Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eleanor, age 69, worked her whole life as a legal assistant, but never earned a large salary. She had no pension plan at her place

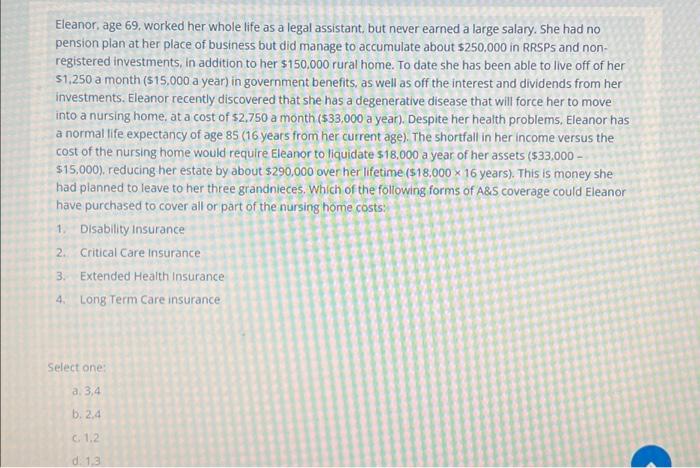

Eleanor, age 69, worked her whole life as a legal assistant, but never earned a large salary. She had no pension plan at her place of business but did manage to accumulate about $250,000 in RRSPS and non- registered investments, in addition to her $150,000 rural home. To date she has been able to live off of her $1,250 a month ($15,000 a year) in government benefits, as well as off the interest and dividends from her investments. Eleanor recently discovered that she has a degenerative disease that will force her to move into a nursing home, at a cost of $2,750 a month ($33,000 a year). Despite her health problems, Eleanor has a normal life expectancy of age 85 (16 years from her current age). The shortfall in her income versus the cost of the nursing home would require Eleanor to liquidate $18,000 a year of her assets ($33,000 - $15,000), reducing her estate by about $290,000 over her lifetime ($18,000 x 16 years). This is money she had planned to leave to her three grandnieces. Which of the following forms of A&S coverage could Eleanor have purchased to cover all or part of the nursing home costs: 1. Disability Insurance 2. Critical Care Insurance 3. Extended Health Insurance 4. Long Term Care insurance Select one: a. 3,4 b. 2,4 C. 1,2 d. 1.3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started