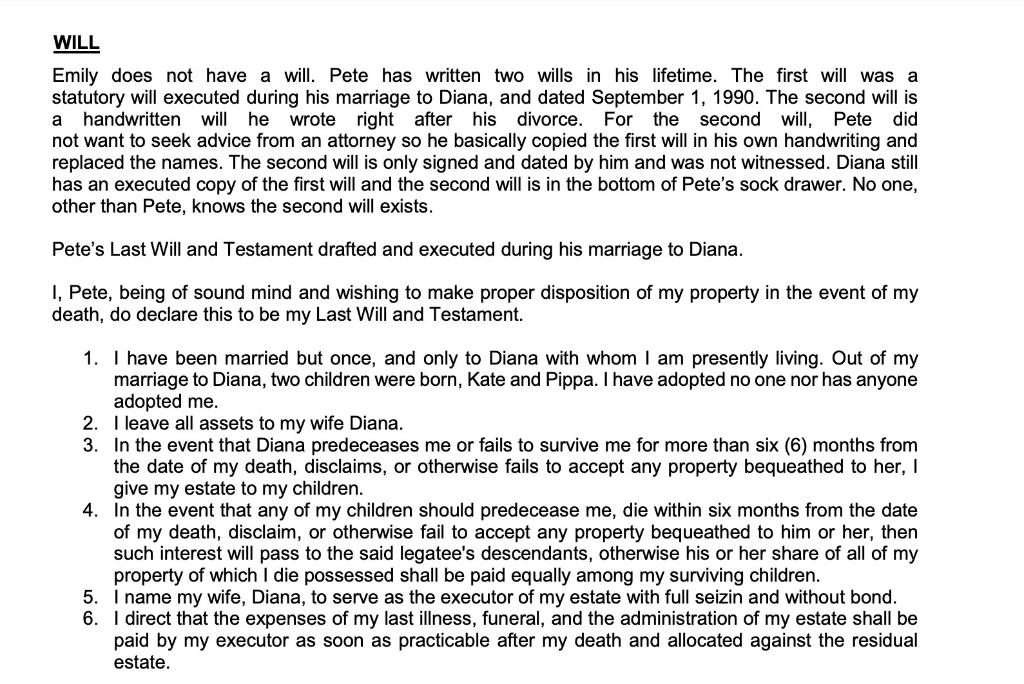

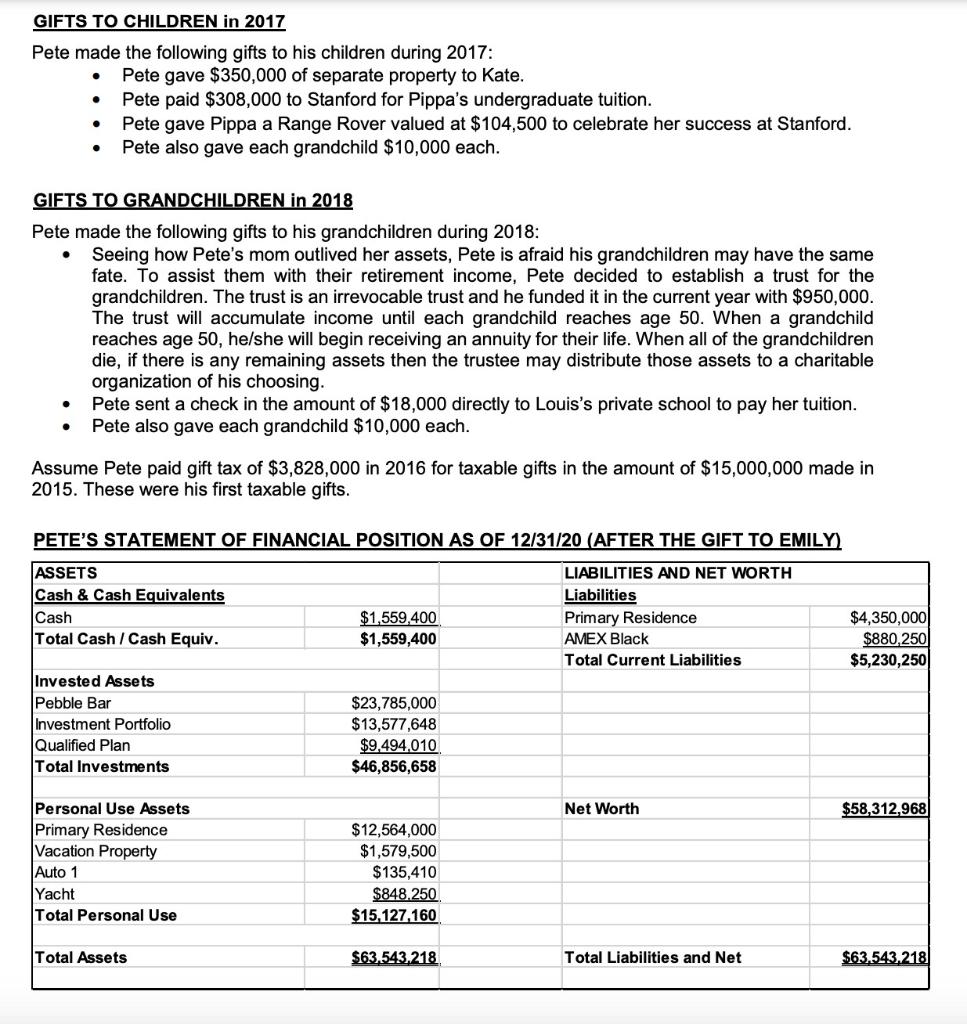

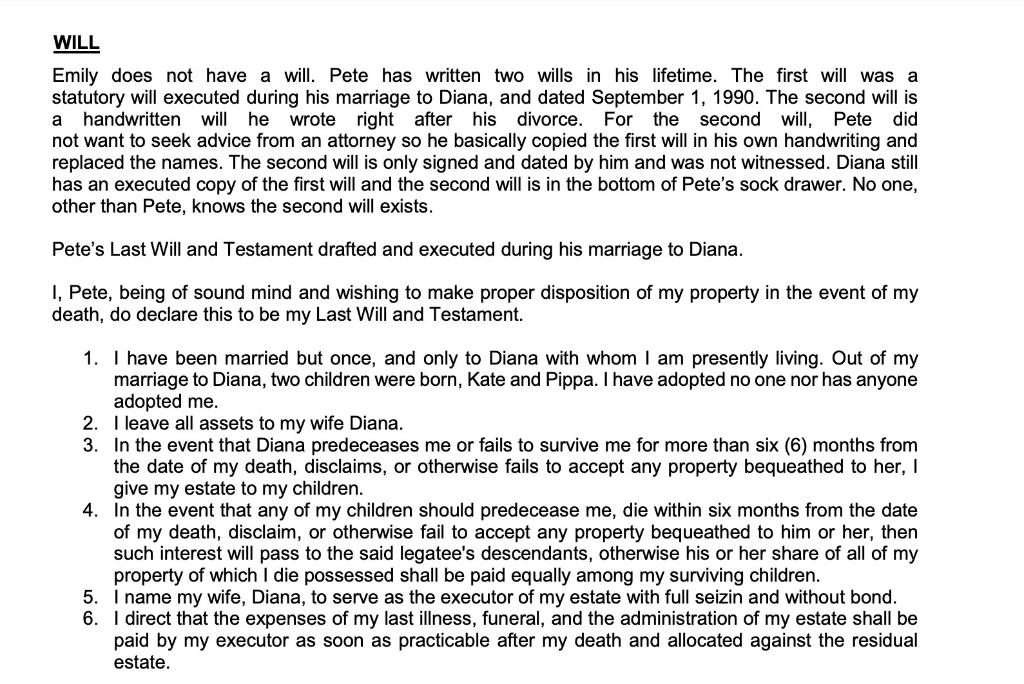

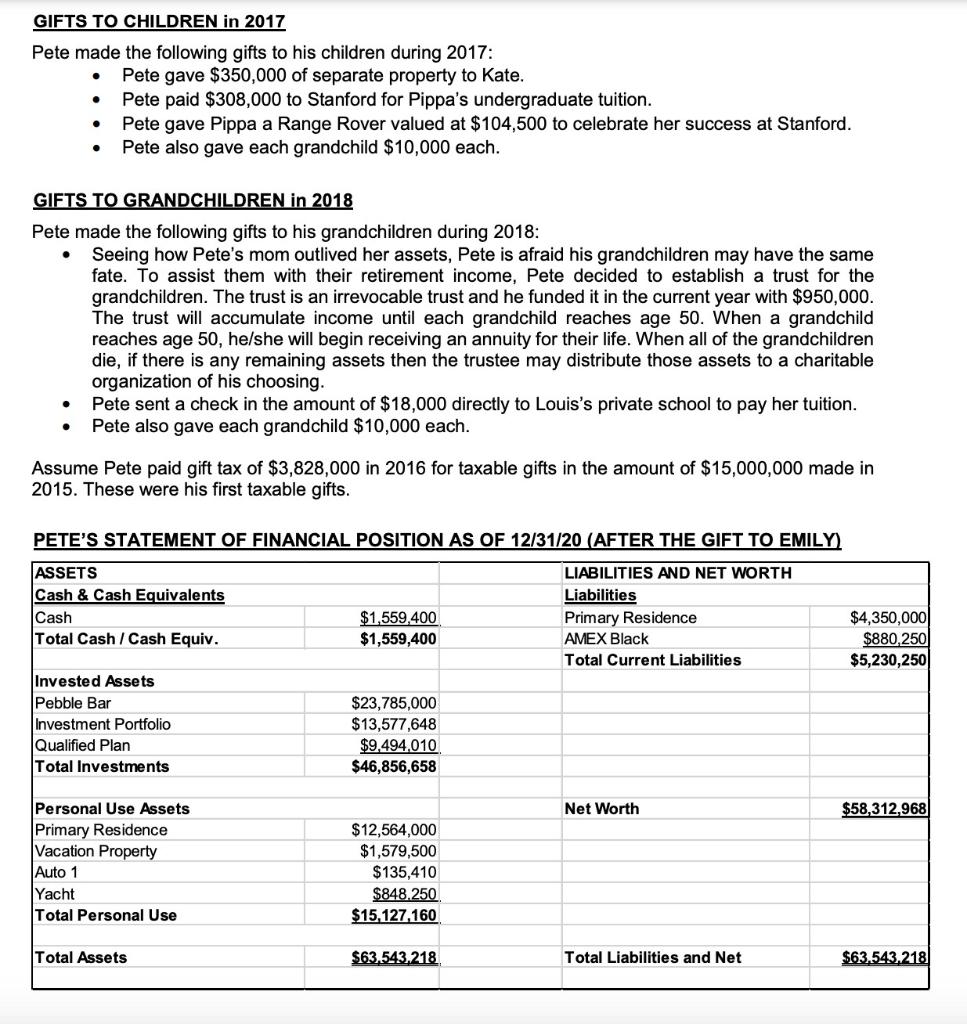

Emily does not have a will. Pete has written two wills in his lifetime. The first will was a statutory will executed during his marriage to Diana, and dated September 1, 1990. The second will is a handwritten will he wrote right after his divorce. For the second will, Pete did not want to seek advice from an attorney so he basically copied the first will in his own handwriting and replaced the names. The second will is only signed and dated by him and was not witnessed. Diana still has an executed copy of the first will and the second will is in the bottom of Pete's sock drawer. No one, other than Pete, knows the second will exists. Pete's Last Will and Testament drafted and executed during his marriage to Diana. I, Pete, being of sound mind and wishing to make proper disposition of my property in the event of my death, do declare this to be my Last Will and Testament. 1. I have been married but once, and only to Diana with whom I am presently living. Out of my marriage to Diana, two children were born, Kate and Pippa. I have adopted no one nor has anyone adopted me. 2. I leave all assets to my wife Diana. 3. In the event that Diana predeceases me or fails to survive me for more than six (6) months from the date of my death, disclaims, or otherwise fails to accept any property bequeathed to her, I give my estate to my children. 4. In the event that any of my children should predecease me, die within six months from the date of my death, disclaim, or otherwise fail to accept any property bequeathed to him or her, then such interest will pass to the said legatee's descendants, otherwise his or her share of all of my property of which I die possessed shall be paid equally among my surviving children. 