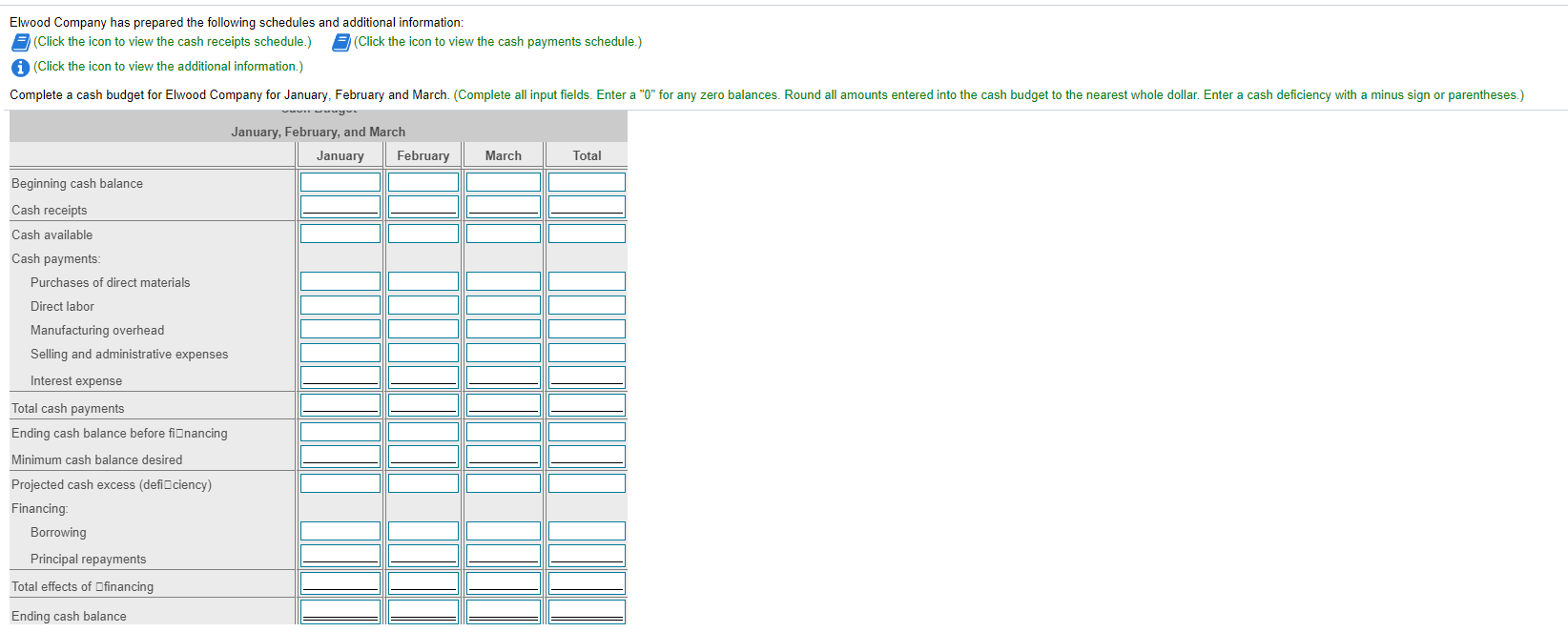

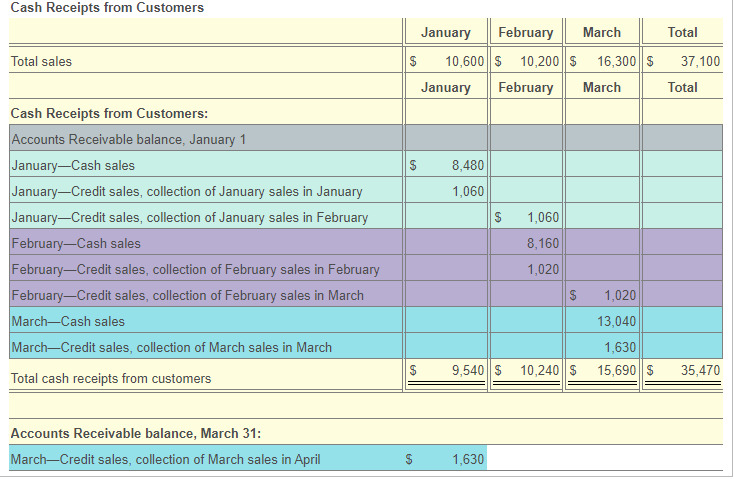

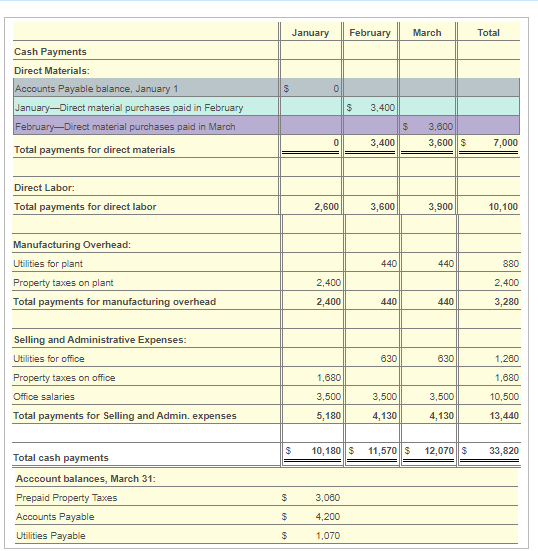

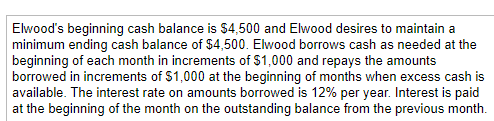

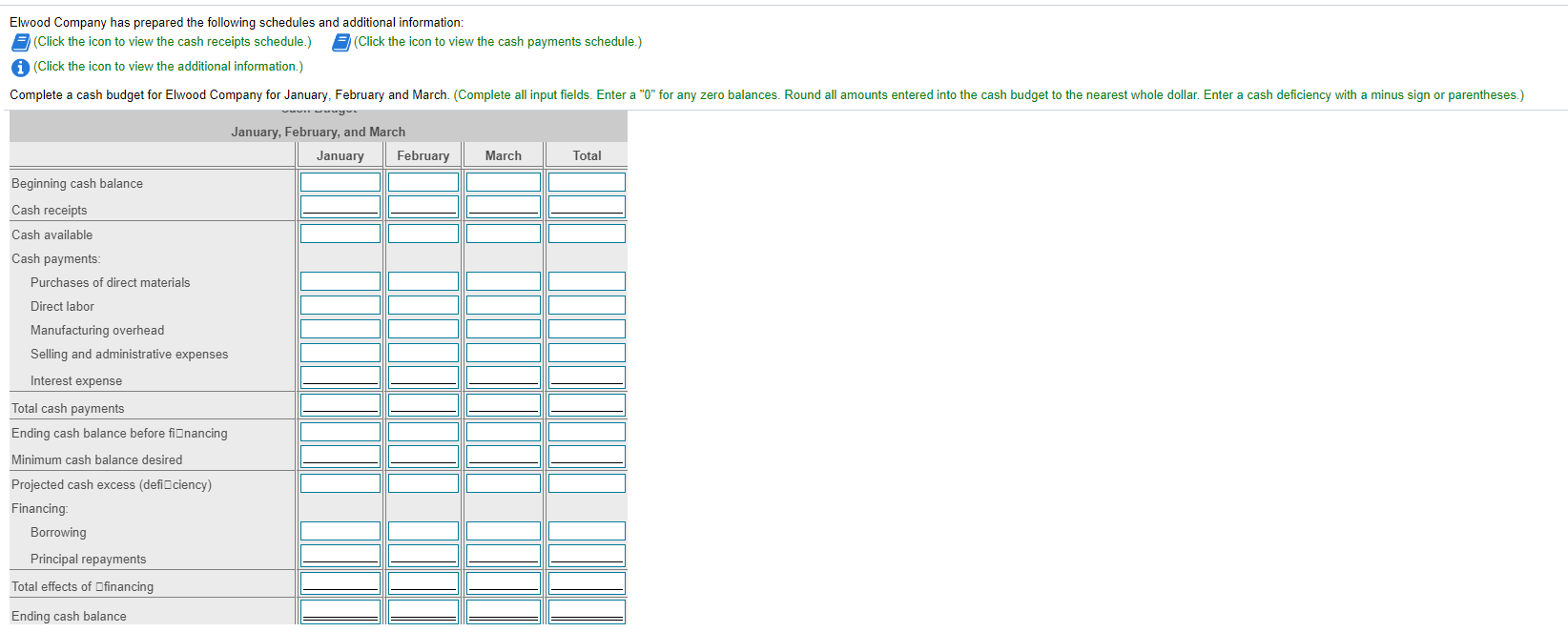

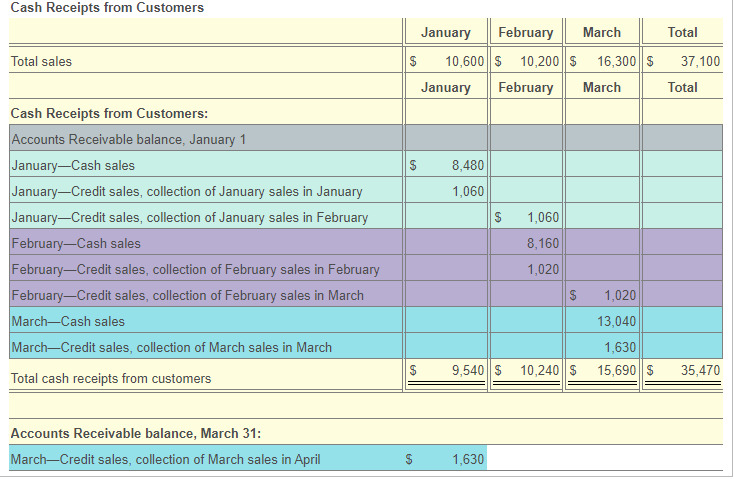

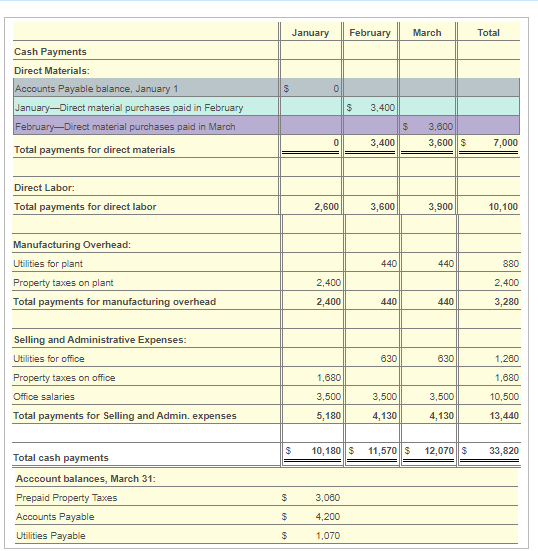

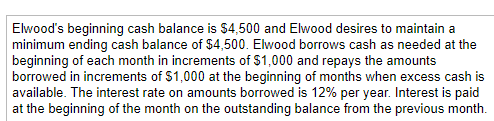

Elwood Company has prepared the following schedules and additional information: (Click the icon to view the cash receipts schedule.) (Click the icon to view the cash payments schedule.) (Click the icon to view the additional information.) Complete a cash budget for Elwood Company for January, February and March. (Complete all input fields. Enter a "0" for any zero balances. Round all amounts entered into the cash budget to the nearest whole dollar. Enter a cash deficiency with a minus sign or parentheses.) March Total January, February, and March January February Beginning cash balance Cash receipts Cash available Cash payments: Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses Interest expense Total