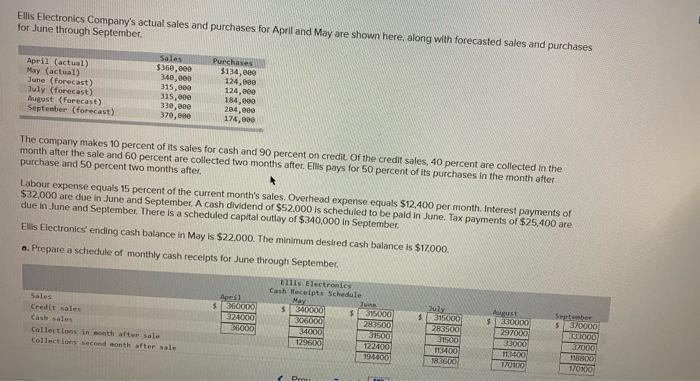

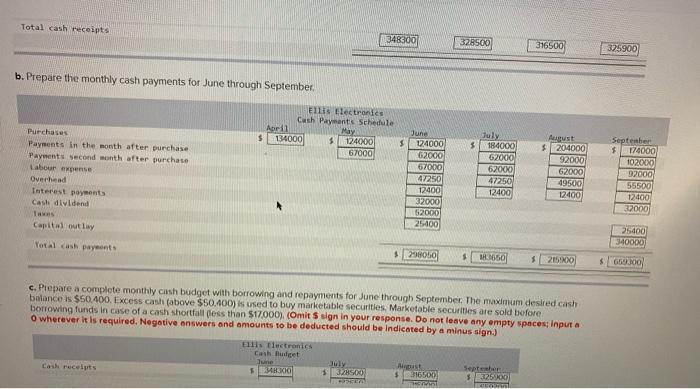

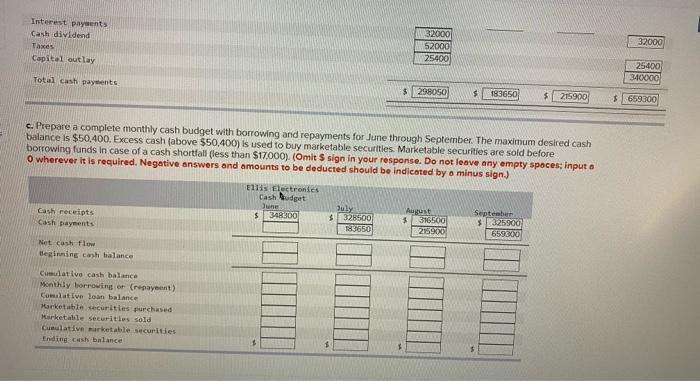

Ellis Electronics Company's actual sales and purchases for April and May are shown here, along with forecasted sales and purchases for June through September April (actual) May (actual) June (forecast) July (forecast) August (forecast) September (forecast) Sales $360,000 340,000 315,000 315,000 330.000 370,000 Purchases $134,200 124.000 124,000 184,000 204,000 174,000 The company makes 10 percent of its sales for cash and 90 percent on credil of the credit sales 40 percent are collected in the month after the sale and 60 percent are collected two months after. Eles pays for 50 percent of its purchases in the month after purchase and 50 percent two months after Labour expense equals 15 percent of the current month's sales, Overhead expense equals $12,400 per month. Interest payments of $32,000 are due in June and September. A cash dividend of $52.000 is scheduled to be paid in June. Tax payments of $25,400 are due in June and September. There is a scheduled capital outlay of $340,000 in September Ellis Electronics'ending cash balance in May is $22,000. The minimum desired cash balance is $17,000 a. Prepare a schedule of monthly cash receipts for June through September 15 Electronics Cash Wecelts Schedule Apelli Sales May June 2017 August $ 360000 5340000 September $ 395000 $ 315000 Credit sal $ 330000 5 3/0000 324000 36000 283500 Cash sales 283500 27000 000 36000 4000 31500 31500 D5000 37000 Collections in the after sale 12-0600 122400 T3400 T. MOO Collection conth after sale 116800 194000 co 1/0100 1/020 Pro Total cash receipts 348300 328500 316500 325900 b. Prepare the monthly cash payments for June through September Enlls Electronics Cash Payments Schedule Abril May $ 134000 s 1240001 67000 $ Purchases Payments in the month after purchase Payments second month after purchase Labour expense Overhead Interest payments Cash dividend ws Capital outlay June 124000 62000 67000 47250 12400 32000 52000 25400 July 1840CX 62000 62000 47250 12400 August $204000 92000 62000 49500 12400 September 5 174000 10200X 92000 55500 12400 32000 25400 340000 Yotal cash payants $29050 18650 20500 $668300 c. Prepare a complete monthly cash budget with borrowing and repayments for June through September. The maximum desired cash balance is $50.400. Excess cash (above $50.400) is used to buy marketable securities. Marketable securities are sold before borrowing funds in case of a cash shortfall less than $17000). (Omit S sign in your response. Do not leave any empty spaces; input a O wherever it is required. Negative answers and amounts to be deducted should be indicated by a minus sign.) Ellis Electronics Cash Budget June July Cash receipts $ 3.28500 $ 316500) $325200 CE Interest payments Cash dividend Taxes Capital outlay 32000 52000 25400 32000 25400 3400000 Total cash payments $ 298050 $ 183650 $ 215900 $ 659300 c. Prepare a complete monthly cash budget with borrowing and repayments for June through September. The maximum desired cash balance is $50.400. Excess cash (above $50,400) is used to buy marketable securities. Marketable securities are sold before borrowing funds in case of a cash shortfall (less than $17,000). (Omit S sign in your response. Do not leave any empty spaces; input o O wherever it is required. Negative answers and amounts to be deducted should be indicated by o minus sign.) EITI Electronics Cashbudget June July August Cash receipts 3483001 $328500 5 316500 $325900 Cash payments 183650 215900 65930 $ September Net cash flow Beginning cash balance Cumulative cash balance Monthly borrowing or (repayment) Cumulative loan balance Marketable securities purchased Marketable Securities sold Gelative marketable securities Ending cash balance