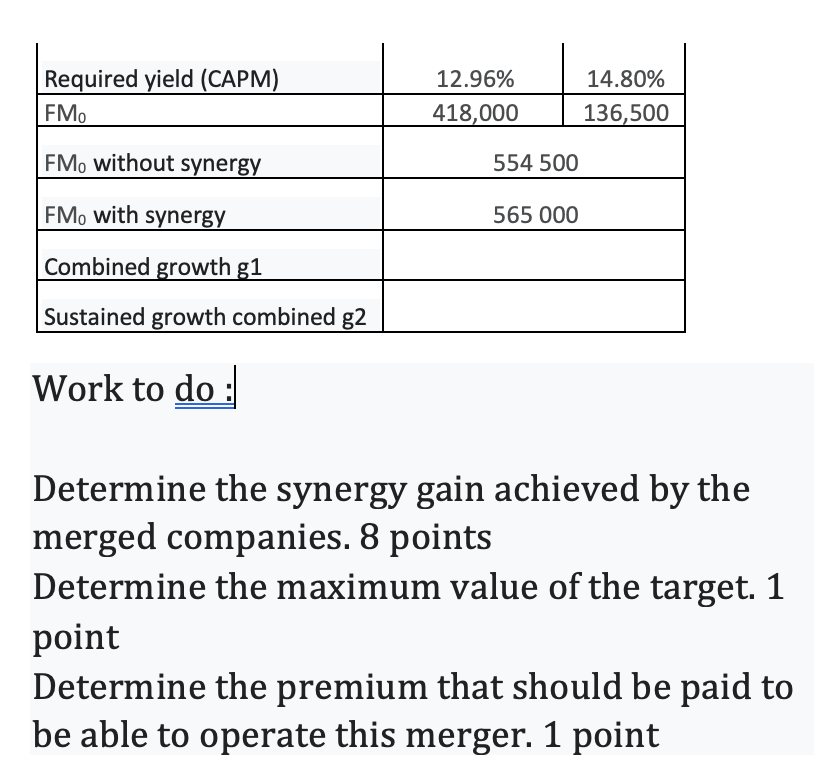

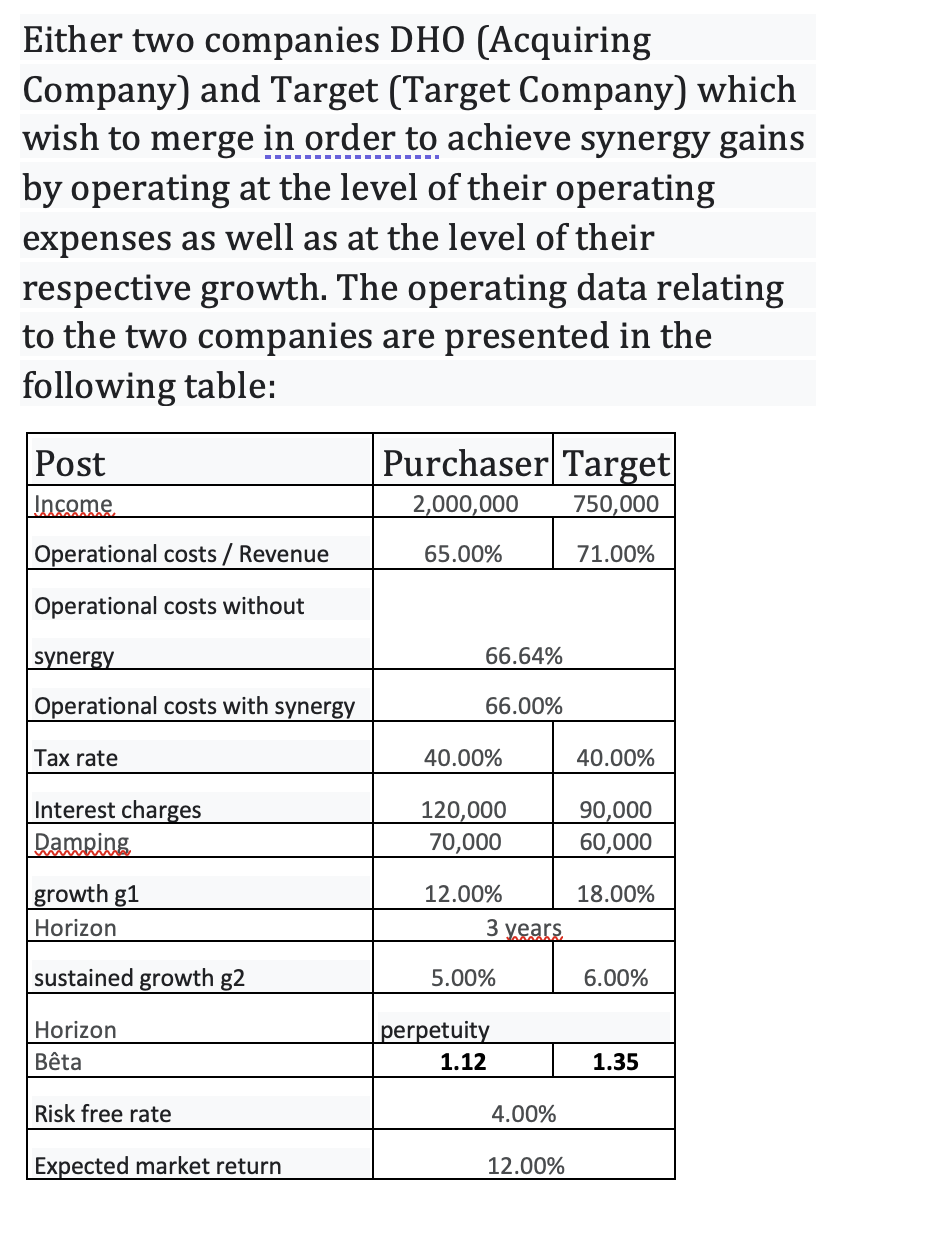

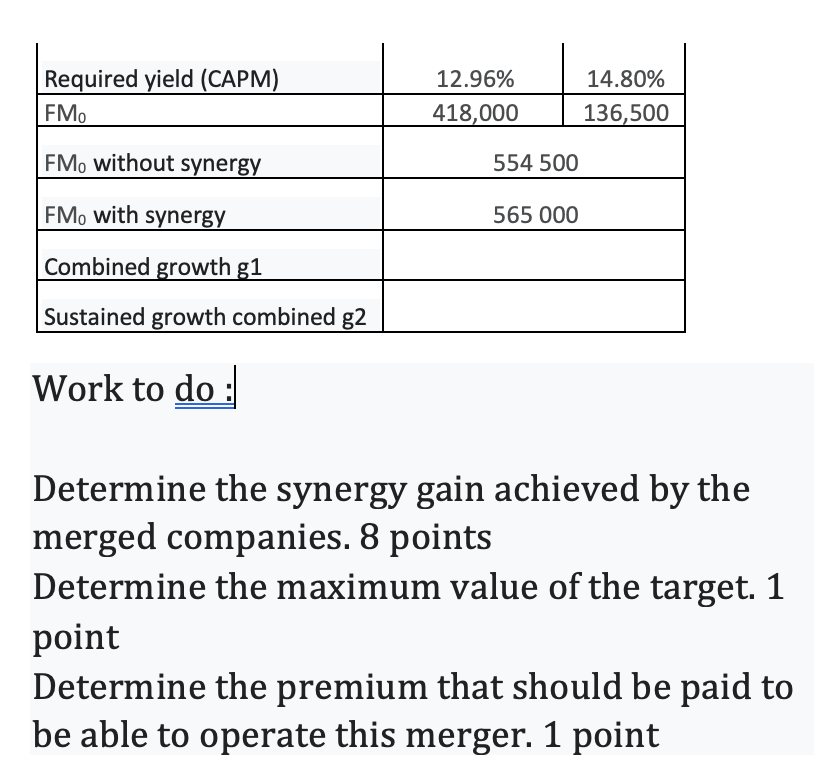

Either two companies DHO (Acquiring Company) and Target (Target Company) which wish to merge in order to achieve synergy gains by operating at the level of their operating expenses as well as at the level of their respective growth. The operating data relating to the two companies are presented in the following table: Post Income Purchaser Target 2,000,000 750,000 Operational costs / Revenue 65.00% 71.00% Operational costs without synergy 66.64% Operational costs with synergy 66.00% Tax rate 40.00% 40.00% Interest charges Damping 120,000 70,000 90,000 60,000 12.00% 18.00% growth g1 Horizon 3 years sustained growth g2 5.00% 6.00% Horizon Bta perpetuity 1.12 1.35 Risk free rate 4.00% Expected market return 12.00% Required yield (CAPM) FMO 12.96% 418,000 14.80% 136,500 FM, without synergy 554 500 FMo with synergy 565 000 Combined growth g1 Sustained growth combined g2 Work to do: Determine the synergy gain achieved by the merged companies. 8 points Determine the maximum value of the target. 1 point Determine the premium that should be paid to be able to operate this merger. 1 point Either two companies DHO (Acquiring Company) and Target (Target Company) which wish to merge in order to achieve synergy gains by operating at the level of their operating expenses as well as at the level of their respective growth. The operating data relating to the two companies are presented in the following table: Post Income Purchaser Target 2,000,000 750,000 Operational costs / Revenue 65.00% 71.00% Operational costs without synergy 66.64% Operational costs with synergy 66.00% Tax rate 40.00% 40.00% Interest charges Damping 120,000 70,000 90,000 60,000 12.00% 18.00% growth g1 Horizon 3 years sustained growth g2 5.00% 6.00% Horizon Bta perpetuity 1.12 1.35 Risk free rate 4.00% Expected market return 12.00% Required yield (CAPM) FMO 12.96% 418,000 14.80% 136,500 FM, without synergy 554 500 FMo with synergy 565 000 Combined growth g1 Sustained growth combined g2 Work to do: Determine the synergy gain achieved by the merged companies. 8 points Determine the maximum value of the target. 1 point Determine the premium that should be paid to be able to operate this merger. 1 point