Question

Elegance, a manufacturer of high-end winter apparel, is keen to expand its offerings by introducing a new range of coats made from the fur of

Elegance, a manufacturer of high-end winter apparel, is keen to expand its offerings by introducing a new range of coats made from the fur of baby sea lions. This project is expected to require an initial investment of $800 million. However, a concerted campaign by animal rights activists has seen the company's sourcing practices draw the ire of legislators. The company is eagerly awaiting the results of a key regulatory ruling that will have a material impact on the value of its existing business and future investment.

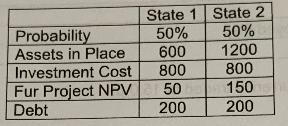

Given the uncertainty, the company is unable to secure additional debt financing (it has $200m of outstanding debt on its balance sheet) and must raise the required $800m by issuing outside equity. The following table details the outcomes depending on whether the regulatory ruling is harsh (State 1) or soft (State 2), as well as the market's assessment of the probability of each state. All dollar values are in millions.

When answering this question, state any additional assumptions you may need to make. Show your calculations. la novo yo inunos 15 UD (3 SOS base TE boone say Isionsmil od 101 unor

Required:

a) If Elegance's managers must issue equity without knowing whether the ruling will be harsh or soft, what percentage of the firm's equity must original equity holders give up in exchange for the capital?

b) If there was no debt in Elegance's capital structure, would this raise or lower the percent of equity demanded by outside investors in part a)? Explain briefly. Assume all other numbers remain unchanged. on (4 marks) For the remainder of this question, assume the company has $200 million of debt in its capital structure (as per the table above).

c) Now assume that management knows the true state of the world before the decision to issue and invest is made. If management is maximising the wealth of old shareholders and can sell equity at the terms described in part a), do they have an incentive to use their inside information when deciding whether to issue equity and invest? Explain.

State 1| State 2 50% Probability Assets in Place Investment Cost 50% 1200 600 800 800 Fur Project NPV Debt 50 150 200 200 State 1| State 2 50% Probability Assets in Place Investment Cost 50% 1200 600 800 800 Fur Project NPV Debt 50 150 200 200

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Assuming the total capital employed by the Elegance is 2000M the current capital structure of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started