Answered step by step

Verified Expert Solution

Question

1 Approved Answer

H and J are married and file a joint return. Neither is over 65 and both have good vision. V and T are their

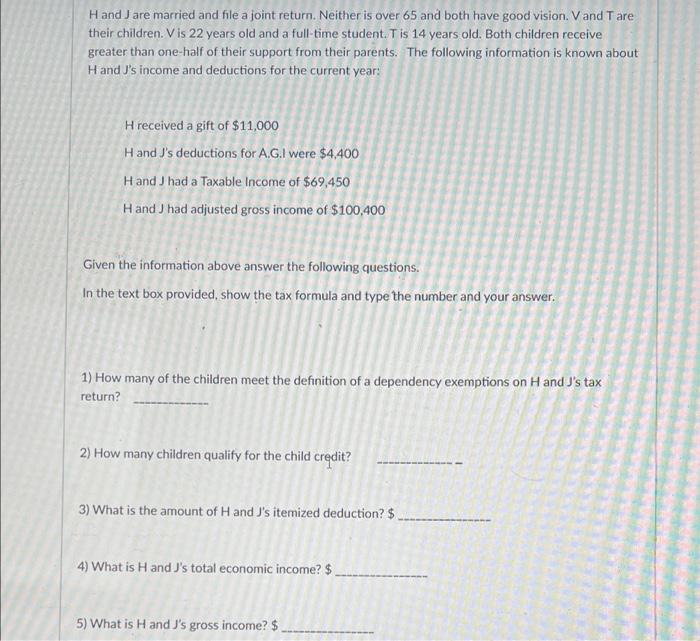

H and J are married and file a joint return. Neither is over 65 and both have good vision. V and T are their children. V is 22 years old and a full-time student. T is 14 years old. Both children receive greater than one-half of their support from their parents. The following information is known about H and J's income and deductions for the current year: H received a gift of $11,000 H and J's deductions for A.G.I were $4,400 Hand J had a Taxable Income of $69,450 H and J had adjusted gross income of $100,400 Given the information above answer the following questions. In the text box provided, show the tax formula and type the number and your answer. 1) How many of the children meet the definition of a dependency exemptions on H and J's tax return? 2) How many children qualify for the child credit? 3) What is the amount of H and J's itemized deduction? $. 4) What is H and J's total economic income? $. 5) What is H and J's gross income? $.

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 Exemptions of Dependents x 4000 2 x 4000 8000 V and T both meet the definition of a dependent exem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started