Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Elton Fink owns and manages an antelope farm. The price of antelopes has fluctuated wildly over the last year and Fink wants to lock

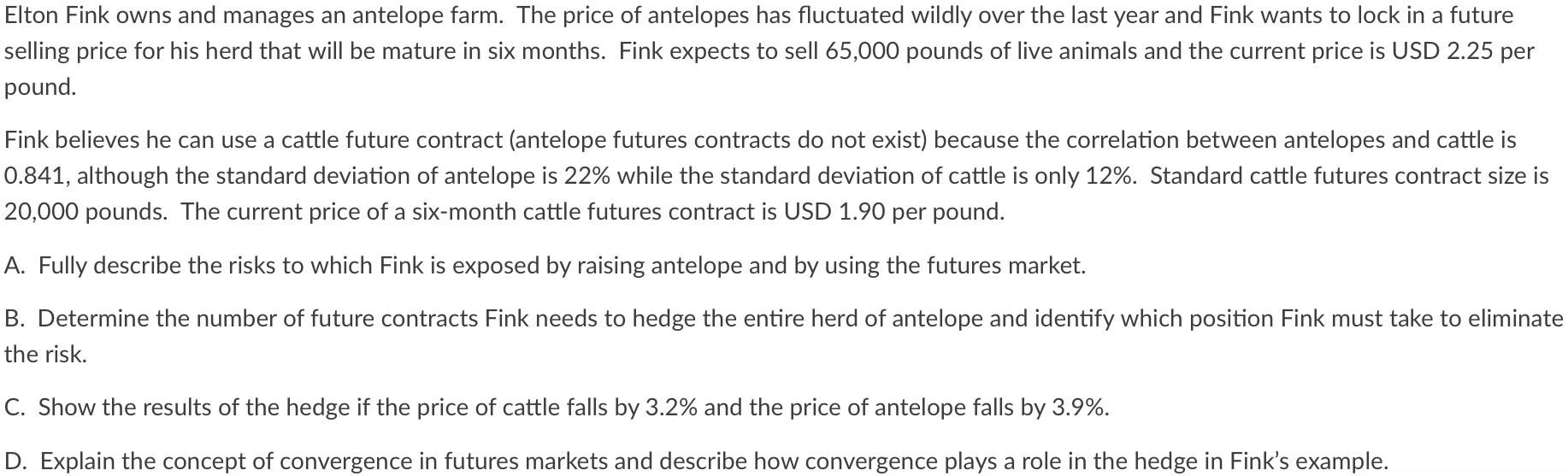

Elton Fink owns and manages an antelope farm. The price of antelopes has fluctuated wildly over the last year and Fink wants to lock in a future selling price for his herd that will be mature in six months. Fink expects to sell 65,000 pounds of live animals and the current price is USD 2.25 per pound. Fink believes he can use a cattle future contract (antelope futures contracts do not exist) because the correlation between antelopes and cattle is 0.841, although the standard deviation of antelope is 22% while the standard deviation of cattle is only 12%. Standard cattle futures contract size is 20,000 pounds. The current price of a six-month cattle futures contract is USD 1.90 per pound. A. Fully describe the risks to which Fink is exposed by raising antelope and by using the futures market. B. Determine the number of future contracts Fink needs to hedge the entire herd of antelope and identify which position Fink must take to eliminate the risk. C. Show the results of the hedge if the price of cattle falls by 3.2% and the price of antelope falls by 3.9%. D. Explain the concept of convergence in futures markets and describe how convergence plays a role in the hedge in Fink's example.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started