cash payments Ending cash balance before fiOnancing Minimum cash balance desired Projected cash excess (deficiency) Financing Borrowing Principal repayments Total effects of financing Ending cash balance Cash Receipts from Customers Total Total sales January February March $ 10,600 $ 10,200 $ 16,300 $ January February March 37,100 Total $ 8,480 1,060 $ 1,060 Cash Receipts from Customers: Accounts Receivable balance, January 1 January-Cash sales January-Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February February-Cash sales February-Credit sales, collection of February sales in February FebruaryCredit sales, collection of February sales in March MarchCash sales MarchCredit sales, collection of March sales in March Total cash receipts from customers 8,160 1,020 $ 1,020 13,040 1,630 15,690 $ S 9,540 $ 10,240 $ 35,470 Accounts Receivable balance, March 31: March-Credit sales, collection of March sales in April 1,630 January February March Total 0 Cash Payments Direct Materials: Accounts Payable balance, January 1 JanuaryDirect material purchases paid in February February-Direct material purchases paid in March Total payments for direct materials $ 3,400 S 3,600 3,600 $ 0 3,400 7,000 Direct Labor Total payments for direct labor 2,600 3,600 3,900 10,100 440 440 880 Manufacturing Overhead: Utilities for plant Property taxes on plant Total payments for manufacturing overhead 2,400 2,400 2,400 440 440 3,280 630 630 1,280 Selling and Administrative Expenses: Utilities for office Property taxes on office Office salaries Total payments for Selling and Admin. expenses 1.680 1,680 3,500 3,500 3,500 4,130 10,500 13,440 5,180 4,130 $ 10,180 $ 11,570 $ 12,070 $ 33,820 Total cash payments $ 3,060 Acccount balances, March 31: Prepaid Property Taxes Accounts Payable Utilities Payable 4,200 1,070 $ Elwood's beginning cash balance is $4,500 and Elwood desires to maintain a minimum ending cash balance of $4,500. Elwood borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 12% per year. Interest is paid at the beginning of the month on the outstanding balance from the previous month