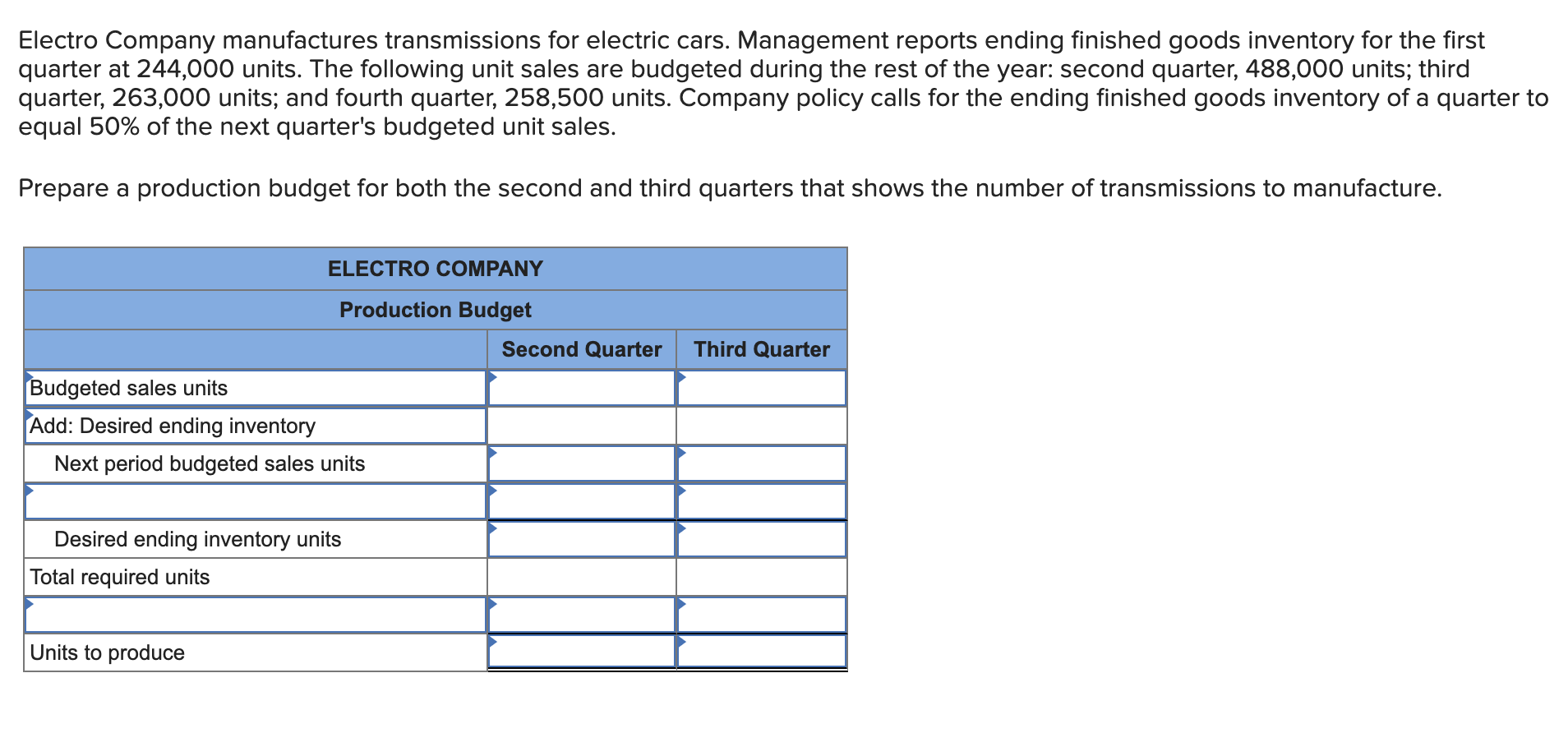

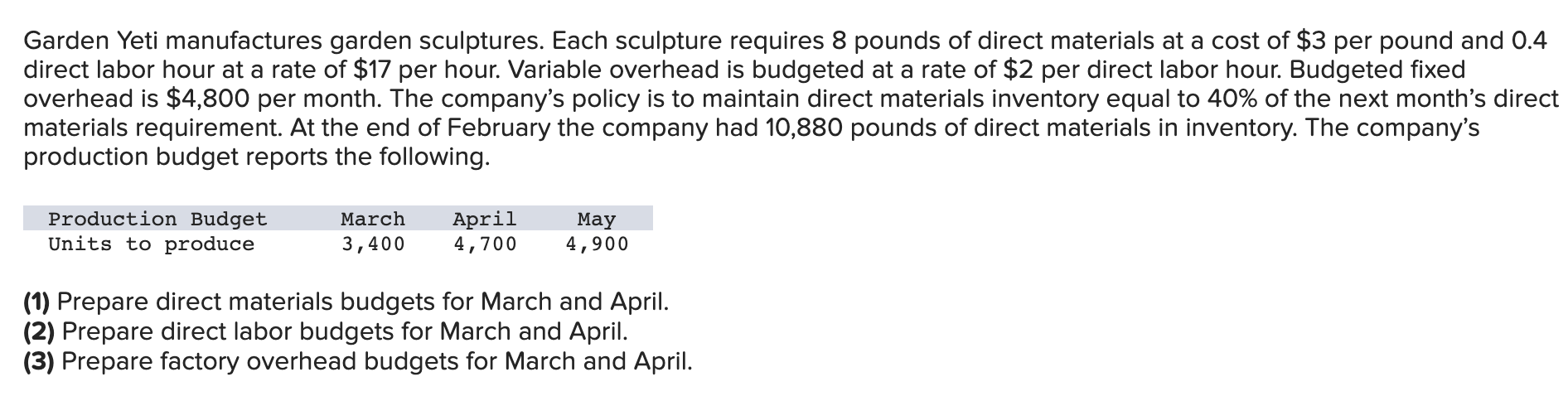

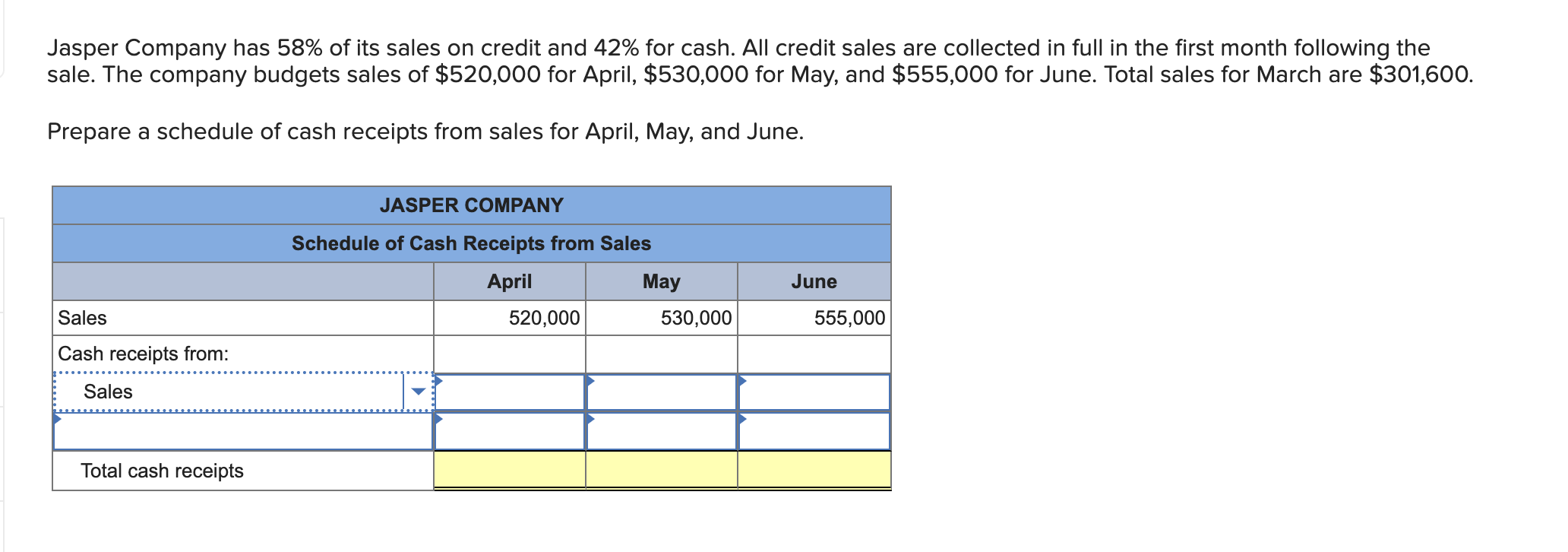

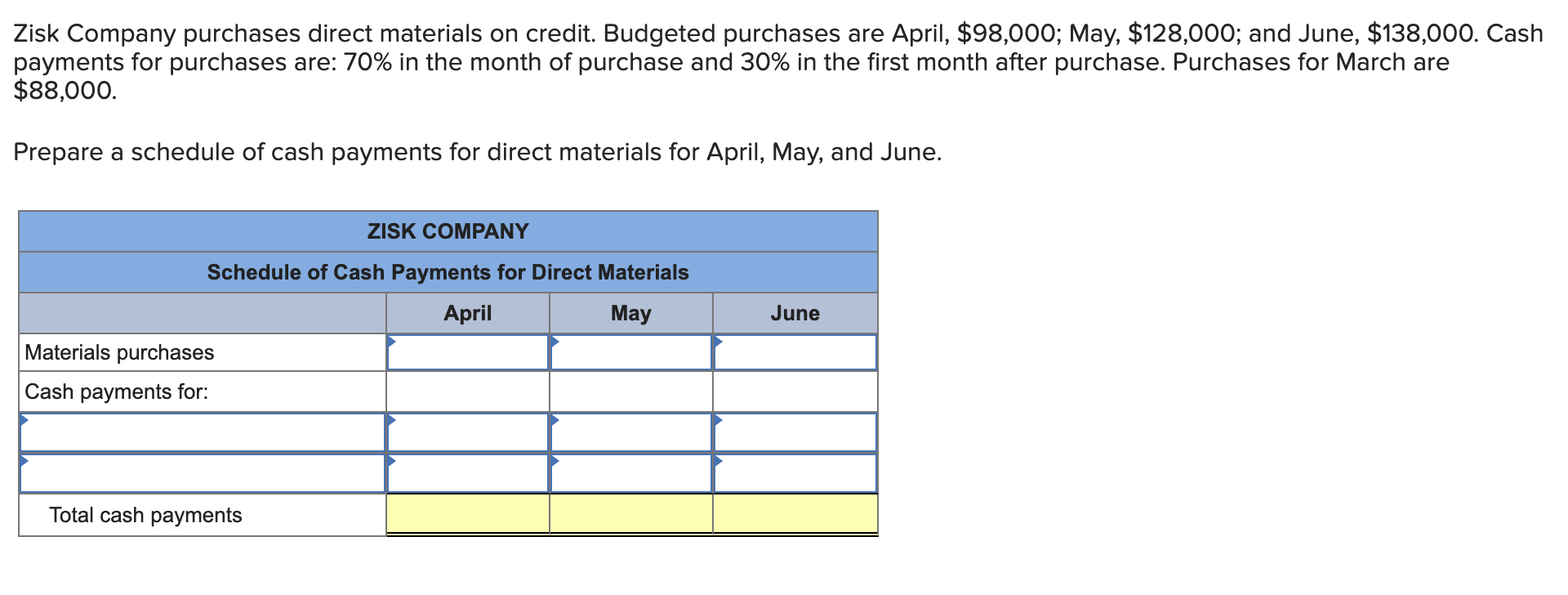

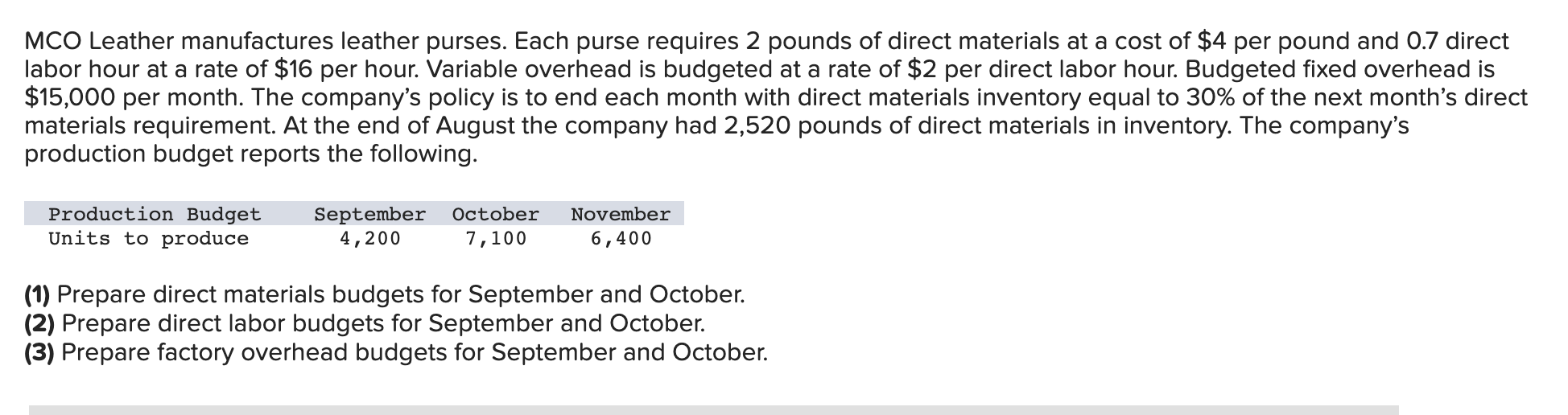

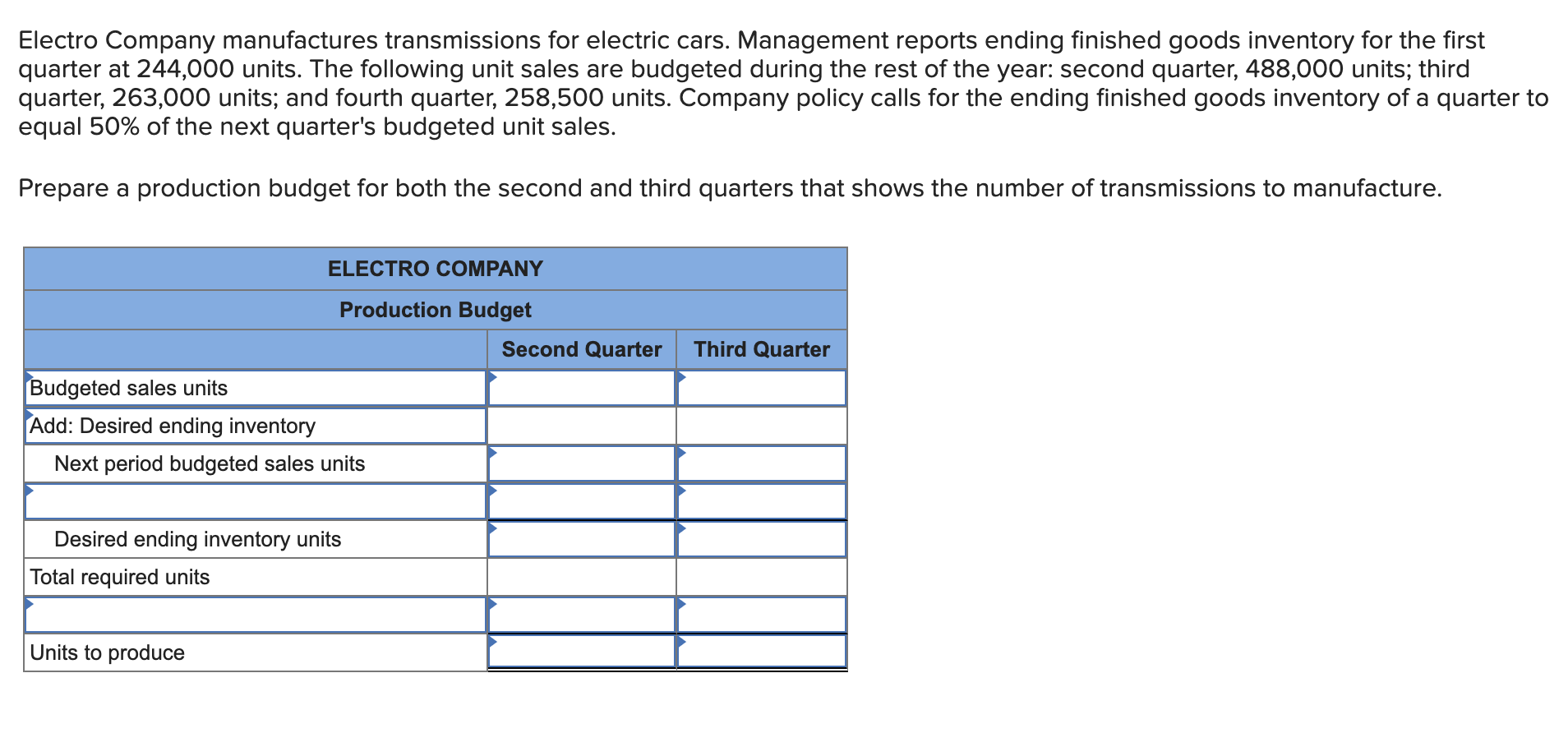

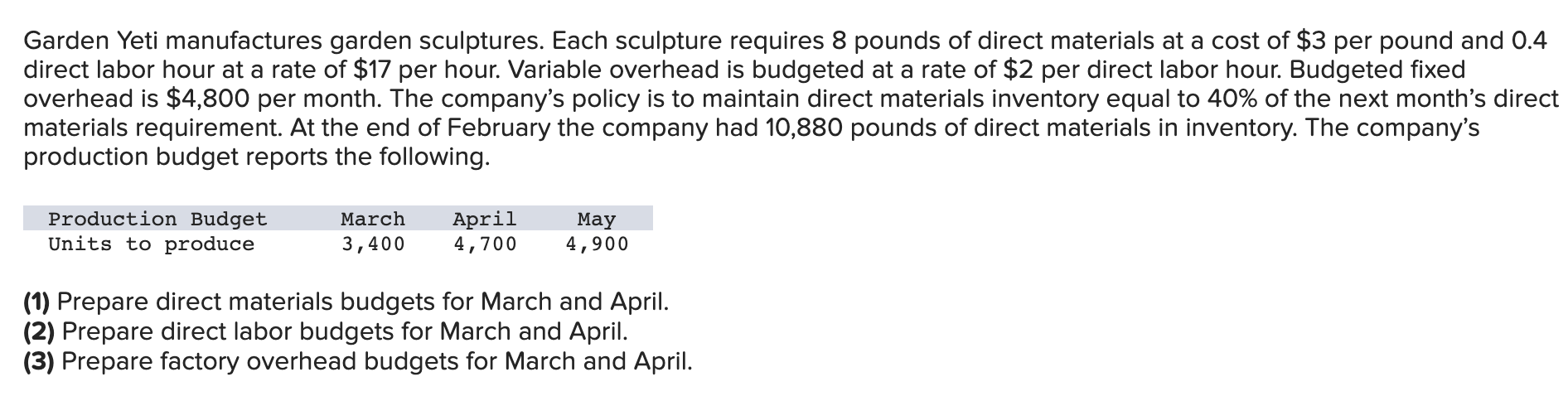

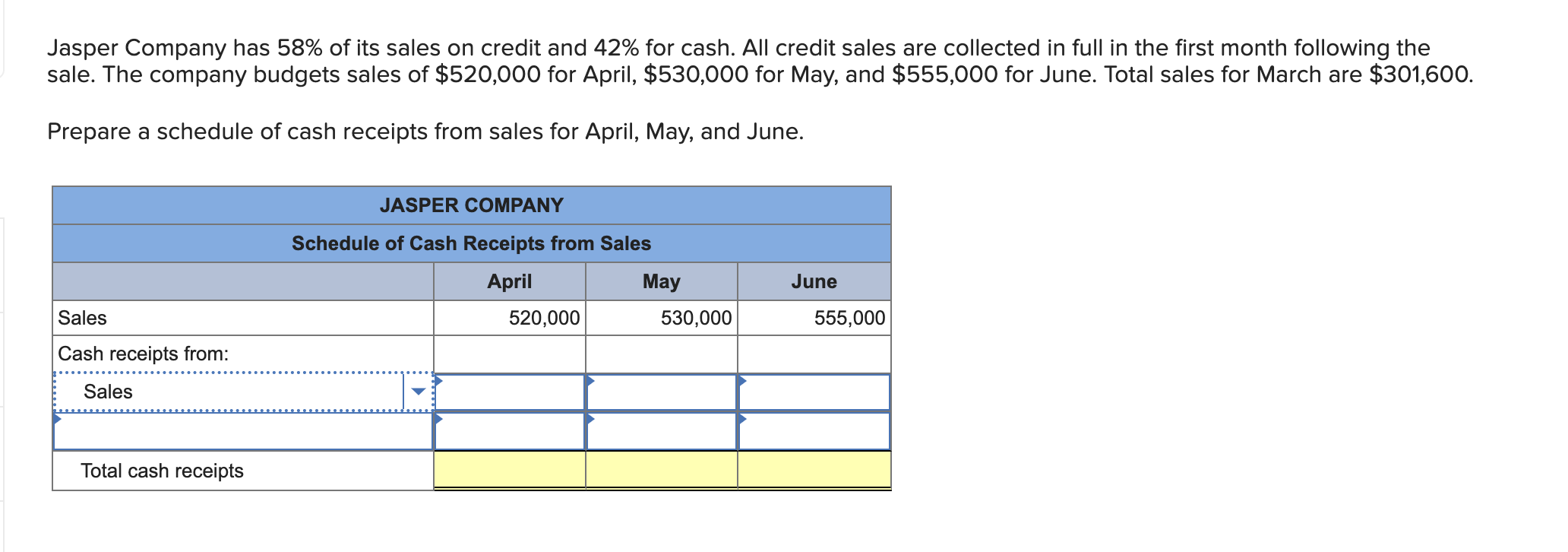

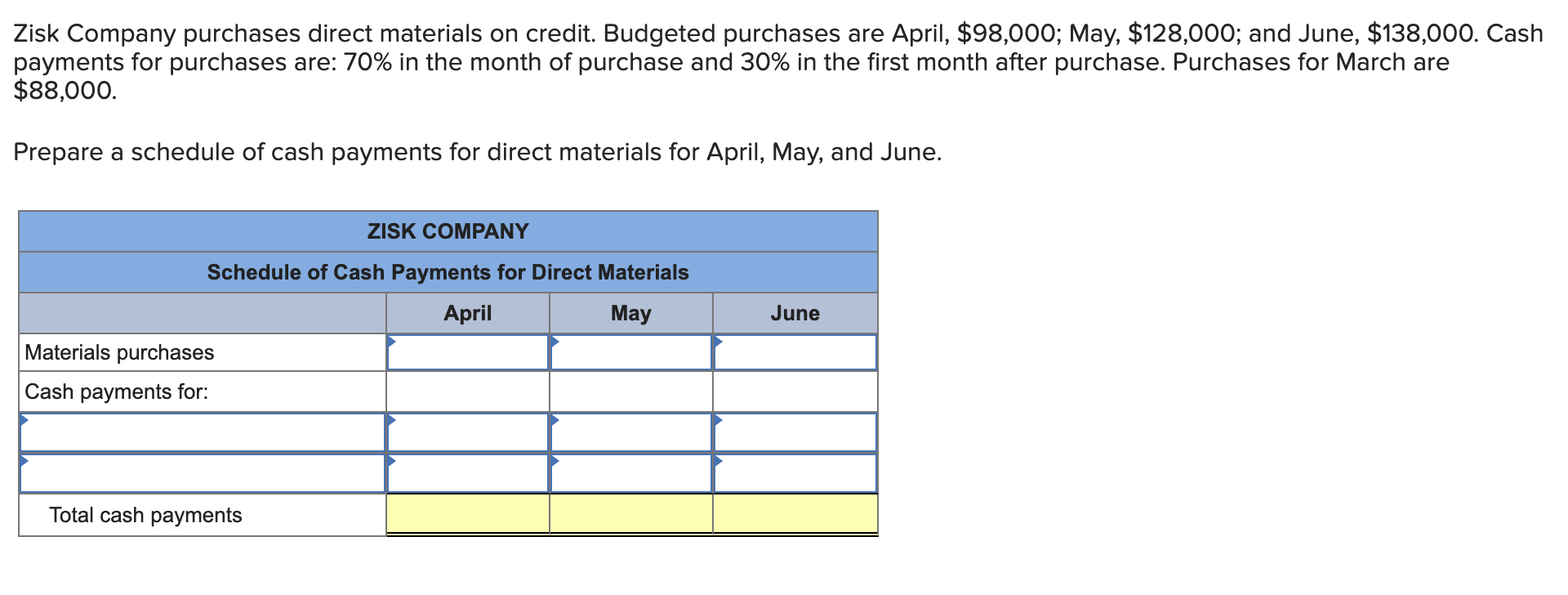

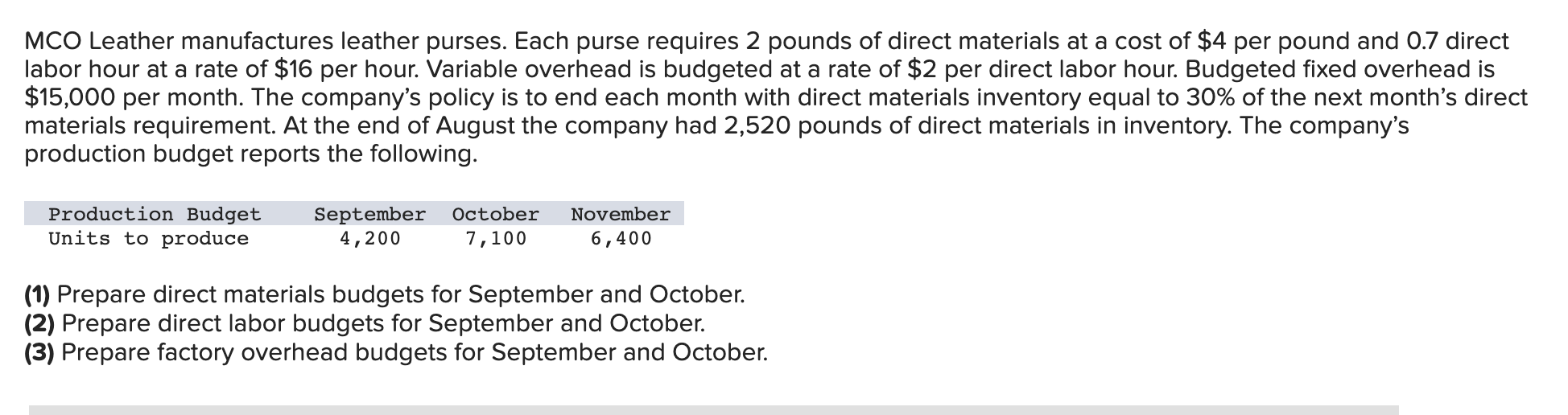

