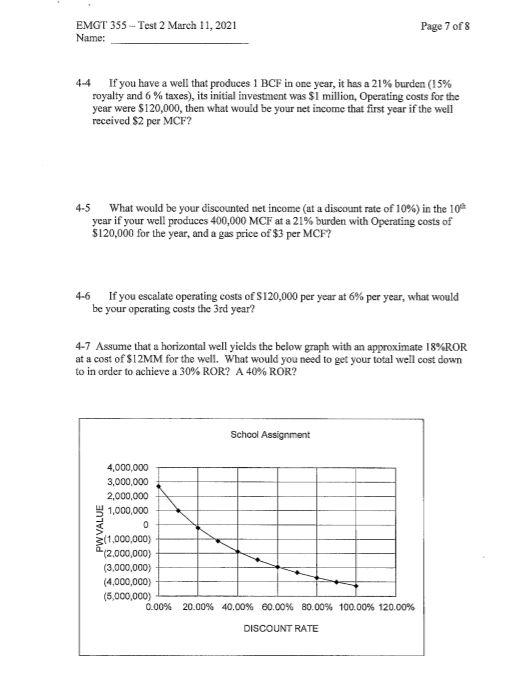

EMGT 355 - Test 2 March 11, 2021 Name: Page 7 of 8 44 If you have a well that produces 1 BCF in one year, it has a 21% burden (15% royalty and 6 % taxes), its initial investment was $1 million, Operating costs for the year were $120,000, then what would be your net income that first year if the well received S2 per MCF2 4-5 What would be your discounted net income (at a discount rate of 10%) in the 10% year if your well produces 400,000 MCF at a 21% burden with Operating costs of $120,000 for the year, and a gas price of $3 per MCF? 4-6 If you escalate operating costs of S120,000 per year at 6% per year, what would be your operating costs the 3rd year? 4-7 Assume that a horizontal well yields the below graph with an approximate 18%ROR at a cost of $12MM for the well. What would you need to get your total well cost down to in order to achieve a 30% ROR? A 40% ROR? School Assignment PW VALUE 4,000,000 3,000,000 2,000,000 1,000,000 0 11,000,000) (2.000,000) (3.000.000) (4,000,000) (5,000,000) 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% DISCOUNT RATE EMGT 355 - Test 2 March 11, 2021 Name: Page 7 of 8 44 If you have a well that produces 1 BCF in one year, it has a 21% burden (15% royalty and 6 % taxes), its initial investment was $1 million, Operating costs for the year were $120,000, then what would be your net income that first year if the well received S2 per MCF2 4-5 What would be your discounted net income (at a discount rate of 10%) in the 10% year if your well produces 400,000 MCF at a 21% burden with Operating costs of $120,000 for the year, and a gas price of $3 per MCF? 4-6 If you escalate operating costs of S120,000 per year at 6% per year, what would be your operating costs the 3rd year? 4-7 Assume that a horizontal well yields the below graph with an approximate 18%ROR at a cost of $12MM for the well. What would you need to get your total well cost down to in order to achieve a 30% ROR? A 40% ROR? School Assignment PW VALUE 4,000,000 3,000,000 2,000,000 1,000,000 0 11,000,000) (2.000,000) (3.000.000) (4,000,000) (5,000,000) 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% DISCOUNT RATE