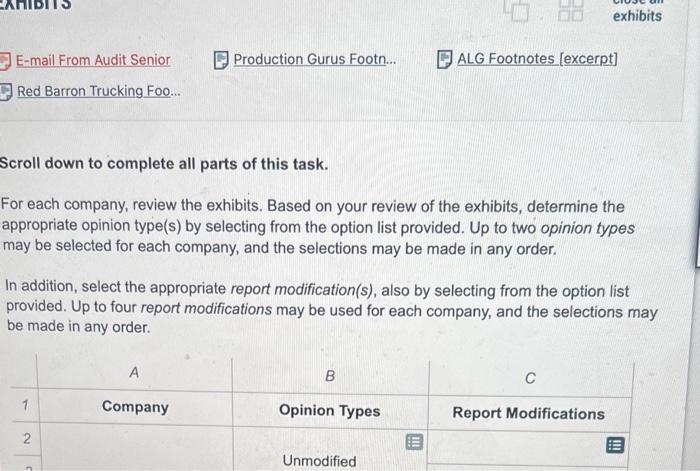

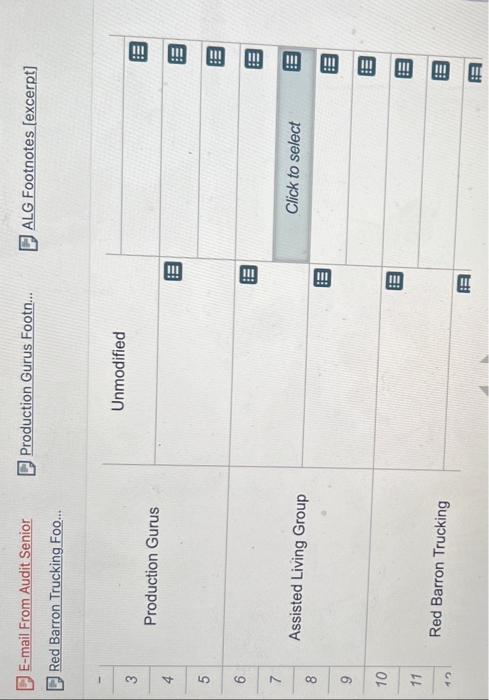

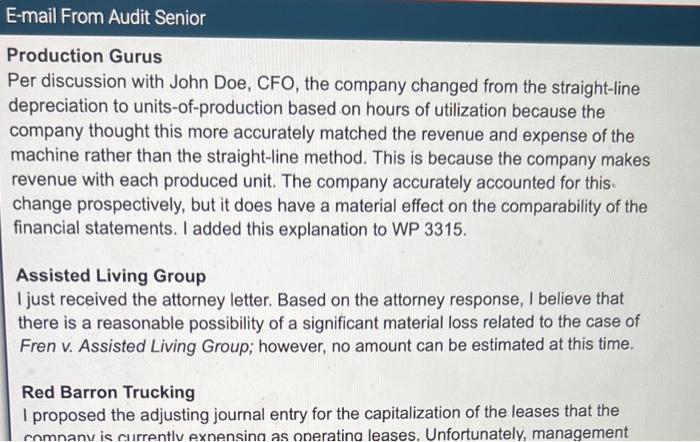

E-mail From Audit Senior Red Barron Trucking Foo... Scroll down to complete all parts of this task. For each company, review the exhibits. Based on your review of the exhibits, determine the appropriate opinion type(s) by selecting from the option list provided. Up to two opinion types may be selected for each company, and the selections may be made in any order. In addition, select the appropriate report modification(s), also by selecting from the option list provided. Up to four report modifications may be used for each company, and the selections may be made in any order. E-mail From Audit Senior Production Gurus Footn... OALG Footnotes [excerpt] Red Barron Trucking Foo... Unmodified Production Gurus 5 7698 Assisted Living Group 10 11 Red Barron Trucking Production Gurus Per discussion with John Doe, CFO, the company changed from the straight-line depreciation to units-of-production based on hours of utilization because the company thought this more accurately matched the revenue and expense of the machine rather than the straight-line method. This is because the company makes revenue with each produced unit. The company accurately accounted for this change prospectively, but it does have a material effect on the comparability of the financial statements. I added this explanation to WP 3315. Assisted Living Group I just received the attorney letter. Based on the attorney response, I believe that there is a reasonable possibility of a significant material loss related to the case of Fren v. Assisted Living Group; however, no amount can be estimated at this time. Red Barron Trucking I proposed the adjusting journal entry for the capitalization of the leases that the comnanv is currently exnensinn as oneratina leases. Unfortunately, management E-mail From Audit Senior Red Barron Trucking Foo... Scroll down to complete all parts of this task. For each company, review the exhibits. Based on your review of the exhibits, determine the appropriate opinion type(s) by selecting from the option list provided. Up to two opinion types may be selected for each company, and the selections may be made in any order. In addition, select the appropriate report modification(s), also by selecting from the option list provided. Up to four report modifications may be used for each company, and the selections may be made in any order. E-mail From Audit Senior Production Gurus Footn... OALG Footnotes [excerpt] Red Barron Trucking Foo... Unmodified Production Gurus 5 7698 Assisted Living Group 10 11 Red Barron Trucking Production Gurus Per discussion with John Doe, CFO, the company changed from the straight-line depreciation to units-of-production based on hours of utilization because the company thought this more accurately matched the revenue and expense of the machine rather than the straight-line method. This is because the company makes revenue with each produced unit. The company accurately accounted for this change prospectively, but it does have a material effect on the comparability of the financial statements. I added this explanation to WP 3315. Assisted Living Group I just received the attorney letter. Based on the attorney response, I believe that there is a reasonable possibility of a significant material loss related to the case of Fren v. Assisted Living Group; however, no amount can be estimated at this time. Red Barron Trucking I proposed the adjusting journal entry for the capitalization of the leases that the comnanv is currently exnensinn as oneratina leases. Unfortunately, management