Electro Company manufactures transmissions for electric cars. Management reports ending finished goods inventory for the first quarter at 244,000 units. The following unit sales are budgeted during the rest of the year: second quarter, 488,000 units; third quarter, 263,000 units; and fourth quarter, 258,500 units. Company policy calls for the ending finished goods inventory of a quarter to equal 50% of the next quarter's budgeted unit sales. Prepare a production budget for both the second and third quarters that shows the number of transmissions to manufacture. Garden Yeti manufactures garden sculptures. Each sculpture requires 8 pounds of direct materials at a cost of $3 per pound and 0.4 direct labor hour at a rate of $17 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $4,800 per month. The company's policy is to maintain direct materials inventory equal to 40% of the next month's direct materials requirement. At the end of February the company had 10,880 pounds of direct materials in inventory. The company's production budget reports the following. (1) Prepare direct materials budgets for March and April. (2) Prepare direct labor budgets for March and April. (3) Prepare factory overhead budgets for March and April. Jasper Company has 58% of its sales on credit and 42% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $520,000 for April, $530,000 for May, and $555,000 for June. Total sales for March are $301,600. Prepare a schedule of cash receipts from sales for April, May, and June. Zisk Company purchases direct materials on credit. Budgeted purchases are April, $98,000; May, $128,000; and June, $138,000. Cash payments for purchases are: 70% in the month of purchase and 30% in the first month after purchase. Purchases for March are $88,000. Prepare a schedule of cash payments for direct materials for April, May, and June. MCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost of $4 per pound and 0.7 direct labor hour at a rate of $16 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $15,000 per month. The company's policy is to end each month with direct materials inventory equal to 30% of the next month's direct materials requirement. At the end of August the company had 2,520 pounds of direct materials in inventory. The company's production budget reports the following. (1) Prepare direct materials budgets for September and October. (2) Prepare direct labor budgets for September and October. (3) Prepare factory overhead budgets for September and October