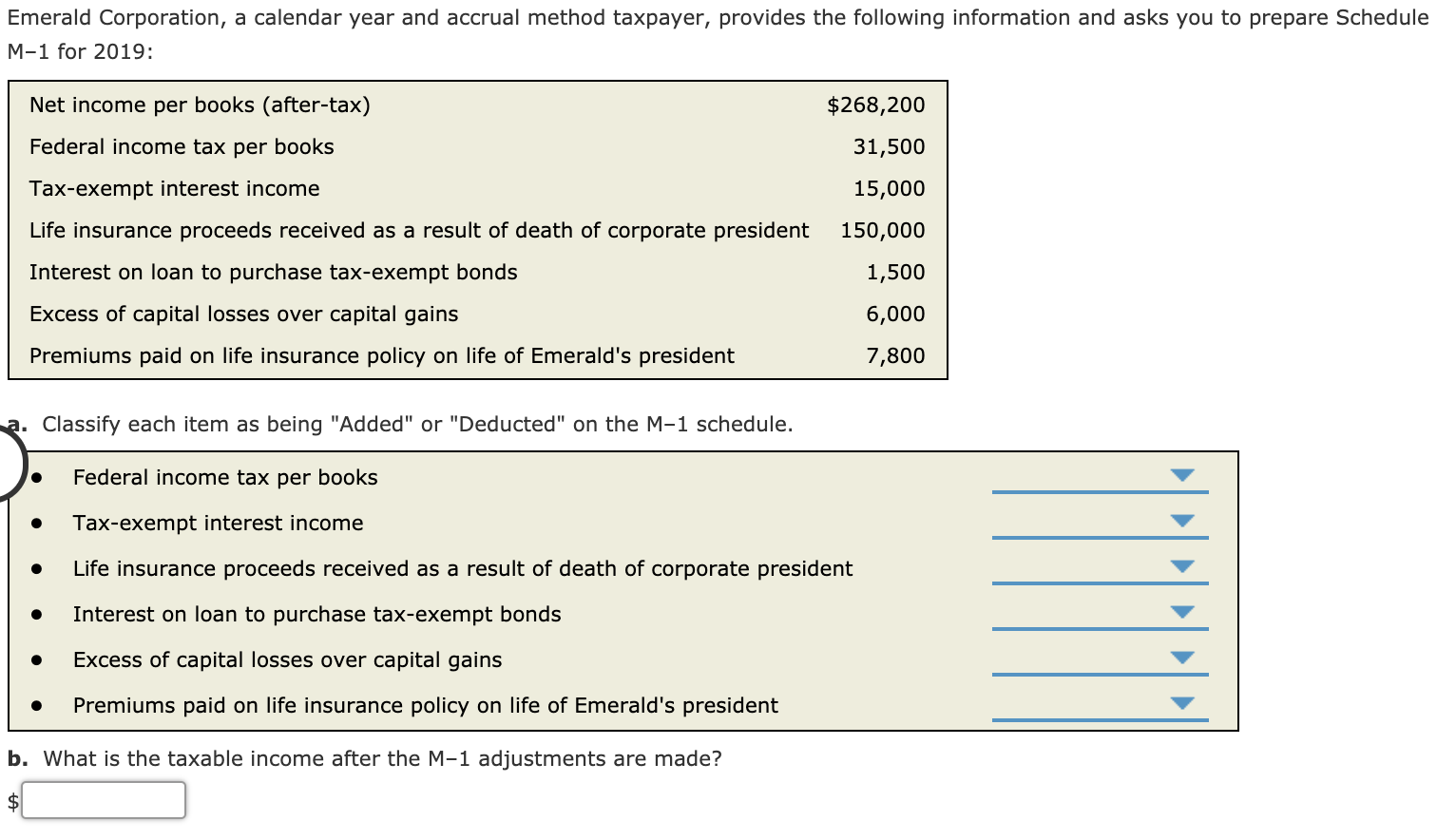

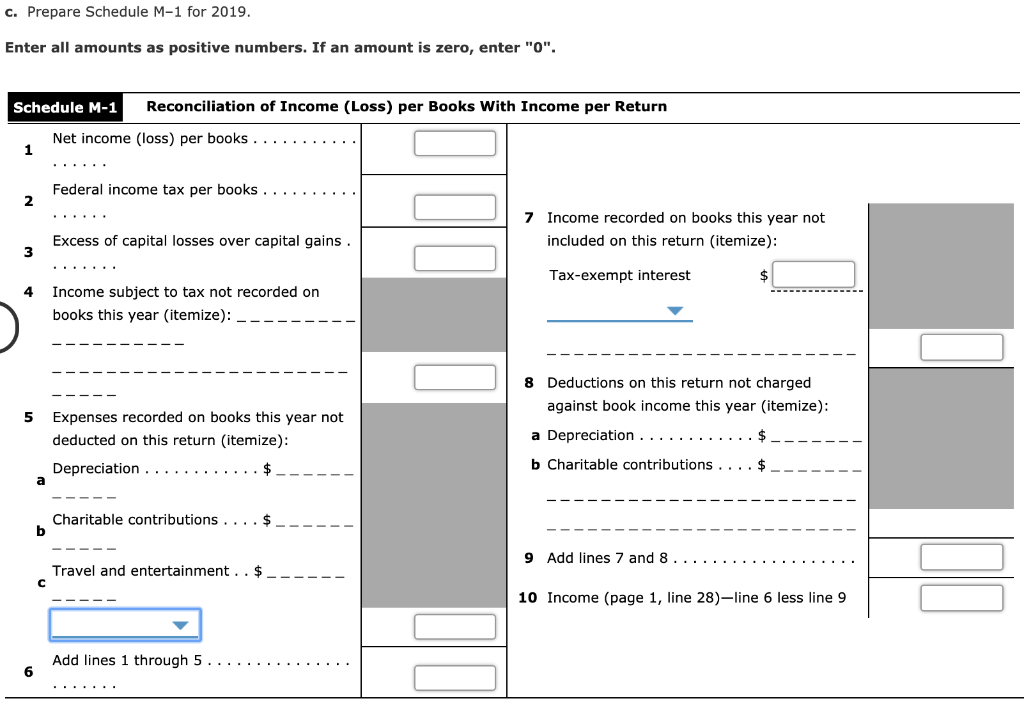

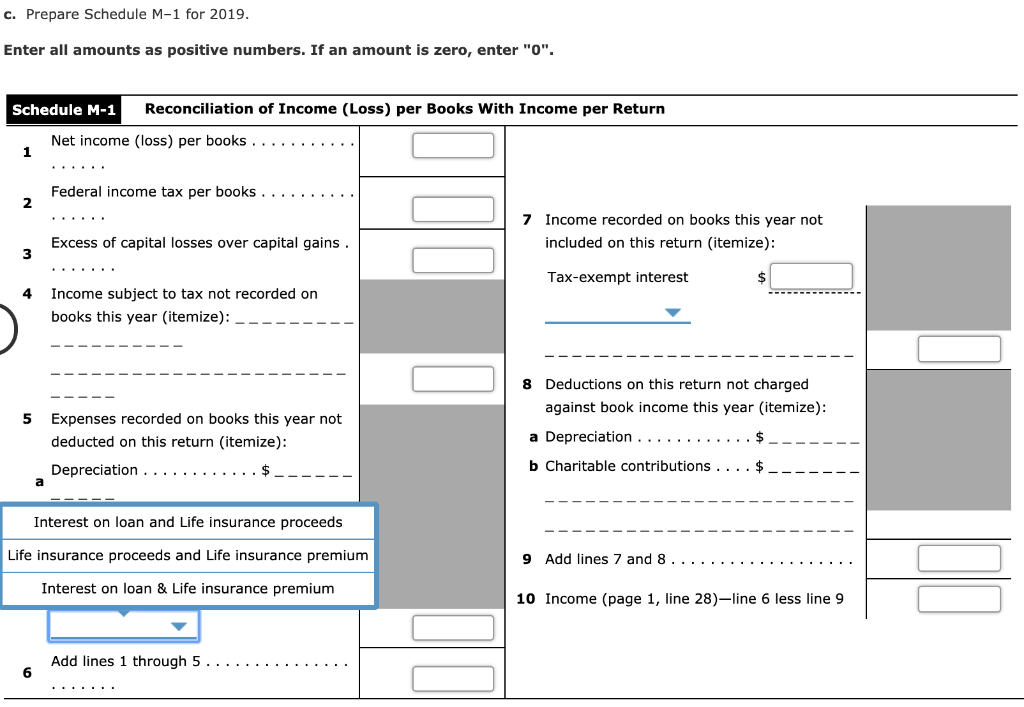

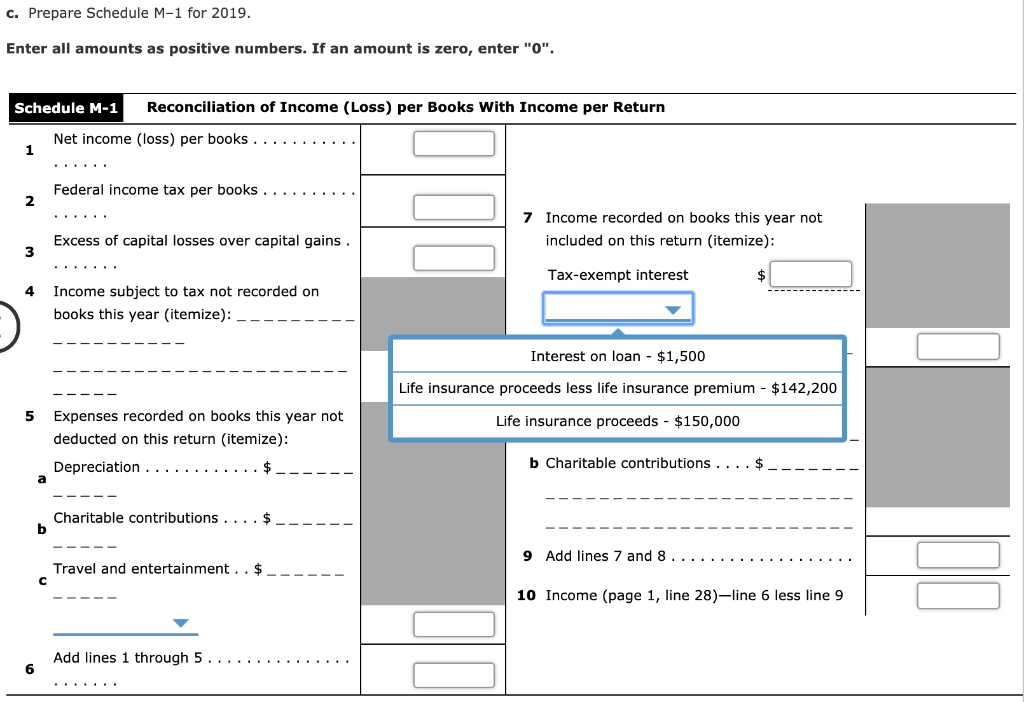

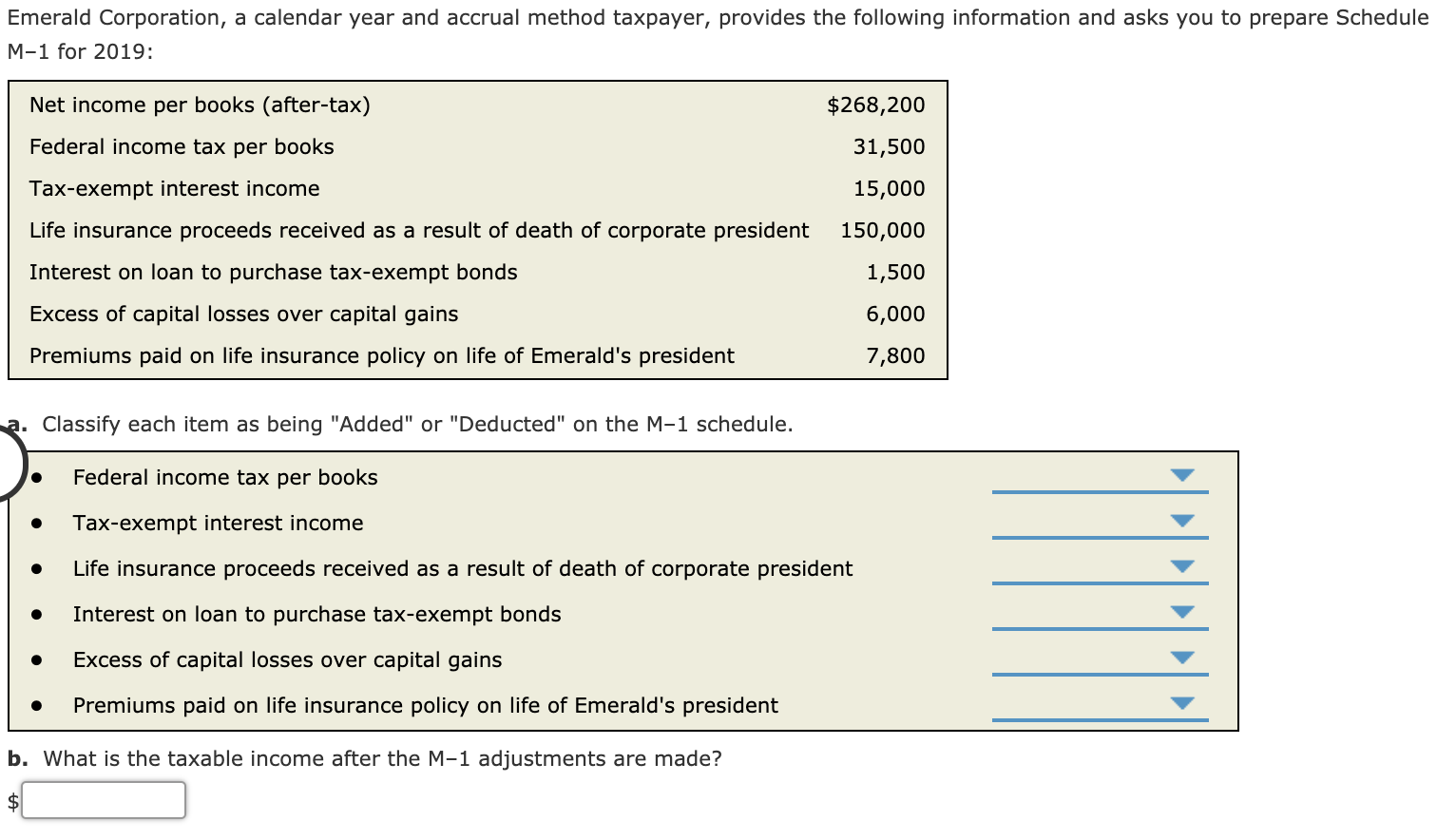

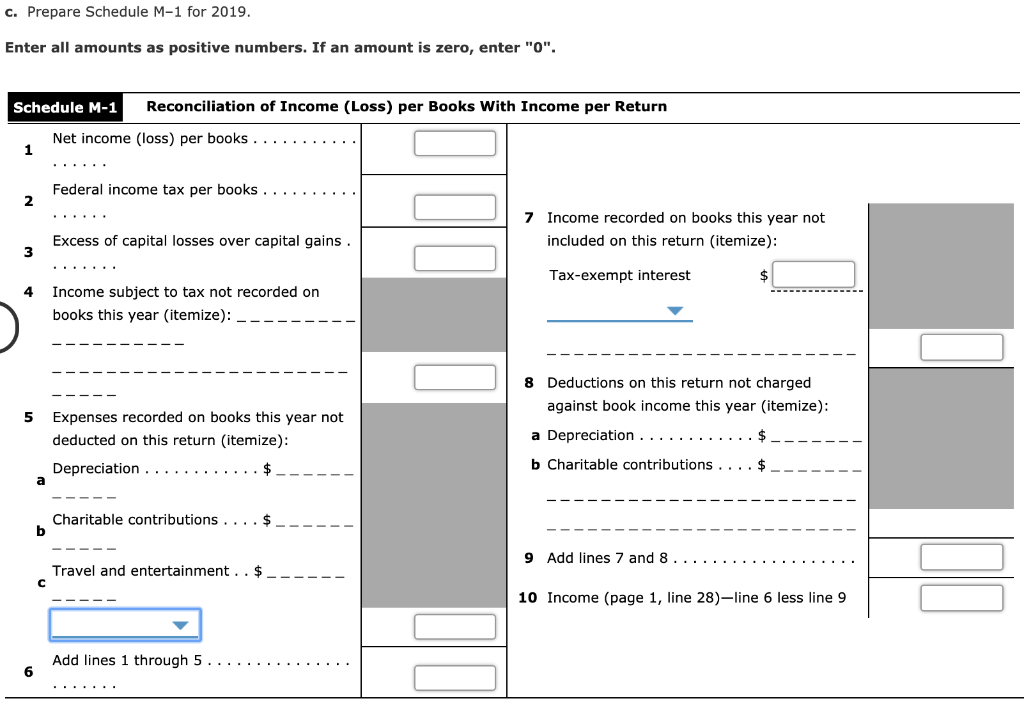

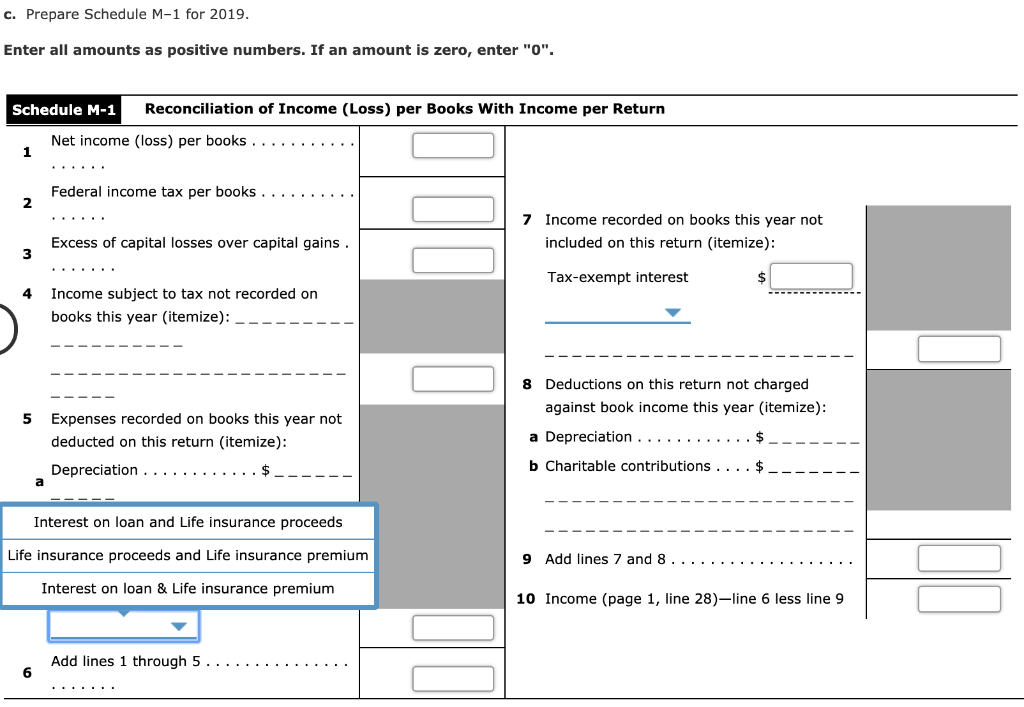

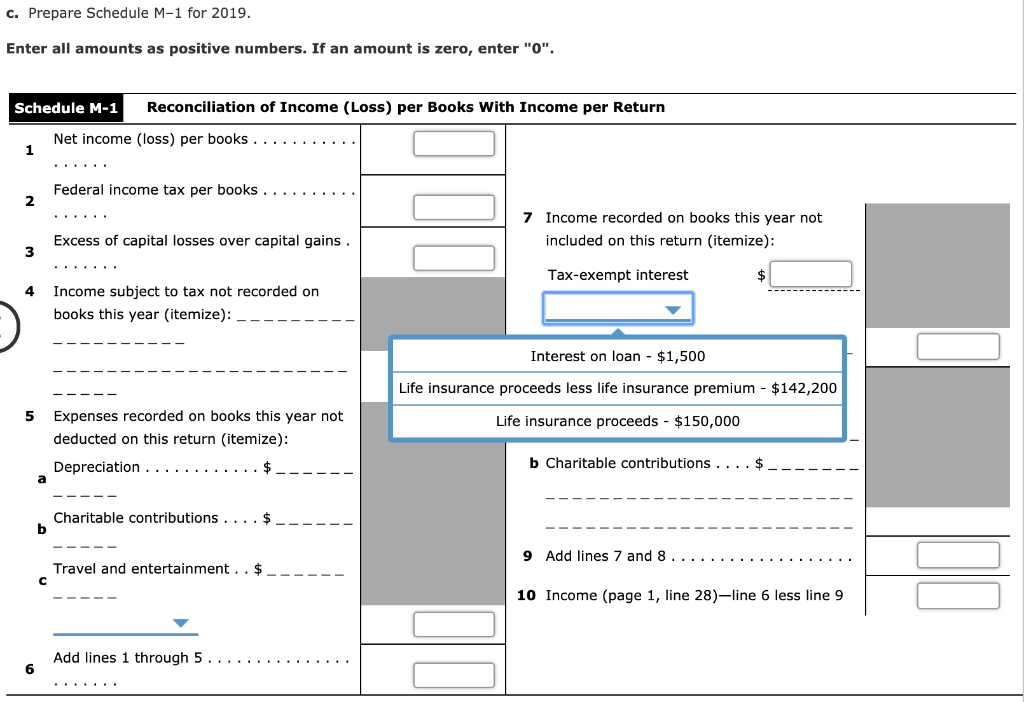

Emerald Corporation, a calendar year and accrual method taxpayer, provides the following information and asks you to prepare Schedule M-1 for 2019: Net income per books (after-tax) $268,200 Federal income tax per books 31,500 Tax-exempt interest income 15,000 Life insurance proceeds received as a result of death of corporate president 150,000 Interest on loan to purchase tax-exempt bonds 1,500 6,000 Excess of capital losses over capital gains Premiums paid on life insurance policy on life of Emerald's president 7,800 Classify each item as being "Added" or "Deducted" on the M-1 schedule. Federal income tax per books Tax-exempt interest income Life insurance proceeds received as a result of death of corporate president Interest on loan to purchase tax-exempt bonds Excess of capital losses