5. I name my wife, Diana, to serve as the executor of my estate with full seizin and without bond. 6. I direct that the expenses of my last illness, funeral, and the administration of my estate shall be paid by my executor as soon as practicable after my death and allocated against the residual estate. GIFTS TO CHILDREN in 2017 Pete made the following gifts to his children during 2017 : - Pete gave $350,000 of separate property to Kate. - Pete paid $308,000 to Stanford for Pippa's undergraduate tuition. - Pete gave Pippa a Range Rover valued at $104,500 to celebrate her success at Stanford. - Pete also gave each grandchild $10,000 each. GIFTS TO GRANDCHILDREN in 2018 Pete made the following gifts to his grandchildren during 2018: - Seeing how Pete's mom outlived her assets, Pete is afraid his grandchildren may have the same fate. To assist them with their retirement income, Pete decided to establish a trust for the grandchildren. The trust is an irrevocable trust and he funded it in the current year with $950,000. The trust will accumulate income until each grandchild reaches age 50 . When a grandchild reaches age 50 , he/she will begin receiving an annuity for their life. When all of the grandchildren die, if there is any remaining assets then the trustee may distribute those assets to a charitable organization of his choosing. - Pete sent a check in the amount of $18,000 directly to Louis's private school to pay her tuition. - Pete also gave each grandchild $10,000 each. Assume Pete paid gift tax of $3,828,000 in 2016 for taxable gifts in the amount of $15,000,000 made in 2015. These were his first taxable gifts. 1. Pete and Emily decide to make an estate plan. What are the appropriate steps to create an estate plan? What practitioners should be included in the estate planning discussions and what are the roles of each practitioner? (Value - 12 points) 2. Assuming Pete died December 31, 2020, calculate his gross estate. For full credit, identify each asset and its value. (Value 10 points) 3. Assuming Pete died December 31,2020 , calculate his probate estate. For full credit, identify each asset and its value. (Value - 10 points) 4. Assuming Pete died December 31, 2020, calculate