Answered step by step

Verified Expert Solution

Question

1 Approved Answer

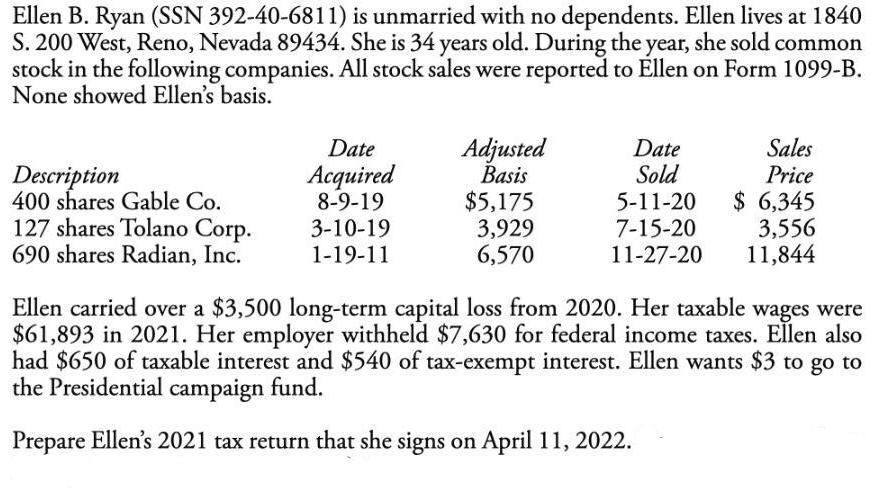

Ellen B. Ryan (SSN 392-40-6811) is unmarried with no dependents. Ellen lives at 1840 S. 200 West, Reno, Nevada 89434. She is 34 years

Ellen B. Ryan (SSN 392-40-6811) is unmarried with no dependents. Ellen lives at 1840 S. 200 West, Reno, Nevada 89434. She is 34 years old. During the year, she sold common stock in the following companies. All stock sales were reported to Ellen on Form 1099-B. None showed Ellen's basis. Description 400 shares Gable Co. 127 shares Tolano Corp. 690 shares Radian, Inc. Date Acquired 8-9-19 3-10-19 1-19-11 Adjusted Basis $5,175 3,929 6,570 Date Sold 5-11-20 7-15-20 11-27-20 Sales Price $ 6,345 3,556 11,844 Ellen carried over a $3,500 long-term capital loss from 2020. Her taxable wages were $61,893 in 2021. Her employer withheld $7,630 for federal income taxes. Ellen also had $650 of taxable interest and $540 of tax-exempt interest. Ellen wants $3 to go to the Presidential campaign fund. Prepare Ellen's 2021 tax return that she signs on April 11, 2022.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Heres the information youve provided formatted into a tax return Ellen ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started