Question

Emerald Ltd is a manufacturing company which is also involved in research and development (R&D) activities. Emerald Ltd qualifies as a small enterprise for R&D

Emerald Ltd is a manufacturing company which is also involved in research and development (R&D) activities. Emerald Ltd qualifies as a small enterprise for R&D purposes.

Emerald Ltds profit before tax figure per the accounts is 3,500,000 for the year ended 31 March 2021. This figure is before the deduction of capital allowances and any further adjustments mentioned below.

(i) Profit before tax

The following amounts have already been deducted from the profit before tax figure of 3,500,000 for the year ended 31 March 2021.

Depreciation Lease premium Research and development - staff costs/consumables Donation to charity (paid 31.12.20)

80,000 30,000 320,000

10,000

The lease premium was paid on 1 April 2020 for the grant of a 10-year lease on a warehouse.

(ii) Capital allowances

The tax written down value of Emerald Ltds main pool is 150,000 on 1 April 2020. During the year ended 31 March 2021 the following additions/disposals took place:

ADDITIONS Laboratory equipment for R&D purposes 120,000 Car (CO2 emissions, 45 g/km) 40,000 Car (C02 emissions, 105g/km)30,000

DISPOSALS Laboratory equipment (original cost, 25,000)

It is estimated that the cars are both used 80% for business use. Ignore VAT on additions/disposals.

(iii) Interest receivable/payable

The draft profit before tax includes the following amounts relating to interest receivable/payable in the year ended 31 March 2021:

Loan interest receivable 20,000

Loan interest payable:

-

- Overdraft interest payable 3,000

-

- Interest on loan to buy shares 5,000

-

Pearl Ltd

-

20,000

3,000 5,000

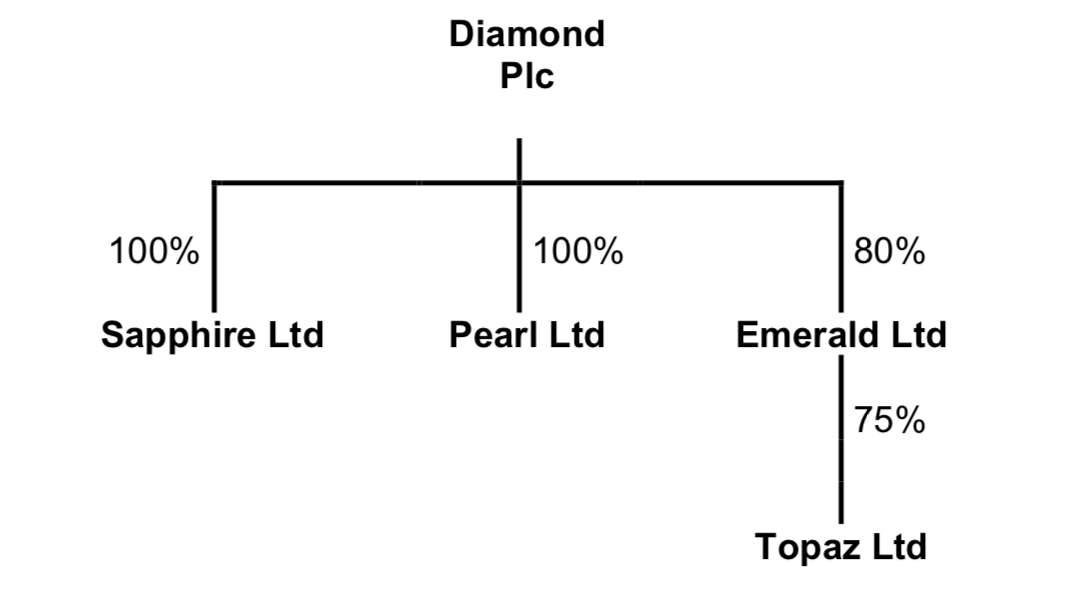

Diamond acquired 100% of Pearl Ltd on 1 July 2020. Pearl Ltd made a trading loss in the year ended 31 March 2021 of 4,000,000. It will surrender as much of the loss as possible to other group members.

Sapphire Ltd

In May 2020, Sapphire Ltd sold a factory used in its trade for 400,000. The factory had been acquired in October 2000 (RPI:171.6) for 150,000. In January 2021 Topaz acquired a new office building for use it its trade for 370,000.

RPI December 2017: 278.1.

Requirements:

a) Explain which companies would be specifically included/excluded from:

-

(i) Diamond Plcs losses group

-

(ii) Diamond Plcs gains group

-

b) Calculate Emerald Ltds total taxable profit for the year ended 31 March 2021.

(9 marks)

-

c) Explain the maximum amount of trading loss Pearl Ltd can surrender to Emerald Ltd in the year ended 31 March 2021.

(4 marks)

-

d) Explain how the chargeable gain arising of the sale of the factory by Sapphire Ltd may be deferred and state how the gain will become chargeable in the future.

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started