Answered step by step

Verified Expert Solution

Question

1 Approved Answer

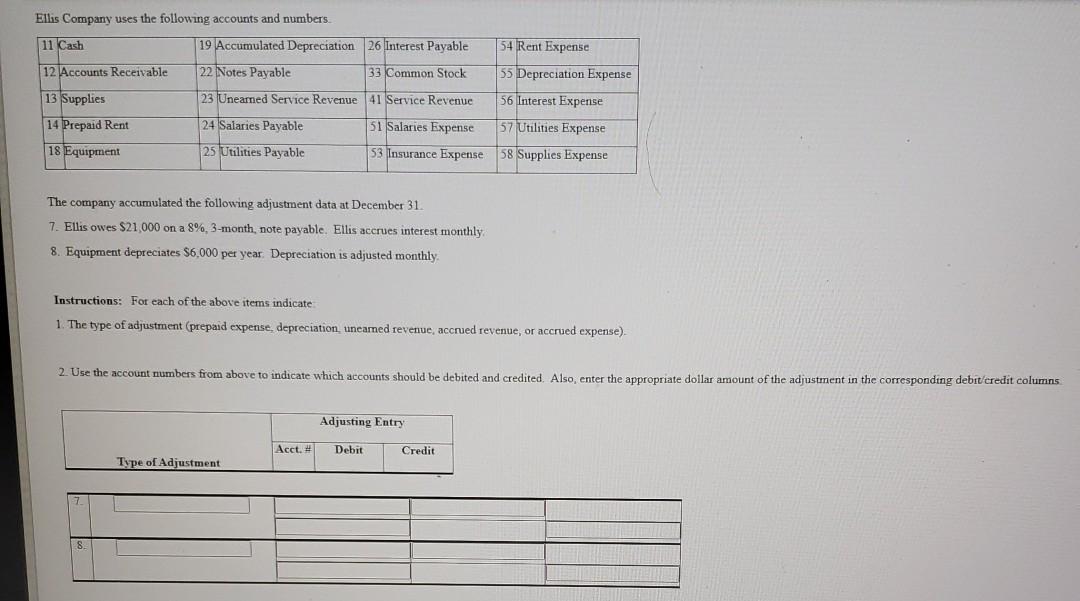

Ellis Company uses the following accounts and numbers 11 Cash 19 Accumulated Depreciation 26 Interest Payable 54 Rent Expense 12 Accounts Receivable 22 Notes Payable

Ellis Company uses the following accounts and numbers 11 Cash 19 Accumulated Depreciation 26 Interest Payable 54 Rent Expense 12 Accounts Receivable 22 Notes Payable 33 Common Stock 55 Depreciation Expense 13 Supplies 23 Uneared Service Revenue 41 Service Revenue 56 Interest Expense 14 Prepaid Rent 24 Salaries Payable 51 Salaries Expense 57 Utilities Expense 18 Equipment 25 Utilities Payable 53 Insurance Expense 58 Supplies Expense The company accumulated the following adjustment data at December 31 7. Ellis owes $21,000 on a 8%, 3-month, note payable. Ellis accrues interest monthly 8. Equipment depreciates $6,000 per year. Depreciation is adjusted monthly Instructions: For each of the above items indicate 1. The type of adjustment (prepaid expense, depreciation uneared revenue, accrued revenue, or accrued expense). 2. Use the account numbers from above to indicate which accounts should be debited and credited. Also, enter the appropriate dollar amount of the adjustment in the corresponding debit/credit columns Adjusting Entry Acct Debit Credit of Adjustment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started