Answered step by step

Verified Expert Solution

Question

1 Approved Answer

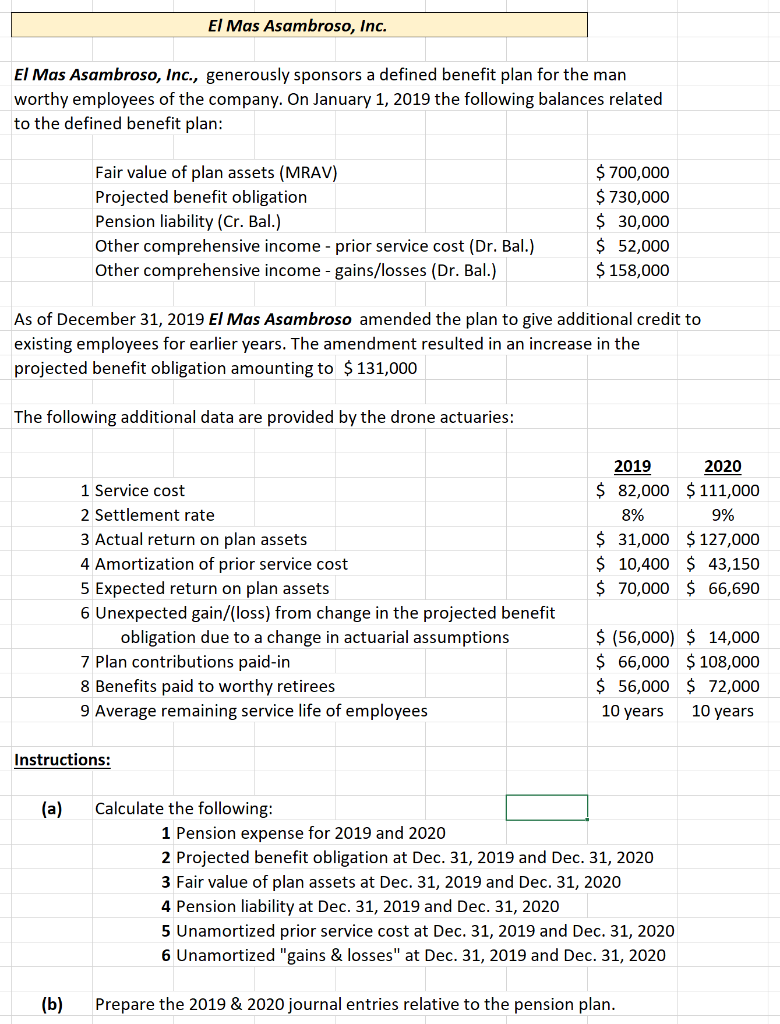

El Mas Asambroso, Inc., generously sponsors a defined benefit plan for the man worthy employees of the company. On January 1, 2019, the following related

El Mas Asambroso, Inc., generously sponsors a defined benefit plan for the man worthy employees of the company. On January 1, 2019, the following related to the defined benefit plan...

Pension Worksheet

If you can help, please can you include calculations? Thank you in advance for your help, I am trying hard to understand what I am doing and the book just isn't much help.

