Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Electronic Inc (EI) produces three types of circuit boards, A, B and C for the Computer Manufacturers and after sales maintenance industries. The cost system

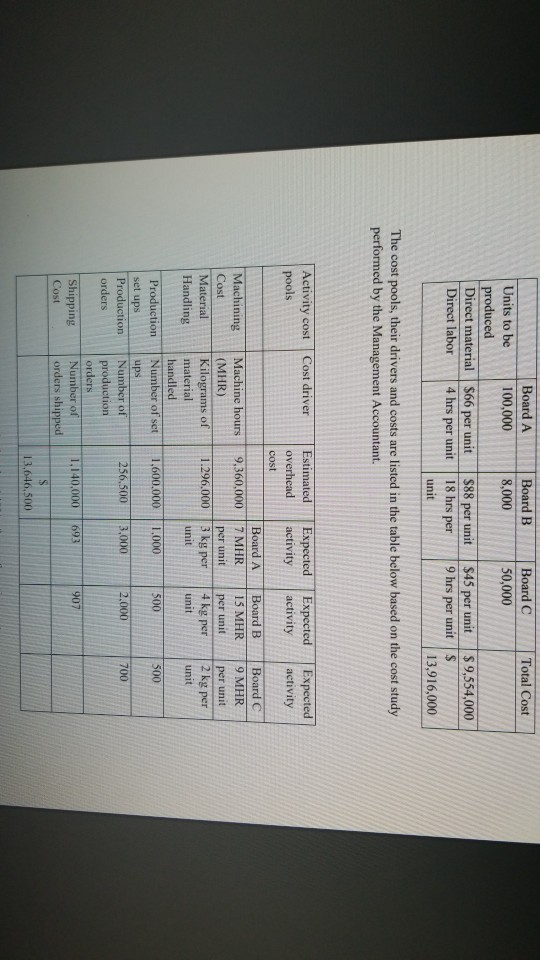

Electronic Inc (EI) produces three types of circuit boards, A, B and C for the Computer Manufacturers and after sales maintenance industries. The cost system used by El until 2013 was classified as the traditional where all cost except direct material and direct labour were allocated to each board based on the direct labour hours used to produce them, (i.e direct labour was the cost driver). The new Management accountant undertook a cost study to improve the costing and pricing of the boards and it was determined that they were six clearly identifiable cost pools which could be used to implement an ABC costing system. The following table details the budgeted information for the year 2015. Total Indirect Production cost for the year is budgeted to be $ 13,646,500. Total Cost Board A 100,000 Board B 8,000 Board C 50,000 Units to be produced Direct material Direct labor $66 per unit 4 hrs per unit $88 per unit 18 hrs per $45 per unit 9 hrs per unit $ 9,554,000 13,916,000 The cost pools, their drivers and costs are listed in the table below based on the cost study performed by the Management Accountant. Activity cost Cost driver pools Estimated overhead cost Expected activity Expected activity Expected activity 9,360,000 Board A 7 MHR per unit 3 kg per unit Board B 15 MHR per unit Machining Cost Material Handling Board C 9 MHR per unit 2 kg per unit 1.296.000 4 kg per unit 1.600.000 Machine hours (MHR) Kilograms of material handled Number of set ups Number of production orders Number of orders shipped 1.000 500 500 Production set ups Production orders 256,500 3,000 2.000 1,140.000 693 9 07 Shipping Cost 13,646,500 The selling price for the product is calculated at 140% of manufacturing cost. Required 1. Compute the predetermined overhead rates under the traditional costing system and determine the total production cost for each product as well as the expected selling price. 2. Compute the ABC overhead cost for each product and determine the total production cost for each product and the expected selling price. 3. Discuss the effect to the organization of changing the costing method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started