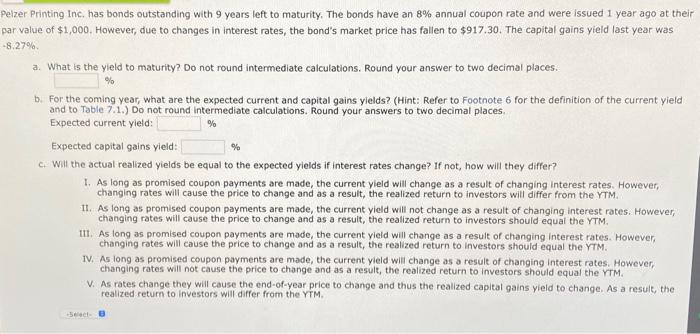

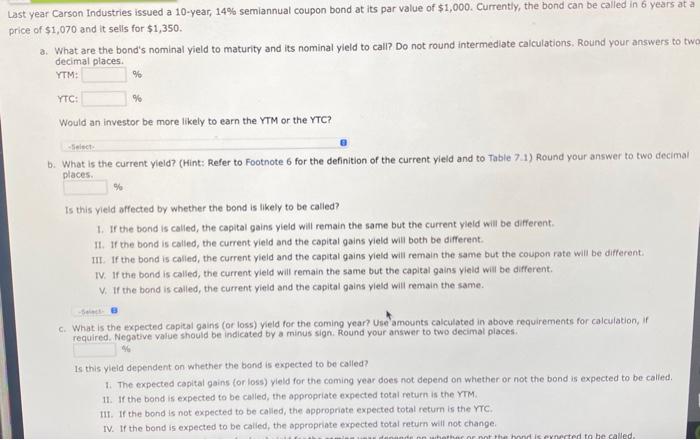

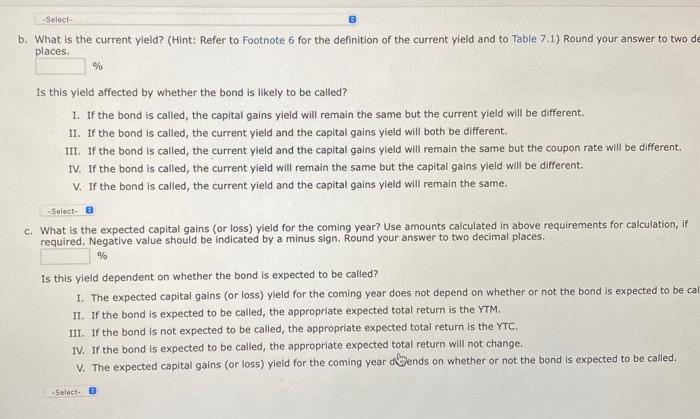

elzer Printing inc. has bonds outstanding with 9 years left to maturity. The bonds have an 8% annual coupon rate and were issued 1 year ago at their ar value of $1,000. However, due to changes in interest rates, the bond's market price has fallen to $917.30. The capital gains yield last year was 8.27% a. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. % b. For the coming year, what are the expected current and capital gains yields? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1.) Do not round intermediate calculations. Round your answers to two decimal places. Expected current yield: % Expected capital gains yield: c. Will the actual realized yields be equal to the expected yields if interest rates change? If not, how will they differ? 1. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors will differ from the YTM. II. As long as promised coupon payments are made, the current yield will not change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors should equal the YTM. III. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However. changing rates will cause the price to change and as a result, the realized return to investors should equal the YTM. IV. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will not cause the price to change and as a result, the realized return to investors should equal the rTM. V. As rates change they will cause the end-of-year price to change and thus the realized capital gains yield to change. As a result, the realized return to investors will differ from the YTM. $1,070 and it sells for $1,350 a. What are the bond's nominal yield to maturity and its nominal yield to call? Do not round intermediate calculations. Round your answers to decimal places. YTM: Would an investor be more likely to earn the YTM or the YTC? b. What is the current yield? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1 ) Round your answer to two decimal blaces. Is this yield offected by whether the bond is likely to be calied? 1. If the bond is calied, the capital gains yield will remain the same but the current yield will be different. I1. If the bond is called, the current yield and the capital gains yield will both be different. III. If the bond is calied, the current yield and the capital gains yield will remain the same but the coupon rate will be different. IV. If the band is called, the current yield will remain the same but the capital gains yield will be different. V. If the bond is called, the current yield and the capital gains yield will remain the same. c. What is the expected capital gains (or loss) yield for the coming year? Use amounts calculated in above requirements for calculation, if reauired. Negative value should be indicated by a minus sign. Round your answer to two decimal piaces. Is this yieid dependent on whether the bond is expected to bo called? 1. The expected capital gains (or loss) yield for the coming year does not depend on whether or not the bond is expected to be called. 11. If the bond is expected to be called, the appropriate expected total roturn is the YTM. III. If the bond is not expected to be calied, the appropriate expected total retum is the Yr. IV. If the bond is expected to be calied, the oppropriate expected total return will not change. b. What is the current yield? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Round your answer to two d places. Is this yield affected by whether the bond is likely to be called? 1. If the bond is called, the capital gains yield will remain the same but the current yield will be different. II. If the bond is called, the current yield and the capital gains yield will both be different. III. If the bond is called, the current yield and the capital gains yield will remain the same but the coupon rate will be different. IV. If the bond is called, the current yield will remain the same but the capital gains yield will be different. V. If the bond is called, the current yield and the capital gains yield will remain the same. c. What is the expected capital gains (or loss) yield for the coming year? Use amounts calculated in above requirements for calculation, if required. Negative value should be indicated by a minus sign. Round your answer to two decimal places. % Is this yield dependent on whether the bond is expected to be called? 1. The expected capital gains (or loss) yield for the coming year does not depend on whether or not the bond is expected to be cal II. If the bond is expected to be called, the appropriate expected total return is the YTM. III. If the bond is not expected to be called, the appropriate expected total return is the YTC. IV. If the bond is expected to be called, the appropriate expected total return will not change. v. The expected capital gains (or loss) yield for the coming year dElends on whether or not the bond is expected to be called