the Marital Deduction available for estate transfers to Emily. (Value - 10 points) Emily does not have a will. Pete has written two wills in his lifetime. The first will was a statutory will executed during his marriage to Diana, and dated September 1, 1990. The second will is a handwritten will he wrote right after his divorce. For the second will, Pete did not want to seek advice from an attorney so he basically copied the first will in his own handwriting and replaced the names. The second will is only signed and dated by him and was not witnessed. Diana still has an executed copy of the first will and the second will is in the bottom of Pete's sock drawer. No one, other than Pete, knows the second will exists. Pete's Last Will and Testament drafted and executed during his marriage to Diana. I, Pete, being of sound mind and wishing to make proper disposition of my property in the event of my death, do declare this to be my Last Will and Testament. 1. I have been married but once, and only to Diana with whom I am presently living. Out of my marriage to Diana, two children were born, Kate and Pippa. I have adopted no one nor has anyone adopted me. 2. I leave all assets to my wife Diana. 3. In the event that Diana predeceases me or fails to survive me for more than six (6) months from the date of my death, disclaims, or otherwise fails to accept any property bequeathed to her, I give my estate to my children. 4. In the event that any of my children should predecease me, die within six months from the date of my death, disclaim, or otherwise fail to accept any property bequeathed to him or her, then such interest will pass to the said legatee's descendants, otherwise his or her share of all of my property of which I die possessed shall be paid equally among my surviving children. 