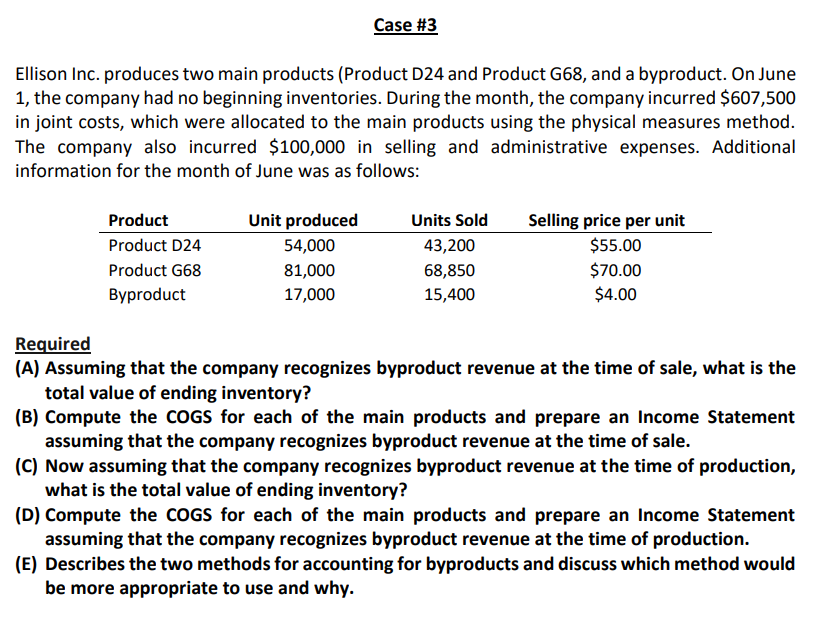

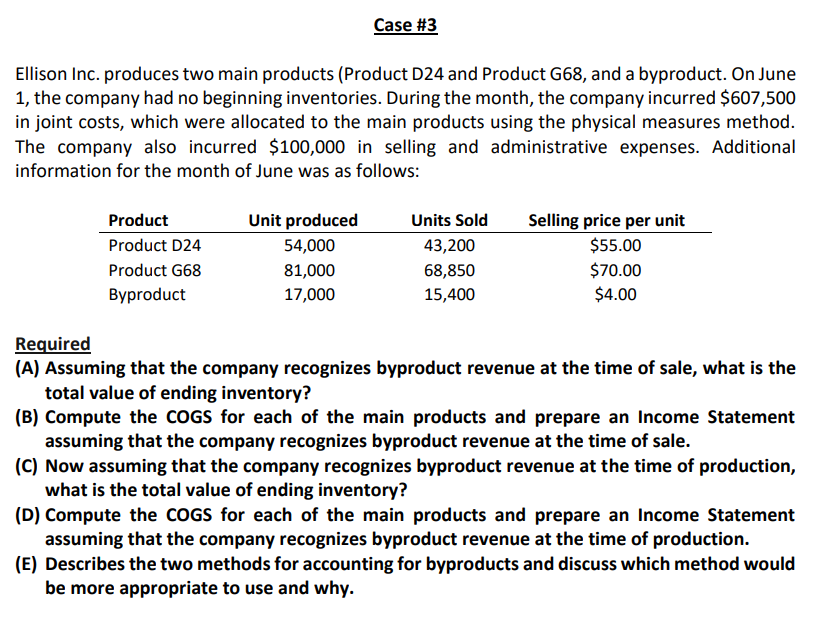

Ellison Inc. produces two main products (Product D24 and Product G68, and a byproduct. On June 1 , the company had no beginning inventories. During the month, the company incurred $607,500 in joint costs, which were allocated to the main products using the physical measures method. The company also incurred $100,000 in selling and administrative expenses. Additional information for the month of June was as follows: Required (A) Assuming that the company recognizes byproduct revenue at the time of sale, what is the total value of ending inventory? (B) Compute the COGS for each of the main products and prepare an Income Statement assuming that the company recognizes byproduct revenue at the time of sale. (C) Now assuming that the company recognizes byproduct revenue at the time of production, what is the total value of ending inventory? (D) Compute the COGS for each of the main products and prepare an Income Statement assuming that the company recognizes byproduct revenue at the time of production. (E) Describes the two methods for accounting for byproducts and discuss which method would be more appropriate to use and why. Ellison Inc. produces two main products (Product D24 and Product G68, and a byproduct. On June 1 , the company had no beginning inventories. During the month, the company incurred $607,500 in joint costs, which were allocated to the main products using the physical measures method. The company also incurred $100,000 in selling and administrative expenses. Additional information for the month of June was as follows: Required (A) Assuming that the company recognizes byproduct revenue at the time of sale, what is the total value of ending inventory? (B) Compute the COGS for each of the main products and prepare an Income Statement assuming that the company recognizes byproduct revenue at the time of sale. (C) Now assuming that the company recognizes byproduct revenue at the time of production, what is the total value of ending inventory? (D) Compute the COGS for each of the main products and prepare an Income Statement assuming that the company recognizes byproduct revenue at the time of production. (E) Describes the two methods for accounting for byproducts and discuss which method would be more appropriate to use and why