Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ekiya, who is single, has been offered a position as a city landscape consultant. The position pays $138,200 in wages, Assume Eklya has no

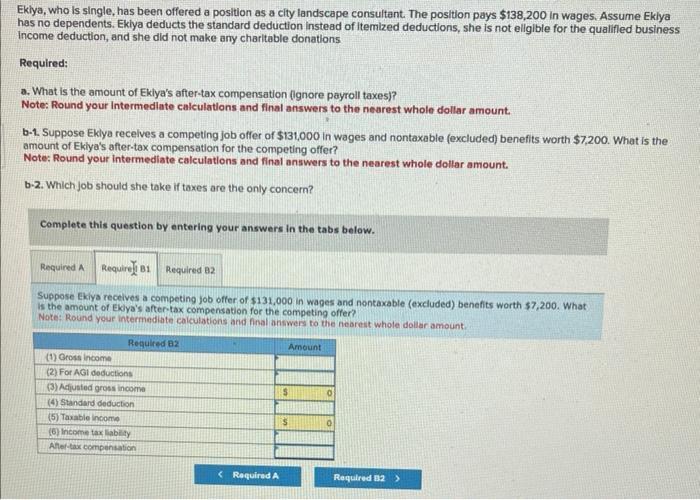

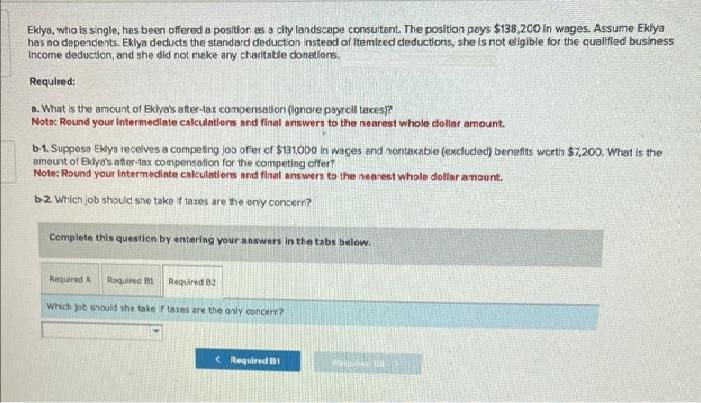

Ekiya, who is single, has been offered a position as a city landscape consultant. The position pays $138,200 in wages, Assume Eklya has no dependents. Eklya deducts the standard deduction instead of itemized deductions, she is not eligible for the qualified business Income deduction, and she did not make any charitable donations Required: a. What is the amount of Ekiya's after-tax compensation (ignore payroll taxes)? Note: Round your Intermediate calculations and final answers to the nearest whole dollar amount. b-1. Suppose Eklya receives a competing job offer of $131,000 in wages and nontaxable (excluded) benefits worth $7,200. What is the amount of Ekiya's after-tax compensation for the competing offer? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. b-2. Which job should she take if taxes are the only concern? Complete this question by entering your answers in the tabs below. Required A Require1 B1 Required 82 Suppose Ekiya receives a competing job offer of $131,000 in wages and nontaxable (excluded) benefits worth $7,200. What is the amount of Ekiya's after-tax compensation for the competing offer? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Required B2 (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Taxable income (6) Income tax liability After-tax compensation < Required A Amount $ S 0 0 Required 132 > Eklya, who is single, has been offered a position as a city landscape consultant. The position pays $138,200 In wages. Assume Eklya has no dependents. Eklya deducts the standard deduction instead of itemized deductions, she is not eligible for the qualified business Income deduction, and she did not make any charitable donations. Required: a. What is the amount of Ekiya's after-tax compensation (ignore payroll taxes? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. b-1. Suppose Eklys receives a competing job offer of $131,000 in wages and nontaxable (excluded) benefits worth $7,200. What is the amount of Ekiye's after-tax compensation for the competing offer? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. b-2. Which job should she take if taxes are the only concern? Complete this question by entering your answers in the tabs below. Required A Required 1 Required 82 Which job should she take if taxes are the only concert? Required 1 TIRANE DO

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Gross income 138200 2 For AGI deductions 0 3 Adjusted gross income 13820...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started