Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eldoria is a country that shares numerous similarities with Australia. In the now-defunct Insight magazine, there used to be a regular column called 'The Speculator'

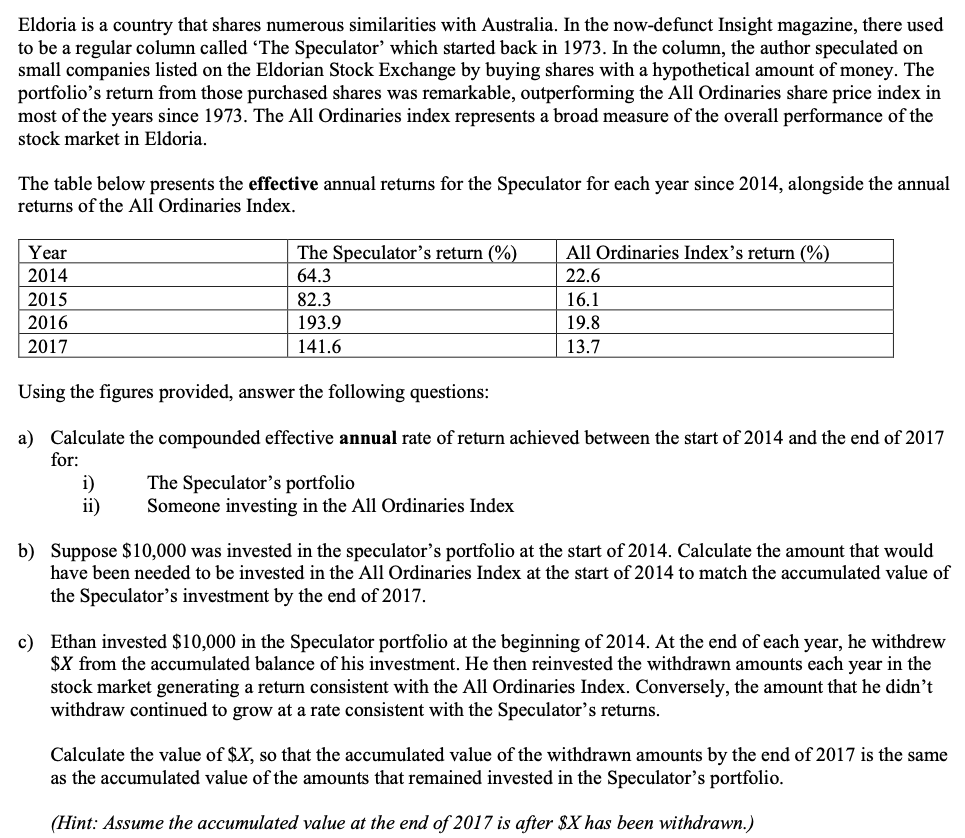

Eldoria is a country that shares numerous similarities with Australia. In the now-defunct Insight magazine, there used to be a regular column called 'The Speculator' which started back in 1973. In the column, the author speculated on small companies listed on the Eldorian Stock Exchange by buying shares with a hypothetical amount of money. The portfolio's return from those purchased shares was remarkable, outperforming the All Ordinaries share price index in most of the years since 1973. The All Ordinaries index represents a broad measure of the overall performance of the stock market in Eldoria. The table below presents the effective annual returns for the Speculator for each year since 2014, alongside the annual returns of the All Ordinaries Index. 5 Using the figures provided, answer the following questions: a) Calculate the compounded effective annual rate of return achieved between the start of 2014 and the end of 2017 for: i) The Speculator's portfolio ii) Someone investing in the All Ordinaries Index b) Suppose $10,000 was invested in the speculator's portfolio at the start of 2014. Calculate the amount that would have been needed to be invested in the All Ordinaries Index at the start of 2014 to match the accumulated value of the Speculator's investment by the end of 2017. c) Ethan invested $10,000 in the Speculator portfolio at the beginning of 2014. At the end of each year, he withdrew $X from the accumulated balance of his investment. He then reinvested the withdrawn amounts each year in the stock market generating a return consistent with the All Ordinaries Index. Conversely, the amount that he didn't withdraw continued to grow at a rate consistent with the Speculator's returns. Calculate the value of $X, so that the accumulated value of the withdrawn amounts by the end of 2017 is the same as the accumulated value of the amounts that remained invested in the Speculator's portfolio. (Hint: Assume the accumulated value at the end of 2017 is after $X has been withdrawn.)

Eldoria is a country that shares numerous similarities with Australia. In the now-defunct Insight magazine, there used to be a regular column called 'The Speculator' which started back in 1973. In the column, the author speculated on small companies listed on the Eldorian Stock Exchange by buying shares with a hypothetical amount of money. The portfolio's return from those purchased shares was remarkable, outperforming the All Ordinaries share price index in most of the years since 1973. The All Ordinaries index represents a broad measure of the overall performance of the stock market in Eldoria. The table below presents the effective annual returns for the Speculator for each year since 2014, alongside the annual returns of the All Ordinaries Index. 5 Using the figures provided, answer the following questions: a) Calculate the compounded effective annual rate of return achieved between the start of 2014 and the end of 2017 for: i) The Speculator's portfolio ii) Someone investing in the All Ordinaries Index b) Suppose $10,000 was invested in the speculator's portfolio at the start of 2014. Calculate the amount that would have been needed to be invested in the All Ordinaries Index at the start of 2014 to match the accumulated value of the Speculator's investment by the end of 2017. c) Ethan invested $10,000 in the Speculator portfolio at the beginning of 2014. At the end of each year, he withdrew $X from the accumulated balance of his investment. He then reinvested the withdrawn amounts each year in the stock market generating a return consistent with the All Ordinaries Index. Conversely, the amount that he didn't withdraw continued to grow at a rate consistent with the Speculator's returns. Calculate the value of $X, so that the accumulated value of the withdrawn amounts by the end of 2017 is the same as the accumulated value of the amounts that remained invested in the Speculator's portfolio. (Hint: Assume the accumulated value at the end of 2017 is after $X has been withdrawn.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started