Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ellen Corp. wants to buy GE stock in nine months. Right now, the GE stock is traded at $14.60. The related annual risk-free interest

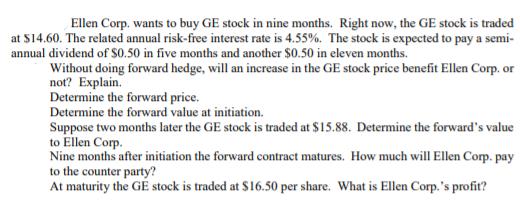

Ellen Corp. wants to buy GE stock in nine months. Right now, the GE stock is traded at $14.60. The related annual risk-free interest rate is 4.55%. The stock is expected to pay a semi- annual dividend of $0.50 in five months and another $0.50 in eleven months. Without doing forward hedge, will an increase in the GE stock price benefit Ellen Corp. or not? Explain. Determine the forward price. Determine the forward value at initiation. Suppose two months later the GE stock is traded at $15.88. Determine the forward's value to Ellen Corp. Nine months after initiation the forward contract matures. How much will Ellen Corp. pay to the counter party? At maturity the GE stock is traded at $16.50 per share. What is Ellen Corp.'s profit?

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether an increase in the GE stock price will benefit Ellen Corp we need to understand the mechanics of a forward contract In a forward ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started