Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Elena died on October 1, 2019. Elena had three children, Oscar, Chance, and Dalia. Due to her family dynamics, Elena had spent a lot

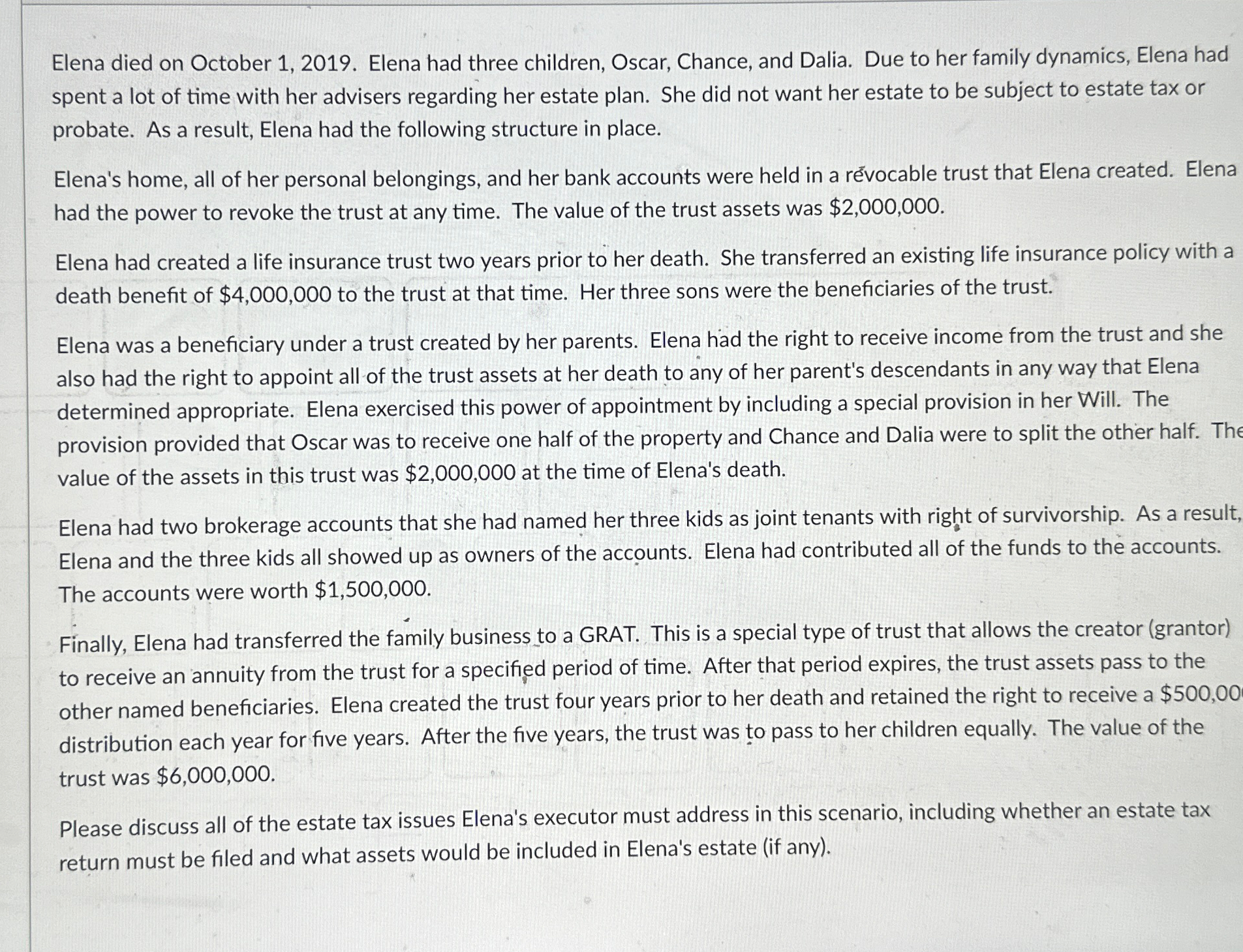

Elena died on October 1, 2019. Elena had three children, Oscar, Chance, and Dalia. Due to her family dynamics, Elena had spent a lot of time with her advisers regarding her estate plan. She did not want her estate to be subject to estate tax or probate. As a result, Elena had the following structure in place. Elena's home, all of her personal belongings, and her bank accounts were held in a revocable trust that Elena created. Elena had the power to revoke the trust at any time. The value of the trust assets was $2,000,000. Elena had created a life insurance trust two years prior to her death. She transferred an existing life insurance policy with a death benefit of $4,000,000 to the trust at that time. Her three sons were the beneficiaries of the trust. Elena was a beneficiary under a trust created by her parents. Elena had the right to receive income from the trust and she also had the right to appoint all of the trust assets at her death to any of her parent's descendants in any way that Elena determined appropriate. Elena exercised this power of appointment by including a special provision in her Will. The provision provided that Oscar was to receive one half of the property and Chance and Dalia were to split the other half. The value of the assets in this trust was $2,000,000 at the time of Elena's death. Elena had two brokerage accounts that she had named her three kids as joint tenants with right of survivorship. As a result, Elena and the three kids all showed up as owners of the accounts. Elena had contributed all of the funds to the accounts. The accounts were worth $1,500,000. Finally, Elena had transferred the family business to a GRAT. This is a special type of trust that allows the creator (grantor) to receive an annuity from the trust for a specified period of time. After that period expires, the trust assets pass to the other named beneficiaries. Elena created the trust four years prior to her death and retained the right to receive a $500,00 distribution each year for five years. After the five years, the trust was to pass to her children equally. The value of the trust was $6,000,000. Please discuss all of the estate tax issues Elena's executor must address in this scenario, including whether an estate tax return must be filed and what assets would be included in Elena's estate (if any).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started