Question

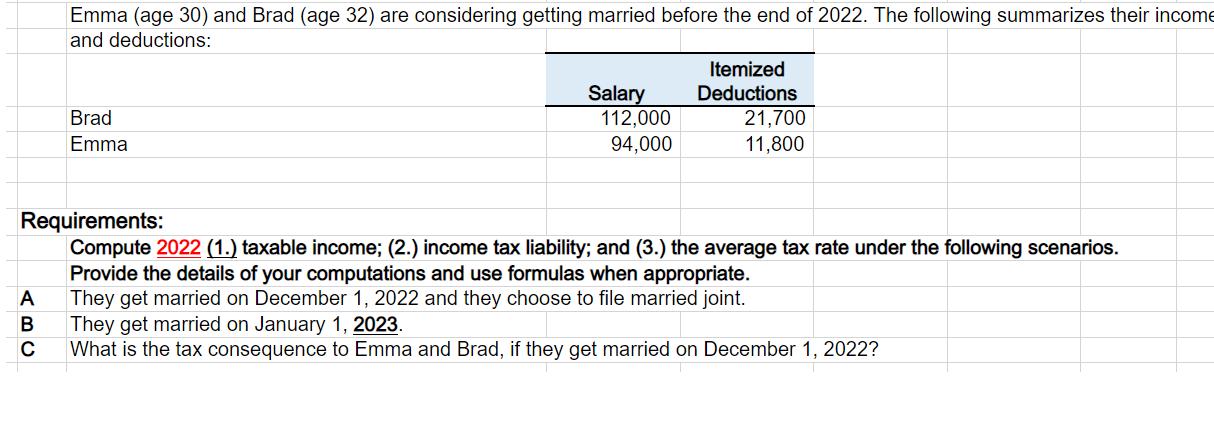

Emma (age 30) and Brad (age 32) are considering getting married before the end of 2022. The following summarizes their income and deductions: ABC

Emma (age 30) and Brad (age 32) are considering getting married before the end of 2022. The following summarizes their income and deductions: ABC Brad Emma Salary 112,000 94,000 Itemized Deductions 21,700 11,800 Requirements: Compute 2022 (1.) taxable income; (2.) income tax liability; and (3.) the average tax rate under the following scenarios. Provide the details of your computations and use formulas when appropriate. They get married on December 1, 2022 and they choose to file married joint. They get married on January 1, 2023. What is the tax consequence to Emma and Brad, if they get married on December 1, 2022?

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A They get married on December 1 2022 and they choose to file married joint Total Salary 112000 9400...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App