over capital gains Premiums paid on life insurance policy on life of Emerald's president b. What is the taxable income after the M-1 adjustments are made? $ c. Prepare Schedule M-1 for 2019. Enter all amounts as positive numbers. If an amount is zero, enter "O". Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Net income (loss) per books ........... Federal income tax per books ...... 7 Income recorded on books this year not included on this return (itemize): Excess of capital losses over capital gains. Tax-exempt interest Income subject to tax not recorded on books this year (itemize): -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 5 Expenses recorded on books this year not deducted on this return (itemize): Depreciation ............$----- 8 Deductions on this return not charged against book income this year (itemize): a Depreciation .... ........$---- b Charitable contributions .... a - - - - Charitable contributions ....$___ 9 Add lines 7 and 8. Travel and entertainment . . $--- 10 Income (page 1, line 28)-line 6 less line 9 Add lines 1 through 5........ c. Prepare Schedule M-1 for 2019. Enter all amounts as positive numbers. If an amount is zero, enter "0". Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Net income (loss) per books ......... Federal income tax per books .. 7 Income recorded on books this year not included on this return (itemize): Excess of capital losses over capital gains Tax-exempt interest 4 Income subject to tax not recorded on books this year (itemize): -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 8 Deductions on this return not charged against book income this year itemize): i Expenses recorded on books this year not deducted on this return (itemize): Depreciation ............$----- a Depreciation ..... b Charitable contributions .... 1 Interest on loan and Life insurance proceeds - - - - - - - - Life insurance proceeds and Life insurance premium 9 Add lines 7 and 8 ......... Interest on loan & Life insurance premium 10 Income (page 1, line 28)-line 6 less line 9 Add lines 1 through 5. c. Prepare Schedule M-1 for 2019. Enter all amounts as positive numbers. If an amount is zero, enter "O". Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Net income (loss) per books ......... Federal income tax per books .. 