Question

Ellen is a single taxpayer who is considering two job offers. Ellen considers both accounting firms to be equally desirable in terms of the opportunities

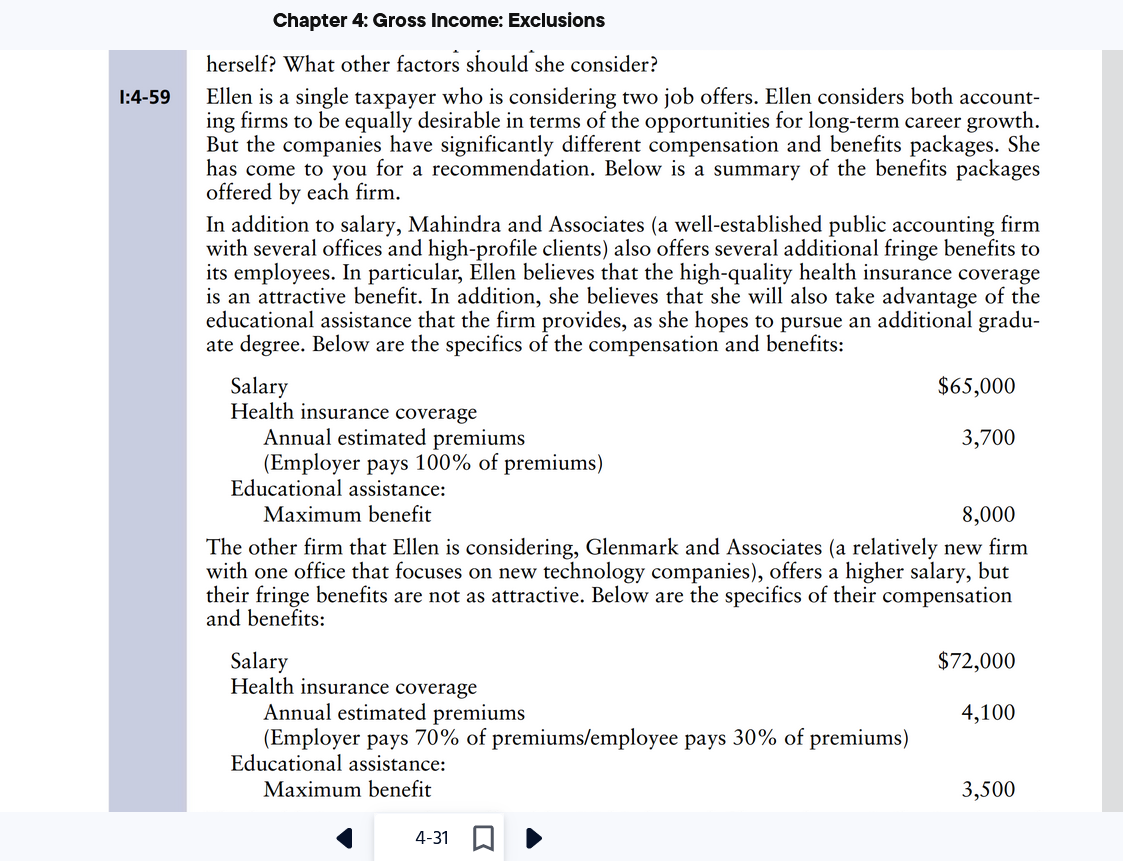

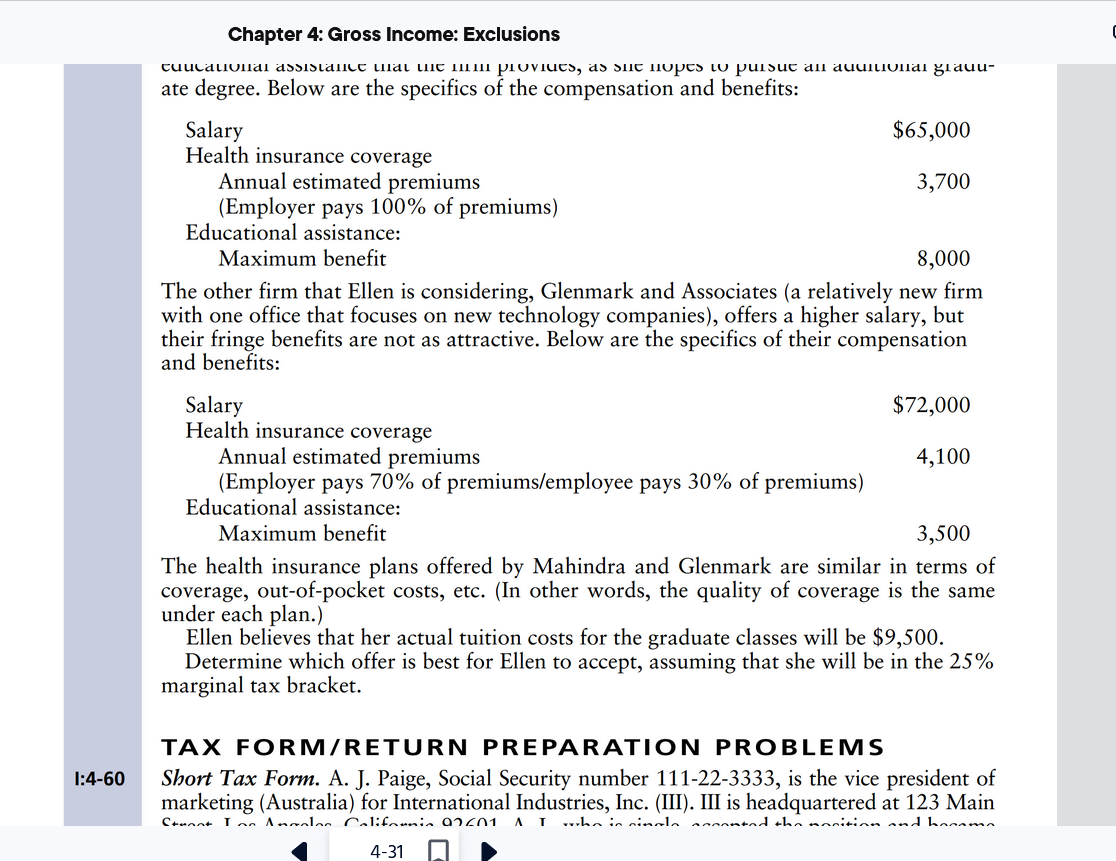

Ellen is a single taxpayer who is considering two job offers. Ellen considers both accounting firms to be equally desirable in terms of the opportunities for long-term career growth . But the companies have significantly different compensation and benefits packages. She has come to you for a recommendation. Below is a summary of the benefits packages offered by each firm. In addition to salary, Mahindra and Associates (a well-estab lished public accounting firm with several offices and high-profile clients) also offers several additional fringe benefits to its emp loyees. In particular, Ellen believes that the high-quality health insurance coverage is an attractive benefit. In addition, she believes that she will also take advantage of the educationa l assistance that the firm provides, as she hopes to pursue an additional gradu - ate degree. Below are the specifics of the compensation and benefits:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started