Question

Ellen Pride is a 24-hectare site in a rural area that is becoming part of the commuter belt of a growing American city. The site

Ellen Pride is a 24-hectare site in a rural area that is becoming part of the commuter belt of a growing American city. The site is zoned for residential development, but its owner, Adam Switz lacks the required capital to develop (i.e. build on) the site himself; instead he plans to sell it. There are two interested parties: Horn Development and Chicago Commerce.

Although the site is zoned for residential development, that does not mean that the eventual developer will be allowed to build on the entire site. The planning authority will require a proportion of the site to be left as green area for public amenity. When the sites buyer lodges a specific development plan, the planning authority will decide the exact number of hectares authorized for development. (There can be considerable variation from site to site and situation to situation.)

Horn Development has offered Adam a price that includes a lump sum plus an additional follow-up payment for each hectare that they are authorized to develop. Their offer is a 3.52 million lump sum and 1.056 million per hectare approved for development. (It typically takes a few months to obtain development authorization and the payment per hectare would come in as soon as authorization is obtained. However, Adam is not concerned about the time value of money and will count all cash flows as present-day values). Adam was very pleased with the Horn Development offer and was planning on accepting it, until he was contacted by Chicago Commerce.

In discussions with Mia Bontire, the CEO of Chicago Commerce, Adam learned that Chicago Commerce is interested in making an offer to buy Ellen Pride because it is adjacent to Capture Inc, another site owned by the company and would enable them to expand and improve a housing development that they are already hoping to build. They are currently trying to obtain permission to build on the Capture Inc. site, but for various reasons, the planning authority might not give permission to build at Capture Inc.

In short, Chicago Commerces ownership of Capture Inc. would make Ellen Pride more valuable to them than to other prospective buyers. However, Mia Bontire acknowledged that they might not succeed in getting planning permission for Capture Inc. In fact, he believes the probability of success is 0.7. The Capture Inc. discussions are expected to take another six months to complete, and Tom needs to sell his site before then, so he proceeded to negotiate a deal with Mia Bontire that allowed for two possible contingencies: what Chicago Commerce would pay if Capture Inc. succeeds in getting planning permission, and what they would pay if Capture Inc. fails to get permission.

The negotiation closed with a proposal from Chicago Commerce to pay 2.72 million in cash for the Ellen Pride site, plus 2.08 million per hectare approved for development if Capture Inc. is granted permission or 0.512 million per hectare if Capture Inc. is not granted permission. We believe our offer to be excellent, said Pat Leahy. Theres considerable upside potential for you in comparison to what other buyers are likely to pay, as long as youre willing to help us share the downside risk by accepting lower than typical prices in the event that Capture Inc. doesnt work out. (Once again, the lump sum would be paid immediately, and the per hectare payment would be paid at a later date, but as with the Horn Development proposal, Tom is not concerned about the time value of money and will count all cash flows as present-day values.)

Tom discussed the Chicago Commerce offer with a friend of his who is an expert on planning and development. His friend stated that Chicago Commerce and Mia Bontire were too optimistic about their chances of getting permission to build at Capture Inc. The expert said that a more realistic estimate of the likelihood of Capture Inc. getting permission was only 0.4. Tom knew that this experts assessment was more reliable than Mia Bontires, so Tom will use the experts 0.4 assessment when making his decision.

Tom also told Horn Development that he had received another offer and that, subject to his evaluation of it, Wotton might have to make an improved counteroffer.

Horn Development responded by saying that they had another acquisition opportunity so they would not be improving their offer for Ellen Pride if they were outbid by another prospective buyer. Tom was certain that they were not bluffing and that the offer they had put on the table was the best one they would make.

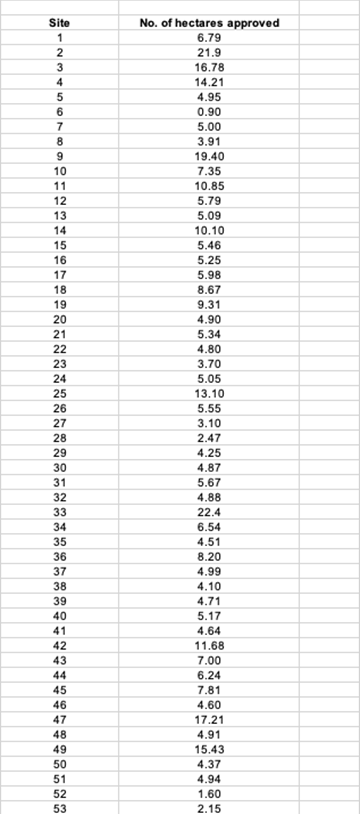

Before making his decision, Tom decided to gather some information about the number of hectares likely to be approved for development at Ellen Pride. He wanted to factor in the uncertainty about how much land at Ellen Pride would be approved for development, as this would affect the total price he would receive from either buyer. He gathered data about the number of hectares approved for development on other 24-hectare sites in the past five years, finding data on over fifty sites of similar size and character. He was alarmed to discover that there is considerable variation in how much or how little development is allowed on such sites (see Appendix 1: Ellen Pride Table 1 below)

Tom studied background files on all the sites in the list and concluded that all were representative of the type of development potential present at Ellen Pride. There was clearly a significant range of possible outcomes.

This information has made him realize that he shouldnt simply use a single- point estimate for the number of approved development hectares; he wants his decision to reflect the level of uncertainty by taking account of five different possible outcomes, using the bracket medians approach.

Tasks:

- Draw a decision tree that represents the decision that Tom has to make. Solve using the rollback process. Assume that his decision is based solely on expected value disregarding taxes, inflation, and time value of money. Make a recommendation based on your findings. In your accompanying report, clearly explain the approach you took to modelling uncertainty in the problem, show any calculations or estimations you undertook, and demonstrate how you used the bracket medians method.

- Tom has thought about the difference between his probability estimate for the success of Capture Inc. and the estimate made by Mia Bontire. He feels that this difference could enable him to develop a proposal that both he and Chicago Commerce could accept. After working through a number of possibilities, Tom has developed a proposal to put to Mia Bontire. His proposal is that Chicago Commerce pays a cash sum of 3.84 million, plus 1.344 million per hectare if Capture Inc. is successful and 1.024 million per hectare if Capture Inc. fails. Show Toms decision tree for this new proposal. What is his expected value?

- Mia Bontire is weighing up which offer is better: the one he had originally made to Adam Switz, or Toms revised proposal outlined in (b) above. Draw a decision tree of how that decision looks from Mia Bontires perspective and indicate which proposal he would prefer if he wishes to minimize the expected price paid for Ellen Pride.

- Suppose that Chicago Commerce is willing to accept Toms proposal outlined in (b). Prepare Toms cumulative risk profiles comparing the revised Chicago Commerce proposal (i.e. Toms new proposal) with the Horn Development bid. Draw conclusions and make recommendations, indicating whether there is a dominant risk profile.

- Based on your findings in terms of both the expected value and risk profiles of Toms choices, what would you recommend?

Appendix 1: No. of hectares approved for development on 24-hectare sites similar to Ellen Pride.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started