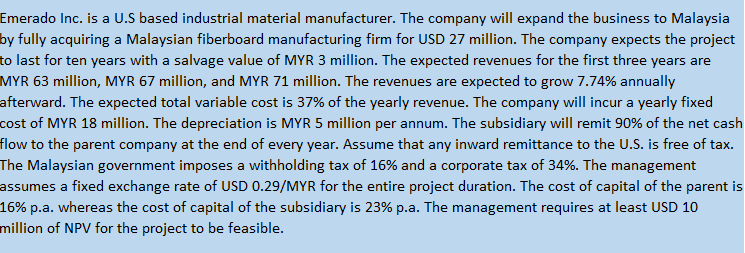

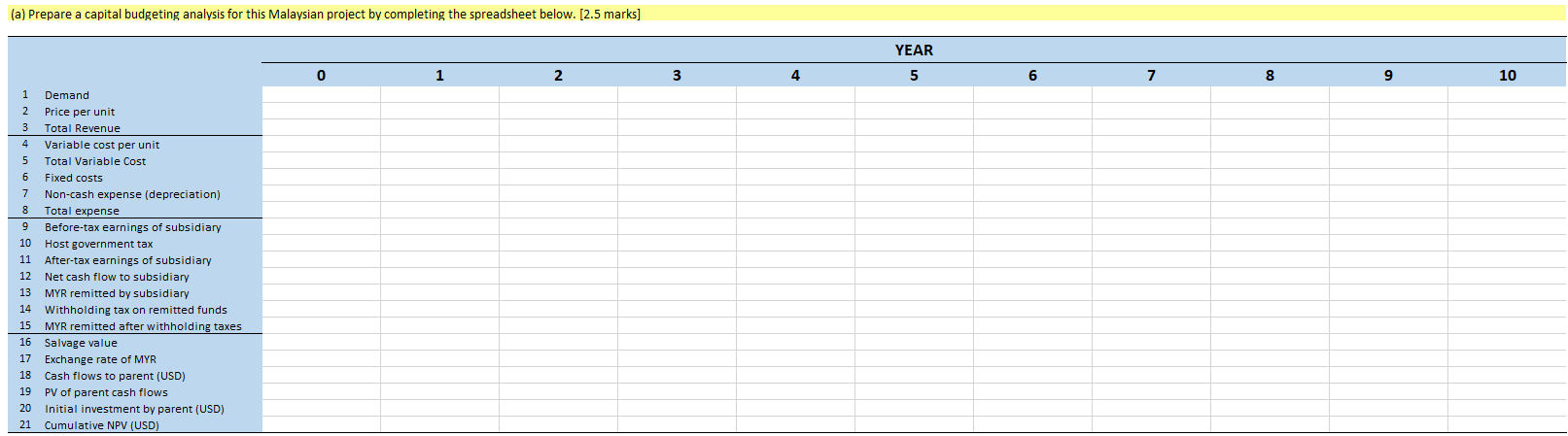

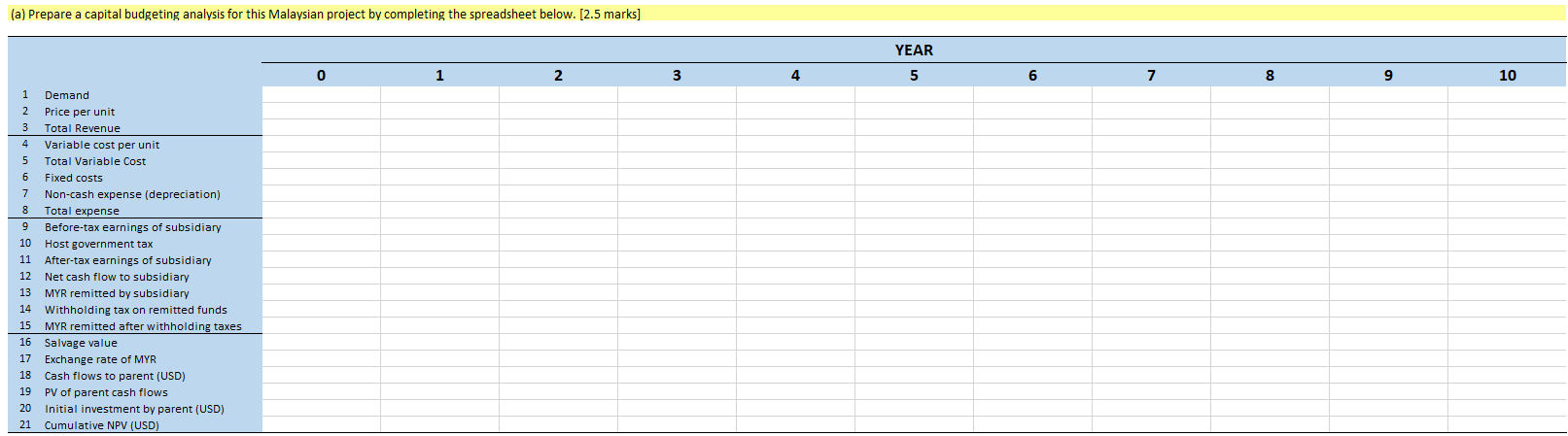

Emerado Inc. is a U.S based industrial material manufacturer. The company will expand the business to Malaysia by fully acquiring a Malaysian fiberboard manufacturing firm for USD 27 million. The company expects the project to last for ten years with a salvage value of MYR 3 million. The expected revenues for the first three years are MYR 63 million, MYR 67 million, and MYR 71 million. The revenues are expected to grow 7.74% annually afterward. The expected total variable cost is 37% of the yearly revenue. The company will incur a yearly fixed cost of MYR 18 million. The depreciation is MYR 5 million per annum. The subsidiary will remit 90% of the net cash flow to the parent company at the end of every year. Assume that any inward remittance to the U.S. is free of tax. The Malaysian government imposes a withholding tax of 16% and a corporate tax of 34%. The management assumes a fixed exchange rate of USD 0.29/MYR for the entire project duration. The cost of capital of the parent is 16% p.a. whereas the cost of capital of the subsidiary is 23% p.a. The management requires at least USD 10 million of NPV for the project to be feasible. (a) Prepare a capital budgeting analysis for this Malaysian project by completing the spreadsheet below. [2.5 marks] 0 1 2 3 1 Demand 2 Price per unit 3 Total Revenue Variable cost per unit 5 Total Variable Cost 6 Fixed costs 7 Non-cash expense (depreciation) 8 Total expense 9 Before-tax earnings of subsidiary 10 Host government tax 11 After-tax earnings of subsidiary 12 Net cash flow 1 subsidiary 13 MYR remitted by subsidiary Withholding tax on remitted funds 15 MYR remitted after withholding taxes 16 Salvage value 17 Exchange rate of MYR Cash flows to parent (USD) PV of parent cash flows Initial investment by parent (USD) Cumulative NPV (USD) nn3u567 18 19 20 21 14 4 YEAR 5 6 7 8 9 10 Emerado Inc. is a U.S based industrial material manufacturer. The company will expand the business to Malaysia by fully acquiring a Malaysian fiberboard manufacturing firm for USD 27 million. The company expects the project to last for ten years with a salvage value of MYR 3 million. The expected revenues for the first three years are MYR 63 million, MYR 67 million, and MYR 71 million. The revenues are expected to grow 7.74% annually afterward. The expected total variable cost is 37% of the yearly revenue. The company will incur a yearly fixed cost of MYR 18 million. The depreciation is MYR 5 million per annum. The subsidiary will remit 90% of the net cash flow to the parent company at the end of every year. Assume that any inward remittance to the U.S. is free of tax. The Malaysian government imposes a withholding tax of 16% and a corporate tax of 34%. The management assumes a fixed exchange rate of USD 0.29/MYR for the entire project duration. The cost of capital of the parent is 16% p.a. whereas the cost of capital of the subsidiary is 23% p.a. The management requires at least USD 10 million of NPV for the project to be feasible. (a) Prepare a capital budgeting analysis for this Malaysian project by completing the spreadsheet below. [2.5 marks] 0 1 2 3 1 Demand 2 Price per unit 3 Total Revenue Variable cost per unit 5 Total Variable Cost 6 Fixed costs 7 Non-cash expense (depreciation) 8 Total expense 9 Before-tax earnings of subsidiary 10 Host government tax 11 After-tax earnings of subsidiary 12 Net cash flow 1 subsidiary 13 MYR remitted by subsidiary Withholding tax on remitted funds 15 MYR remitted after withholding taxes 16 Salvage value 17 Exchange rate of MYR Cash flows to parent (USD) PV of parent cash flows Initial investment by parent (USD) Cumulative NPV (USD) nn3u567 18 19 20 21 14 4 YEAR 5 6 7 8 9 10