Answered step by step

Verified Expert Solution

Question

1 Approved Answer

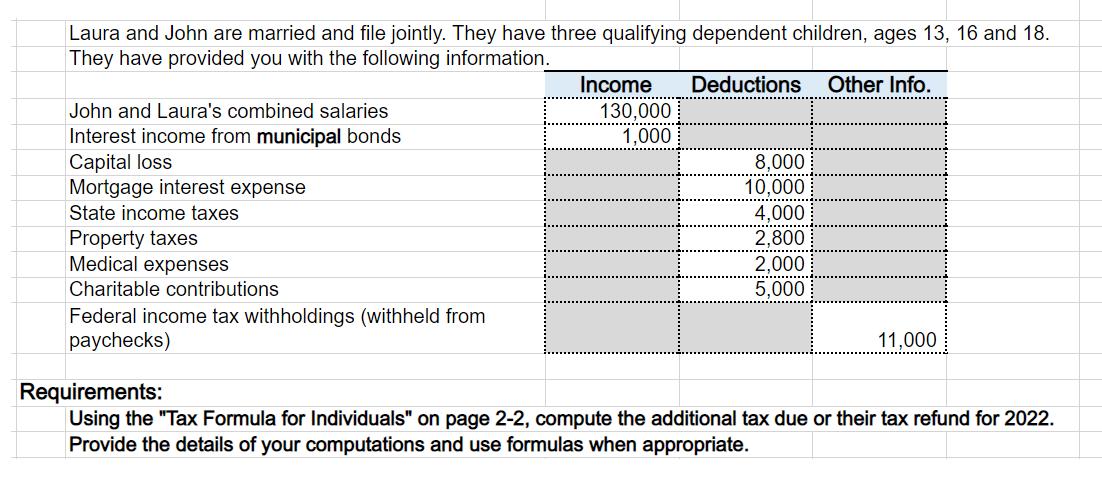

Laura and John are married and file jointly. They have three qualifying dependent children, ages 13, 16 and 18. They have provided you with

Laura and John are married and file jointly. They have three qualifying dependent children, ages 13, 16 and 18. They have provided you with the following information. Deductions Other Info. John and Laura's combined salaries Interest income from municipal bonds Capital loss Mortgage interest expense State income taxes Property taxes Medical expenses Charitable contributions Federal income tax withholdings (withheld from paychecks) Income . 130,000 1,000 8,000 10,000 ........ 4,000 2,800 2,000 5,000 11,000 Requirements: Using the "Tax Formula for Individuals" on page 2-2, compute the additional tax due or their tax refund for 2022. Provide the details of your computations and use formulas when appropriate.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear step by step manner Step 1 Interest from mun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started