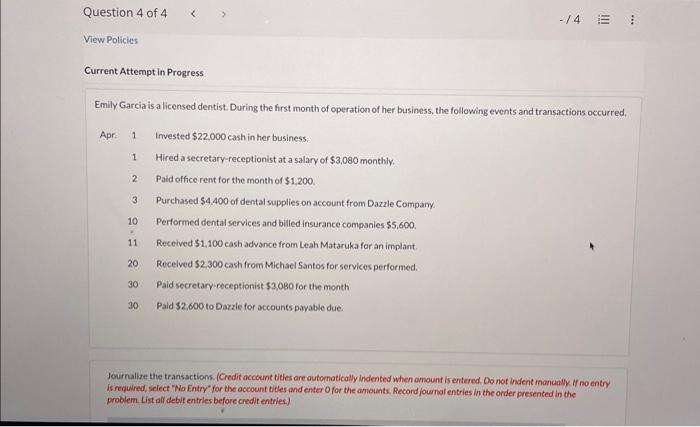

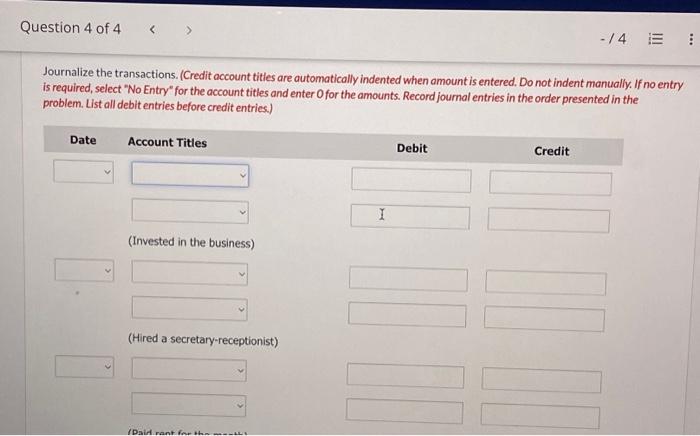

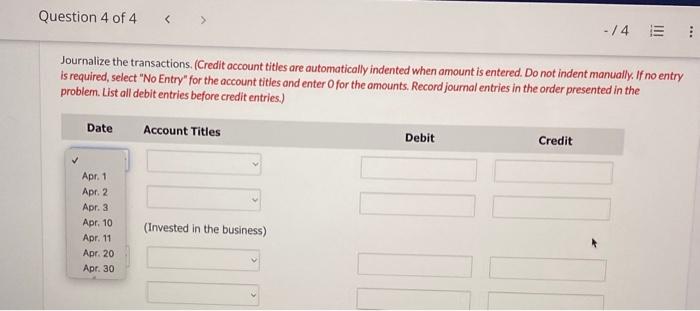

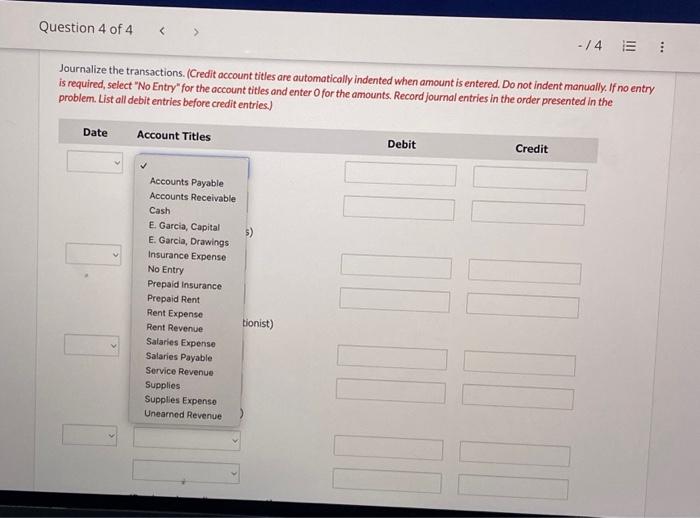

