Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ELECTRONIC ARTS Income Statement RATIO ANALYSIS ASSIGNMIENT Evaluating Financial Performance Please use the Electronic Arts (EA) financial statements at the end of this document to

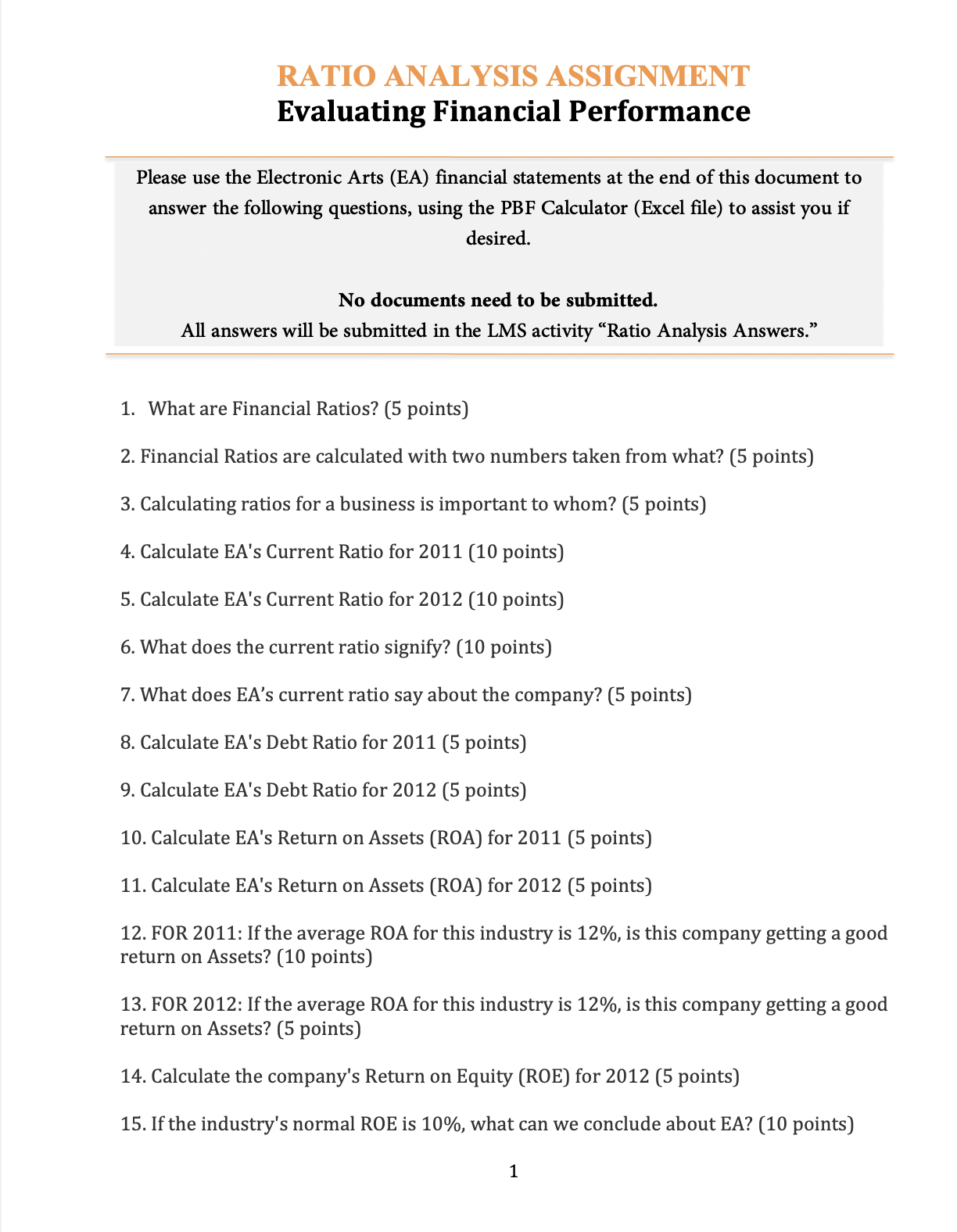

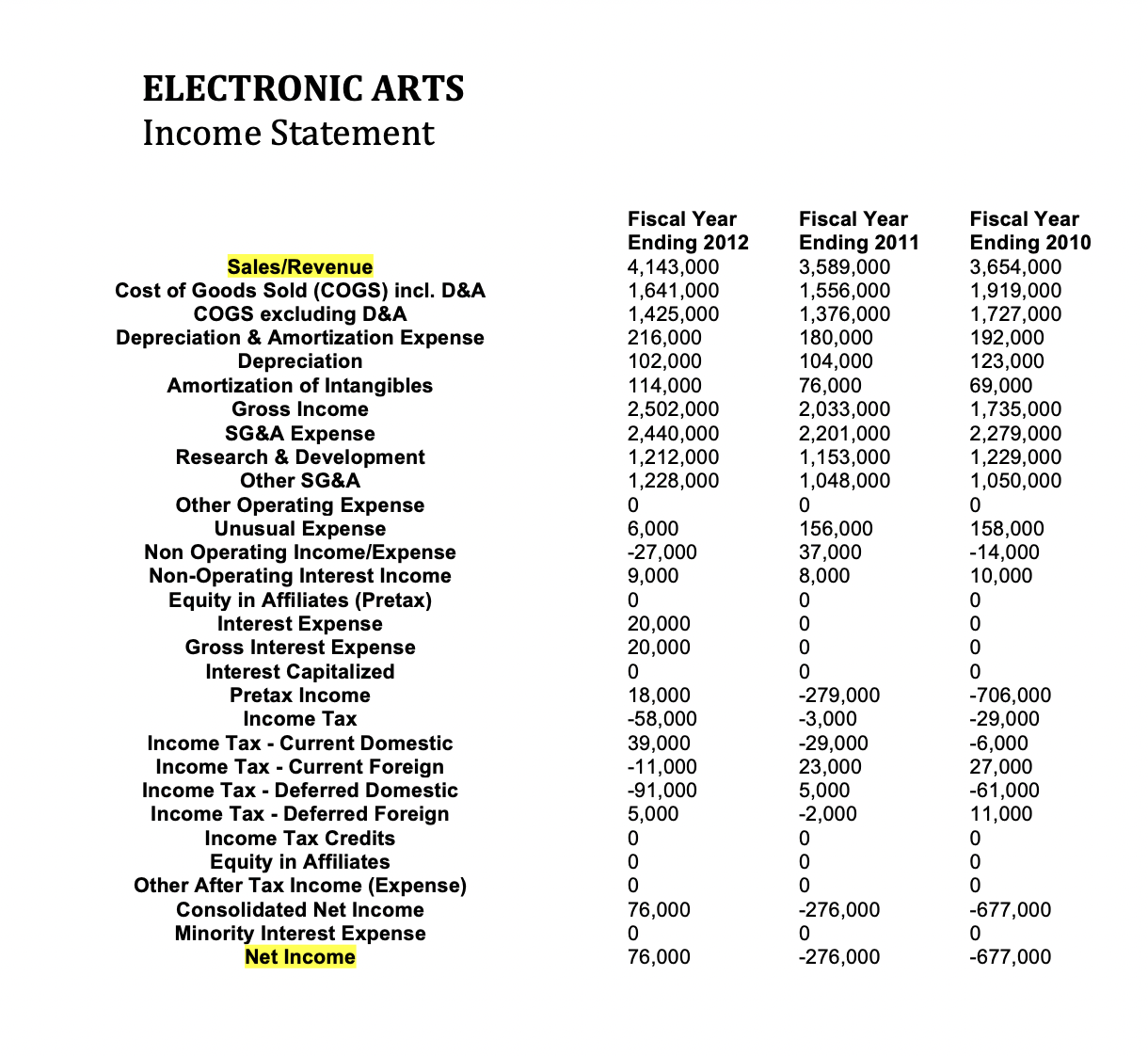

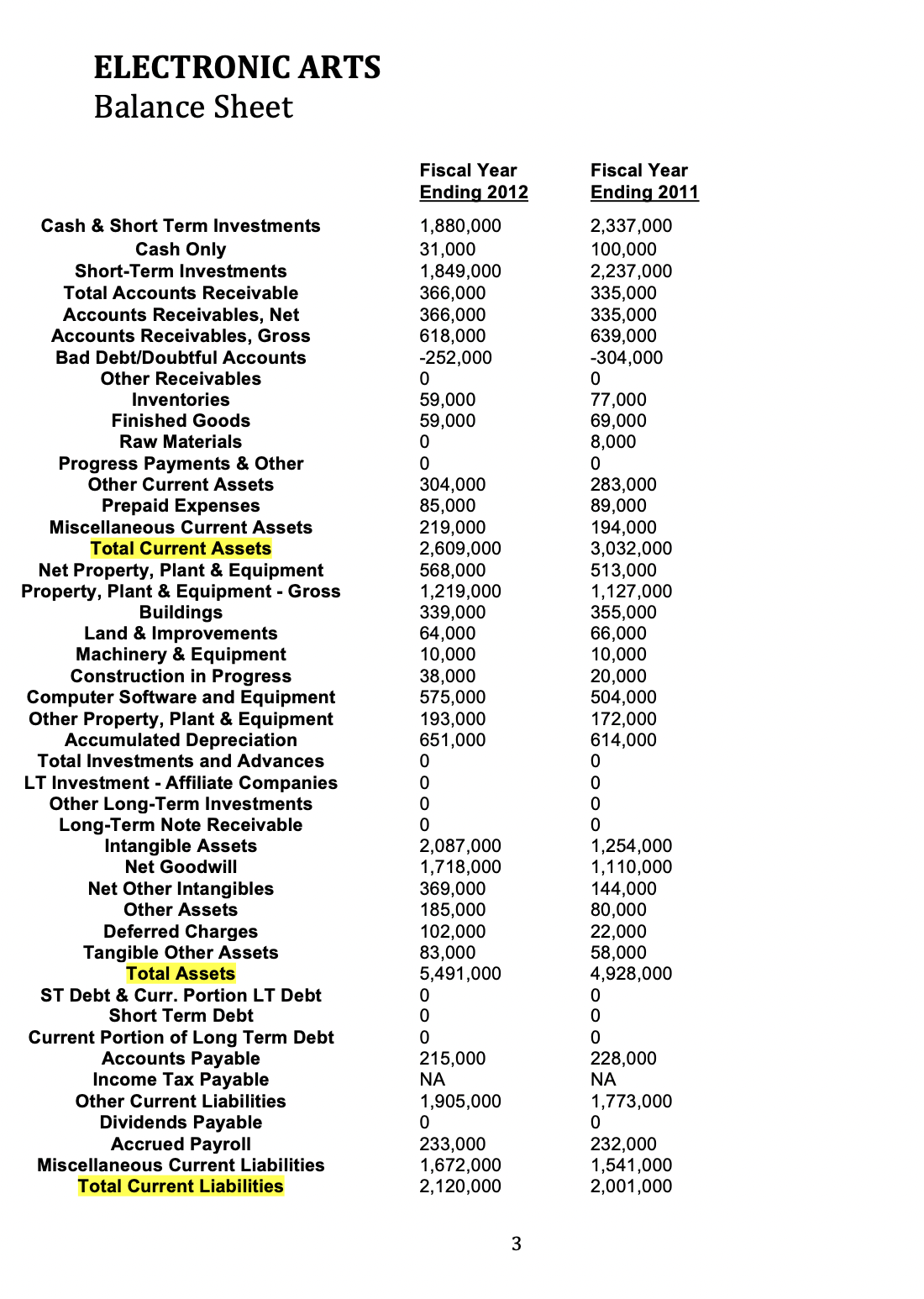

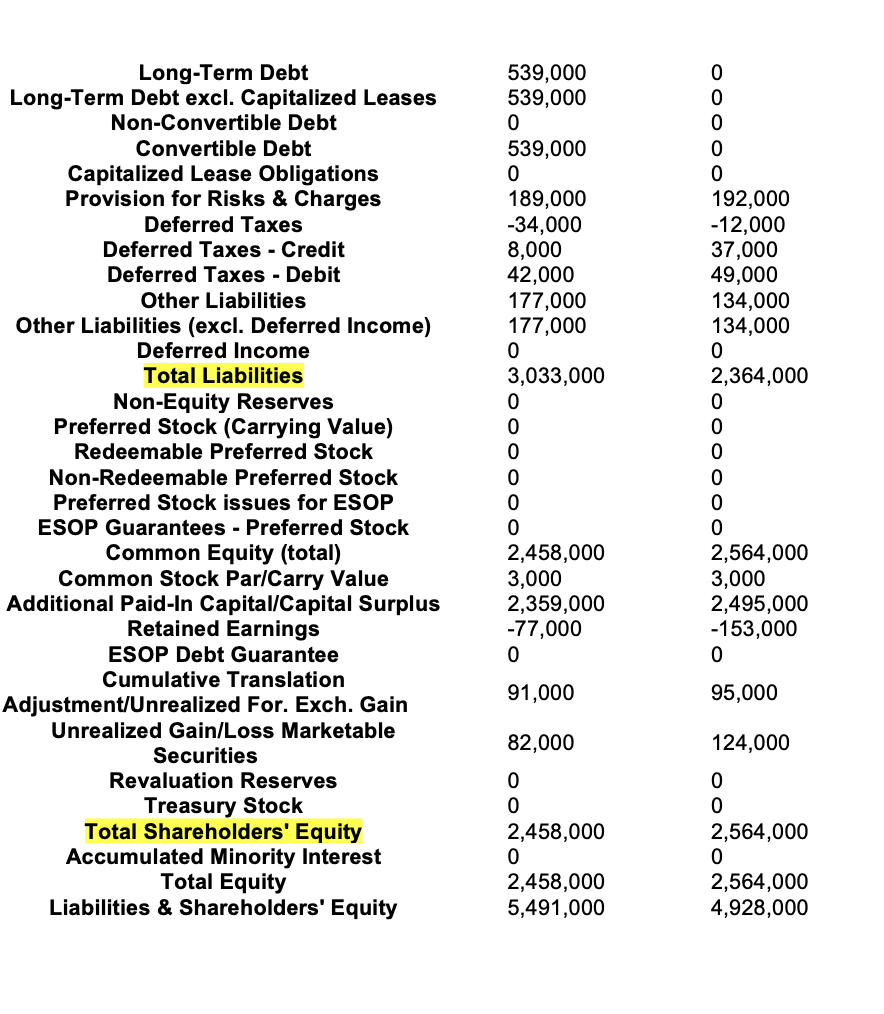

ELECTRONIC ARTS Income Statement RATIO ANALYSIS ASSIGNMIENT Evaluating Financial Performance Please use the Electronic Arts (EA) financial statements at the end of this document to answer the following questions, using the PBF Calculator (Excel file) to assist you if desired. No documents need to be submitted. All answers will be submitted in the LMS activity \"Ratio Analysis Answers.