Question

Eleazar uses the aging method to record bad debt at the end of each fiscal year on December 31. This year, he made sales

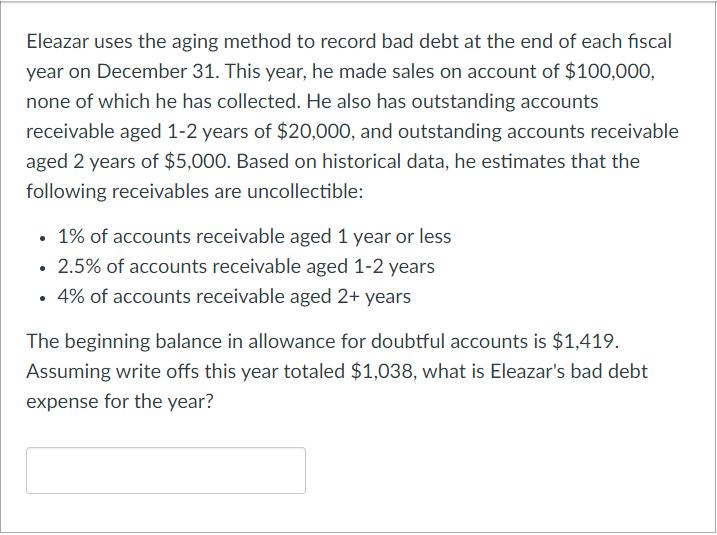

Eleazar uses the aging method to record bad debt at the end of each fiscal year on December 31. This year, he made sales on account of $100,000, none of which he has collected. He also has outstanding accounts receivable aged 1-2 years of $20,000, and outstanding accounts receivable aged 2 years of $5,000. Based on historical data, he estimates that the following receivables are uncollectible: 1% of accounts receivable aged 1 year or less 2.5% of accounts receivable aged 1-2 years 4% of accounts receivable aged 2+ years The beginning balance in allowance for doubtful accounts is $1,419. Assuming write offs this year totaled $1,038, what is Eleazar's bad debt expense for the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Eleazars bad debt expense for the year using the aging method we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Kin Lo, George Fisher

Volume 1, 1st Edition

132612119, 978-0132612111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App