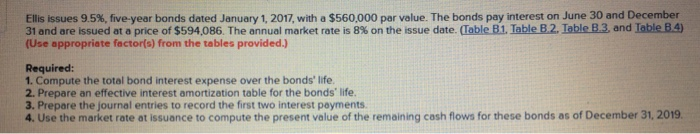

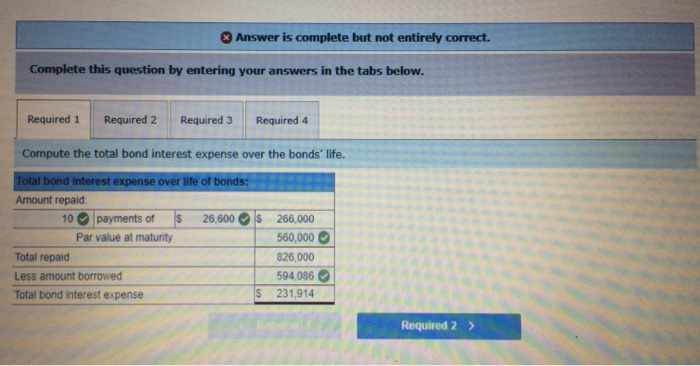

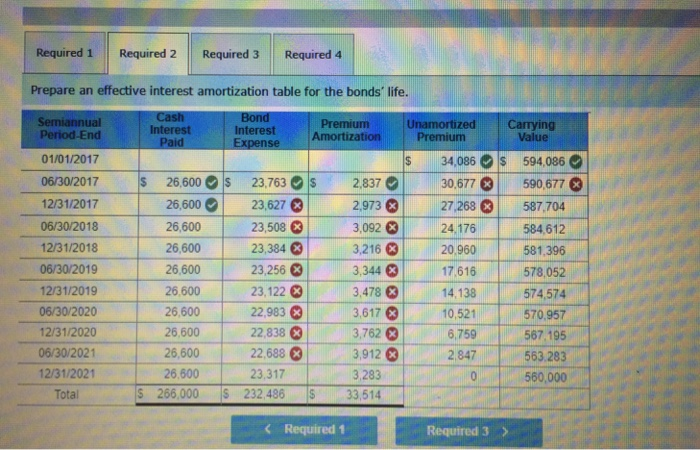

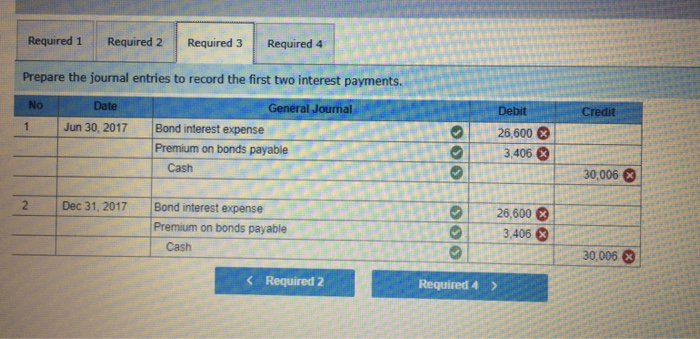

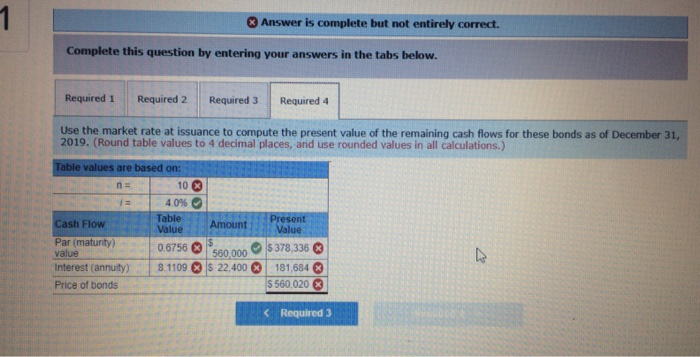

Ellis issues 9.5%, five-year bonds dated January 1, 2017 with a $560,000 par value. The bonds pay interest on June 30 and December 1. Table 2 Table B3 and lable 31 and are issued at a price of $594,086. The annual market rate is 8% on the issue date. (Use appropriate factor(s) from the tables provided.) able Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest poyments 4. Use the market rate at issuance to compute the present value of the remaining cash flows for these bonds as of December 31, 2019 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Required 4 Compute the total bond interest expense over the bonds life. Total bond interest expense over life of bonds Amount repaid 0 payments of 26 600 206,000 60,000 826,000 594.086 S 231,914 Par value at maturity Total repaid Less amount borrowed Total bond interest expense Required 2 Required 1 Required 2 Required 3 Required Prepare an effective interest amortization table for the bonds life. Semiannual PremiumUnamortized Carrying Premium Interest Interest Period-End 01/01/2017 06/30/2017 12/31/2017 06/30/2018 12/31/2018 06/30/2019 12/31/2019 06/30/2020 12/31/2020 06/30/2021 12/31/2021 Total Amortization Value 34,086 594,086 26,600s 23,763s 2.83730,677 590 677 26,60023,627 26,600 26,600 26,600 26,600 26,600 26,600 26,600 22,6883912 2847563283 26,600 2973 27269 587704 23,508- 23.384 23.256 23. 122 * 22,983 22.838 2 3,092 3,216 320,960 3,344 3,478 3 3,617 3,7626,759 24.176 584,612 581,396 578,052 574,574 570.957 567,195 3176165 14.138 10,521 23.317 266,000 S 232.486 3.283 33,514 560,000 Required 1 Required 3 > Required 1Required 2 Required 3 Required 4 Prepare the journal entries to record the first two interest payments. Debit Credit No Date General Journal 26,600 Jun 30, 2017 Bond interest expense | 3.4060| Premium on bonds payable 30,006 3 Cash 26,600 2 Dec 31, 2017 Bond interest expense Premium on bonds payable 3,406 3 Cash 30,006 3 K Required 2 Required 4 > 3 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Required 4 Use the market rate at issuance to compute the present value of the remaining cash flows for these bonds as of December 31, 2019. (Round table values to 4 decimal places, and use rounded values in all calculations.) e values are based on: 10 03 i 4096 Table AmountValue Cash Flow Value Par (matunity) value 6756 560,00 | 8.1 109 C ls 22.400 0 560,000$ 378 336 0 interest (annuity) Price of bonds 181 684 o S 560,020