Answered step by step

Verified Expert Solution

Question

1 Approved Answer

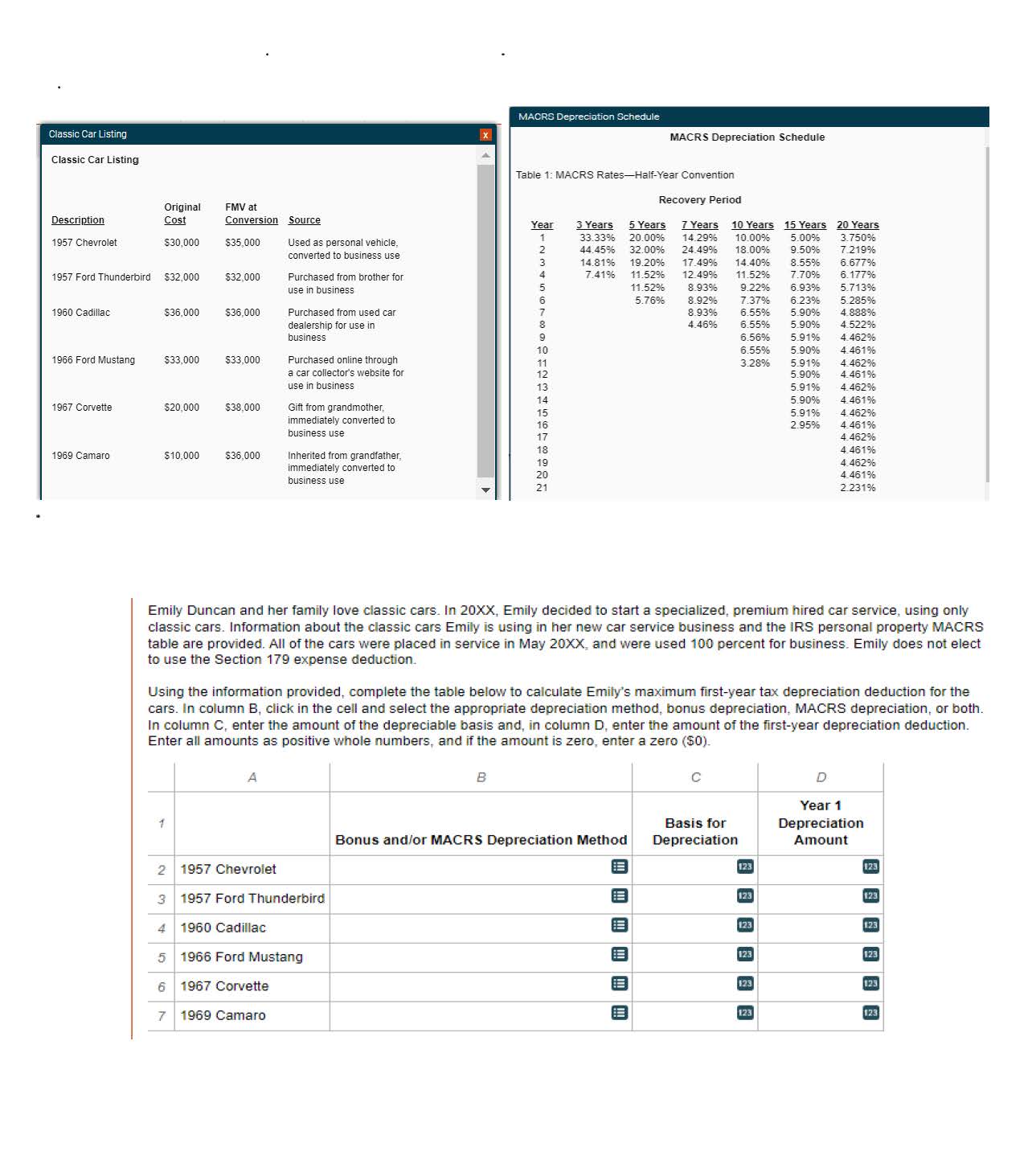

Emily Duncan and her family love classic cars. In 2 0 XX , Emily decided to start a specialized, premium hired car service, using only

Emily Duncan and her family love classic cars. In XX Emily decided to start a specialized, premium hired car service, using only classic cars. Information about the classic cars Emily is using in her new car service business and the IRS personal property MACRS table are provided. All of the cars were placed in service in May XX and were used percent for business. Emily does not elect to use the Section expense deduction.

Using the information provided, complete the table below to calculate Emily's maximum firstyear tax depreciation deduction for the cars. In column B click in the cell and select the appropriate depreciation method, bonus depreciation, MACRS depreciation, or both. In column C enter the amount of the depreciable basis and, in column D enter the amount of the firstyear depreciation deduction. Enter all amounts as positive whole numbers, and if the amount is zero, enter a zero $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started