7 Income recorded on books this year not included on this return (itemize): Excess of capital losses over capital gains. Tax-exempt interest Income subject to tax not recorded on books this year (itemize): - Interest on loan - $1,500 - - - - - - - - - - - Life insurance proceeds less life insurance premium - $142,200 Life insurance proceeds - $150,000 Expenses recorded on books this year not deducted on this return (itemize): Depreciation ............$---- b Charitable contributions ....$---- - - - - - - - - - - - Charitable contributions ....$_- - - - - - - - 9 Add lines 7 and 8 ........ Travel and entertainment..$---- 10 Income (page 1, line 28)-line 6 less line 9 Add lines 1 through 5 ........ 6 Emerald Corporation, a calendar year and accrual method taxpayer, provides the following information and asks you to prepare Schedule M-1 for 2019: Net income per books (after-tax) $268,200 Federal income tax per books 31,500 Tax-exempt interest income 15,000 Life insurance proceeds received as a result of death of corporate president 150,000 Interest on loan to purchase tax-exempt bonds 1,500 6,000 Excess of capital losses over capital gains Premiums paid on life insurance policy on life of Emerald's president 7,800 Classify each item as being "Added" or "Deducted" on the M-1 schedule. Federal income tax per books Tax-exempt interest income Life insurance proceeds received as a result of death of corporate president Interest on loan to purchase tax-exempt bonds Excess of capital losses over capital gains Premiums paid on life insurance policy on life of Emerald's president b. What is the taxable income after the M-1 adjustments are made? $ c. Prepare Schedule M-1 for 2019. Enter all amounts as positive numbers. If an amount is zero, enter "O". Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Net income (loss) per books ........... Federal income tax per books ...... 7 Income recorded on books this year not included on this return (itemize): Excess of capital losses over capital gains. Tax-exempt interest Income subject to tax not recorded on books this year (itemize): -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 5 Expenses recorded on books this year not deducted on this return (itemize): Depreciation ............