5. I name my wife, Diana, to serve as the executor of my estate with full seizin and without bond. 6. I direct that the expenses of my last illness, funeral, and the administration of my estate shall be paid by my executor as soon as practicable after my death and allocated against the residual estate. GIFTS TO CHILDREN in 2017 Pete made the following gifts to his children during 2017 : - Pete gave $350,000 of separate property to Kate. - Pete paid $308,000 to Stanford for Pippa's undergraduate tuition. - Pete gave Pippa a Range Rover valued at $104,500 to celebrate her success at Stanford. - Pete also gave each grandchild $10,000 each. GIFTS TO GRANDCHILDREN in 2018 Pete made the following gifts to his grandchildren during 2018: - Seeing how Pete's mom outlived her assets, Pete is afraid his grandchildren may have the same fate. To assist them with their retirement income, Pete decided to establish a trust for the grandchildren. The trust is an irrevocable trust and he funded it in the current year with $950,000. The trust will accumulate income until each grandchild reaches age 50 . When a grandchild reaches age 50 , he/she will begin receiving an annuity for their life. When all of the grandchildren die, if there is any remaining assets then the trustee may distribute those assets to a charitable organization of his choosing. - Pete sent a check in the amount of $18,000 directly to Louis's private school to pay her tuition. - Pete also gave each grandchild $10,000 each. Assume Pete paid gift tax of $3,828,000 in 2016 for taxable gifts in the amount of $15,000,000 made in 2015. These were his first taxable gifts. 1. Pete and Emily decide to make an estate plan. What are the appropriate steps to create an estate plan? What practitioners should be included in the estate planning discussions and what are the roles of each practitioner? (Value - 12 points) 2. Assuming Pete died December 31, 2020, calculate his gross estate. For full credit, identify each asset and its value. (Value 10 points) 3. Assuming Pete died December 31,2020 , calculate his probate estate. For full credit, identify each asset and its value. (Value - 10 points) 4. Assuming Pete died December 31, 2020, calculate the Marital Deduction available for estate transfers to Emily. (Value - 10 points)