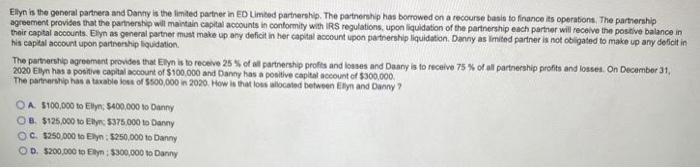

Elyn is the general partnera and Danny is the limited partner in En Limited partnership. The partnership has borrowed on a recourse basis to finance its operations. The partnership agreement provides that the partnership will maintain capital accounts in conformity with IRS regulations, upon liquidation of the partnership each partner will receive the positive balance in their capital accounts. Elyn as general partner must make up any deficit in her capital account upon partnership liquidation. Danny as limited partner is not obligated to make up any deficit in his capital account upon partnership liquidation The partnership agreement provides that Elyn is to receive 25 % of all partnership profits and losses and Duany is to receive 75 % of all partnership profits and losses. On December 31, 2020 Elyn has a positive capital count of $100.000 and Danny has a positive capital account of $300.000, The partnership has a taxable loss of $500,000 in 2020 How is that low wated between Ellyn and Danny O A $100.000 to Ellyn: 5400.000 to Danny OB. $125,000 to Ely: $375,000 to Danny OC. $250,000 to Ely: $250,000 to Danny OD, 5200,000 to Elyn: $300,000 to Danny Elyn is the general partnera and Danny is the limited partner in En Limited partnership. The partnership has borrowed on a recourse basis to finance its operations. The partnership agreement provides that the partnership will maintain capital accounts in conformity with IRS regulations, upon liquidation of the partnership each partner will receive the positive balance in their capital accounts. Elyn as general partner must make up any deficit in her capital account upon partnership liquidation. Danny as limited partner is not obligated to make up any deficit in his capital account upon partnership liquidation The partnership agreement provides that Elyn is to receive 25 % of all partnership profits and losses and Duany is to receive 75 % of all partnership profits and losses. On December 31, 2020 Elyn has a positive capital count of $100.000 and Danny has a positive capital account of $300.000, The partnership has a taxable loss of $500,000 in 2020 How is that low wated between Ellyn and Danny O A $100.000 to Ellyn: 5400.000 to Danny OB. $125,000 to Ely: $375,000 to Danny OC. $250,000 to Ely: $250,000 to Danny OD, 5200,000 to Elyn: $300,000 to Danny