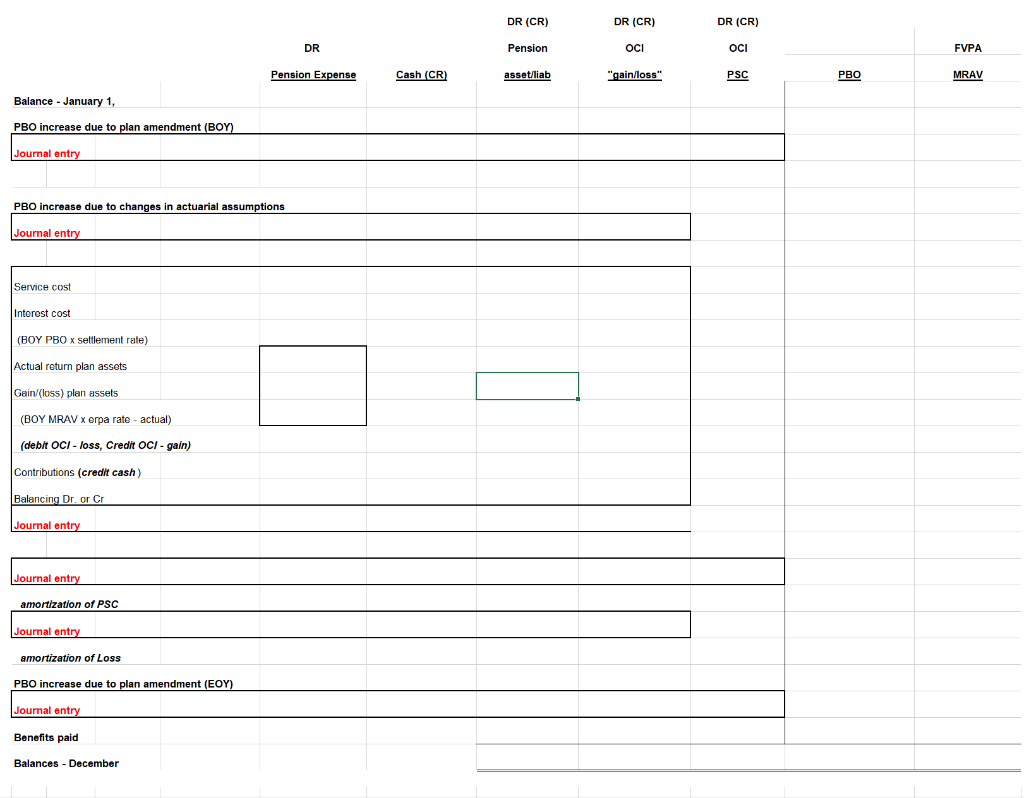

El Mas Asambroso, Inc. El Mas Asambroso, Inc., generously sponsors a defined benefit plan for the man worthy employees of the company. On January 1, 2019 the following balances related to the defined benefit plan: Fair value of plan assets (MRAV) Projected benefit obligation Pension liability (Cr. Bal.) Other comprehensive income - prior service cost (Dr. Bal.) Other comprehensive income-gains/losses (Dr. Bal.) $ 700,000 $ 730,000 $ 30,000 $ 52,000 $ 158,000 As of December 31, 2019 El Mas Asambroso amended the plan to give additional credit to existing employees for earlier years. The amendment resulted in an increase in the projected benefit obligation amounting to $ 131,000 The following additional data are provided by the drone actuaries: 1 Service cost 2 Settlement rate 2019 2020 $ 82,000 $ 111,000 8% 9% $ 31,000 $ 127,000 $ 10,400 $ 43,150 $ 70,000 $ 66,690 4 Amortization of prior service cost 5 Expected return on plan assets 6 Unexpected gain/(loss) from change in the projected benefit 7 Plan contributions paid-in 8 Benefits paid to worthy retirees 9 Average remaining service life of employees $ (56,000) $ 14,000 $ 66,000 $ 108,000 $ 56,000 $ 72,000 10 years 10 years Instructions: (a) Calculate the following: 1 Pension expense for 2019 and 2020 2 Projected benefit obligation at Dec. 31, 2019 and Dec. 31, 2020 3 Fair value of plan assets at Dec. 31, 2019 and Dec. 31, 2020 4 Pension liability at Dec. 31, 2019 and Dec. 31, 2020 5 Unamortized prior service cost at Dec. 31, 2019 and Dec. 31, 2020 (b) Prepare the 2019 & 2020 journal entries relative to the pension plan. DR (CR) DR (CR) DR (CR) DR Pension OCI FVPA Pension Expense Cash (CR) asset/liab "gain/loss" PSC PBO MRAV Balance - January 1, PBO increase due to plan amendment (BOY) Journal entry PBO increase due to changes in actuarial assumptions Journal entry Service cost Interest cost (BOY PBO x settlement rate) Actual return plan assets Gain (loss) plan assets (BOY MRAV x erpa rate - actual) (debit OCI - loss, Credit OCI - gain) Contributions (credit cash) Balancing Dr. or Cr laumalantu Journal entry Journal entry amortization of PSC Journal entry amortization of Loss PBO increase due to plan amendment (EOY) Journal entry Benefits paid Balances - DecemberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started