$----- 8 Deductions on this return not charged against book income this year (itemize): a Depreciation .... ........$---- b Charitable contributions .... a - - - - Charitable contributions ....$___ 9 Add lines 7 and 8. Travel and entertainment . . $--- 10 Income (page 1, line 28)-line 6 less line 9 Add lines 1 through 5........ c. Prepare Schedule M-1 for 2019. Enter all amounts as positive numbers. If an amount is zero, enter "0". Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Net income (loss) per books ......... Federal income tax per books .. 7 Income recorded on books this year not included on this return (itemize): Excess of capital losses over capital gains Tax-exempt interest 4 Income subject to tax not recorded on books this year (itemize): -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 8 Deductions on this return not charged against book income this year itemize): i Expenses recorded on books this year not deducted on this return (itemize): Depreciation ............$----- a Depreciation ..... b Charitable contributions .... 1 Interest on loan and Life insurance proceeds - - - - - - - - Life insurance proceeds and Life insurance premium 9 Add lines 7 and 8 ......... Interest on loan & Life insurance premium 10 Income (page 1, line 28)-line 6 less line 9 Add lines 1 through 5. c. Prepare Schedule M-1 for 2019. Enter all amounts as positive numbers. If an amount is zero, enter "O". Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Net income (loss) per books ......... Federal income tax per books .. 7 Income recorded on books this year not included on this return (itemize): Excess of capital losses over capital gains. Tax-exempt interest Income subject to tax not recorded on books this year (itemize): - Interest on loan - $1,500 - - - - - - - - - - - Life insurance proceeds less life insurance premium - $142,200 Life insurance proceeds - $150,000 Expenses recorded on books this year not deducted on this return (itemize): Depreciation ............$---- b Charitable contributions ....$---- - - - - - - - - - - - Charitable contributions ....$_- - - - - - - - 9 Add lines 7 and 8 ........ Travel and entertainment..$---- 10 Income (page 1, line 28)-line 6 less line 9 Add lines 1 through 5 ........ 6