Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EMERGENCY. CAN ANYONE HELP ME PLS ? I NEED AN ANSWER FORTHIS 1. Customer approach you for RM380,000.00 housing loan with tenor of 10 years.

EMERGENCY. CAN ANYONE HELP ME PLS ? I NEED AN ANSWER FORTHIS

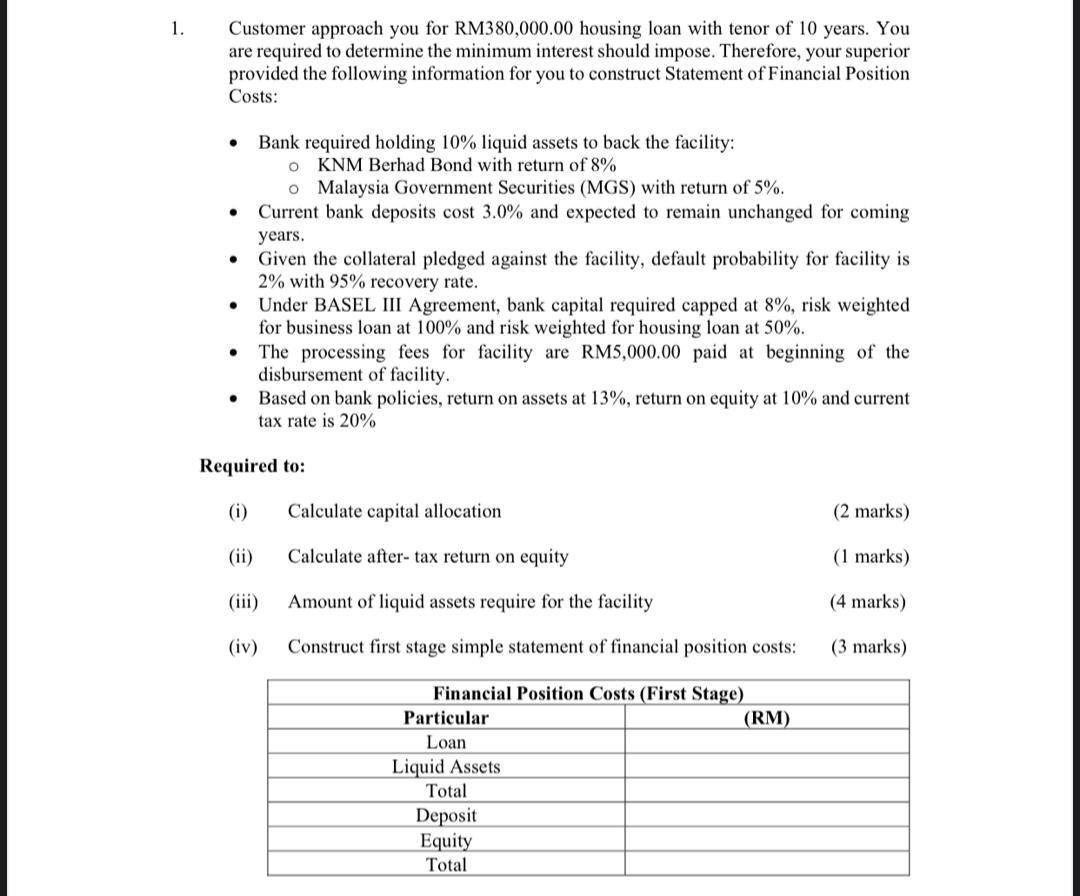

1. Customer approach you for RM380,000.00 housing loan with tenor of 10 years. You are required to determine the minimum interest should impose. Therefore, your superior provided the following information for you to construct Statement of Financial Position Costs: . . Bank required holding 10% liquid assets to back the facility: O KNM Berhad Bond with return of 8% o Malaysia Government Securities (MGS) with return of 5%. Current bank deposits cost 3.0% and expected to remain unchanged for coming years. Given the collateral pledged against the facility, default probability for facility is 2% with 95% recovery rate. Under BASEL III Agreement, bank capital required capped at 8%, risk weighted for business loan at 100% and risk weighted for housing loan at 50%. The processing fees for facility are RM5,000.00 paid at beginning of the disbursement of facility. Based on bank policies, return on assets at 13%, return on equity at 10% and current tax rate is 20% Required to: (i) Calculate capital allocation (2 marks) (ii) Calculate after-tax return on equity (1 marks) Amount of liquid assets require for the facility (4 marks) (iv) Construct first stage simple statement of financial position costs: (3 marks) Financial Position Costs (First Stage) Particular (RM) Loan Liquid Assets Total Deposit Equity Total 1. Customer approach you for RM380,000.00 housing loan with tenor of 10 years. You are required to determine the minimum interest should impose. Therefore, your superior provided the following information for you to construct Statement of Financial Position Costs: . . Bank required holding 10% liquid assets to back the facility: O KNM Berhad Bond with return of 8% o Malaysia Government Securities (MGS) with return of 5%. Current bank deposits cost 3.0% and expected to remain unchanged for coming years. Given the collateral pledged against the facility, default probability for facility is 2% with 95% recovery rate. Under BASEL III Agreement, bank capital required capped at 8%, risk weighted for business loan at 100% and risk weighted for housing loan at 50%. The processing fees for facility are RM5,000.00 paid at beginning of the disbursement of facility. Based on bank policies, return on assets at 13%, return on equity at 10% and current tax rate is 20% Required to: (i) Calculate capital allocation (2 marks) (ii) Calculate after-tax return on equity (1 marks) Amount of liquid assets require for the facility (4 marks) (iv) Construct first stage simple statement of financial position costs: (3 marks) Financial Position Costs (First Stage) Particular (RM) Loan Liquid Assets Total Deposit Equity Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started