\" 1. What are Financial Ratios? (5 points) 2. Financial Ratios are calculated with two numbers taken from what? (5 points) 3. Calculating ratios for a business is important to whom? ( 5 points) 4. Calculate EA's Current Ratio for 2011 (10 points) 5. Calculate EA's Current Ratio for 2012 (10 points) 6. What does the current ratio signify? ( 10 points) 7. What does EA's current ratio say about the company? (5 points) 8. Calculate EA's Debt Ratio for 2011 (5 points) 9. Calculate EA's Debt Ratio for 2012 (5 points) 10. Calculate EA's Return on Assets (ROA) for 2011 (5 points) 11. Calculate EA's Return on Assets (ROA) for 2012 (5 points) 12. FOR 2011: If the average ROA for this industry is \12, is this company getting a good return on Assets? (10 points) 13. FOR 2012: If the average ROA for this industry is \12, is this company getting a good return on Assets? (5 points) 14. Calculate the company's Return on Equity (ROE) for 2012 (5 points) 15. If the industry's normal ROE is \10, what can we conclude about EA? (10 points) 1 ELECTRONIC ARTS Balance Sheet

ELECTRONIC ARTS Income Statement RATIO ANALYSIS ASSIGNMIENT Evaluating Financial Performance Please use the Electronic Arts (EA) financial statements at the end of this document to answer the following questions, using the PBF Calculator (Excel file) to assist you if desired. No documents need to be submitted. All answers will be submitted in the LMS activity \"Ratio Analysis Answers.\" 1. What are Financial Ratios? (5 points) 2. Financial Ratios are calculated with two numbers taken from what? (5 points) 3. Calculating ratios for a business is important to whom? ( 5 points) 4. Calculate EA's Current Ratio for 2011 (10 points) 5. Calculate EA's Current Ratio for 2012 (10 points) 6. What does the current ratio signify? ( 10 points) 7. What does EA's current ratio say about the company? (5 points) 8. Calculate EA's Debt Ratio for 2011 (5 points) 9. Calculate EA's Debt Ratio for 2012 (5 points) 10. Calculate EA's Return on Assets (ROA) for 2011 (5 points) 11. Calculate EA's Return on Assets (ROA) for 2012 (5 points) 12. FOR 2011: If the average ROA for this industry is \12, is this company getting a good return on Assets? (10 points) 13. FOR 2012: If the average ROA for this industry is \12, is this company getting a good return on Assets? (5 points) 14. Calculate the company's Return on Equity (ROE) for 2012 (5 points) 15. If the industry's normal ROE is \10, what can we conclude about EA? (10 points) 1 ELECTRONIC ARTS Balance Sheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started