Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EMHIR is a European MNC that has not accessed the European debt market because of concern about the potential appreciation of the EUR against the

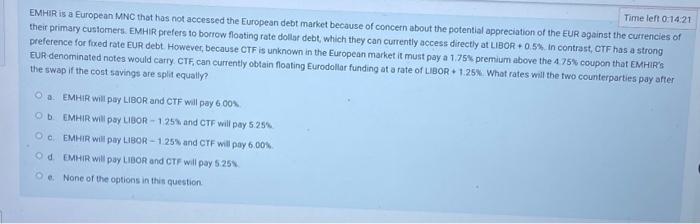

EMHIR is a European MNC that has not accessed the European debt market because of concern about the potential appreciation of the EUR against the currencies of their primary customers. EMHIR prefers to borrow floating rate dollar debt, which they can currently access directly at LIBOR +0.5%. In contrast, CTF has a strong preference for fixed rate EUR debt. However, because CTF is unknown in the European market it must pay a 1.75% premium above the 4.75% coupon that EMHIR's EUR-denominated notes would carry. CTF, can currently obtain floating Eurodollar funding at a rate of LIBOR + 1.25%. What rates will the two counterparties pay after the swap if the cost savings are split equally? O a. EMHIR will pay LIBOR and CTF will pay 6.00%. O b. O c. O d. Oe. EMHIR will pay LIBOR - 1.25% and CTF will pay 5.25%. EMHIR will pay LIBOR - 1.25% and CTF will pay 6.00%. EMHIR will pay LIBOR and CTF will pay 5.25%. None of the options in this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started