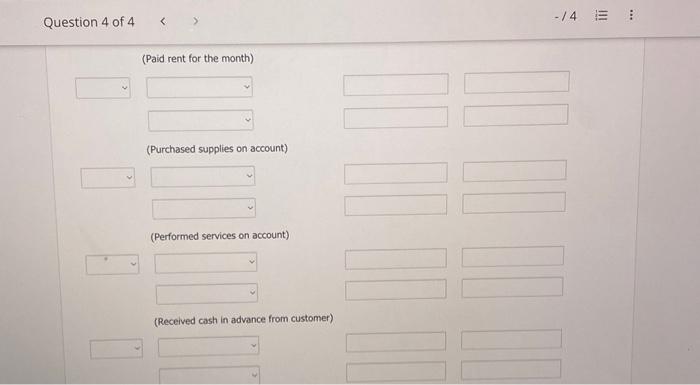

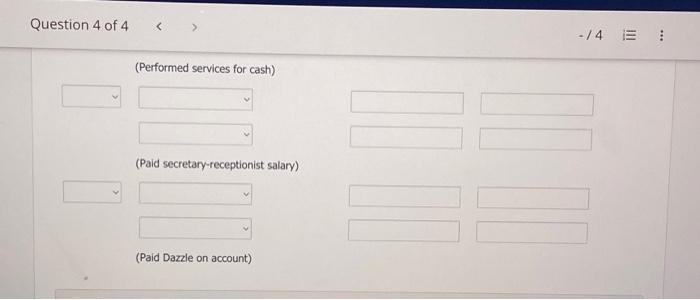

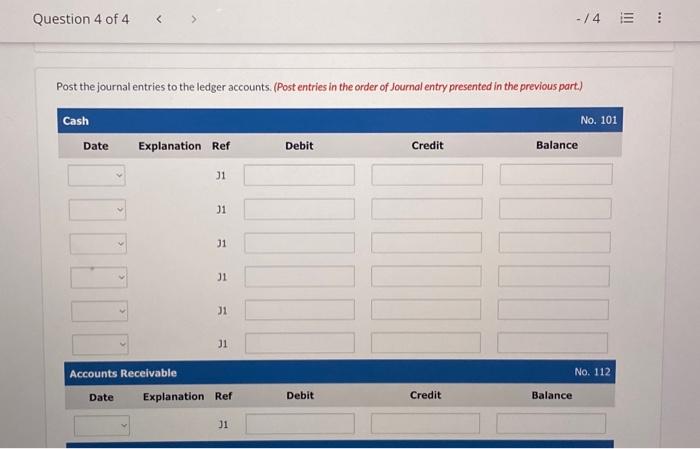

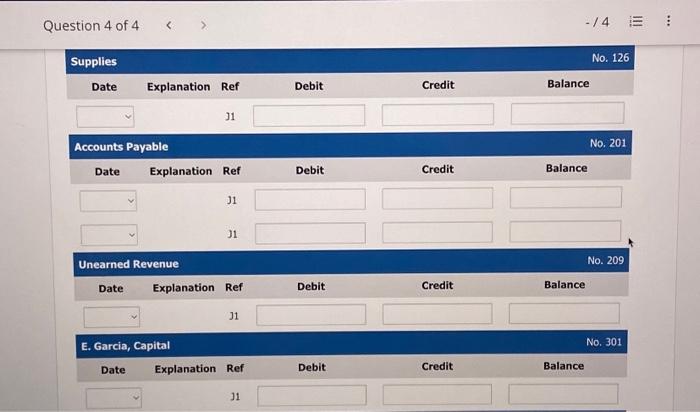

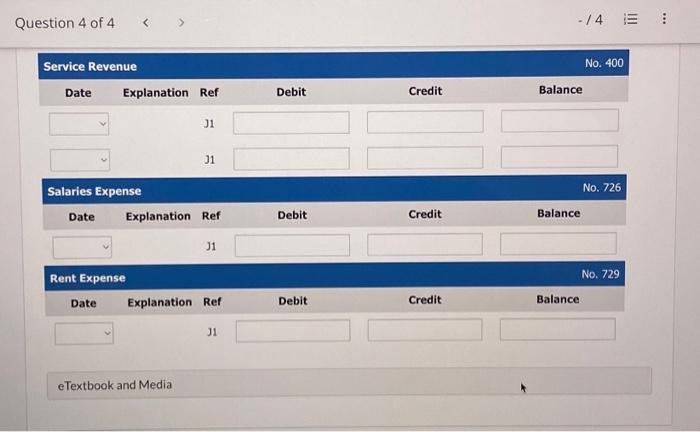

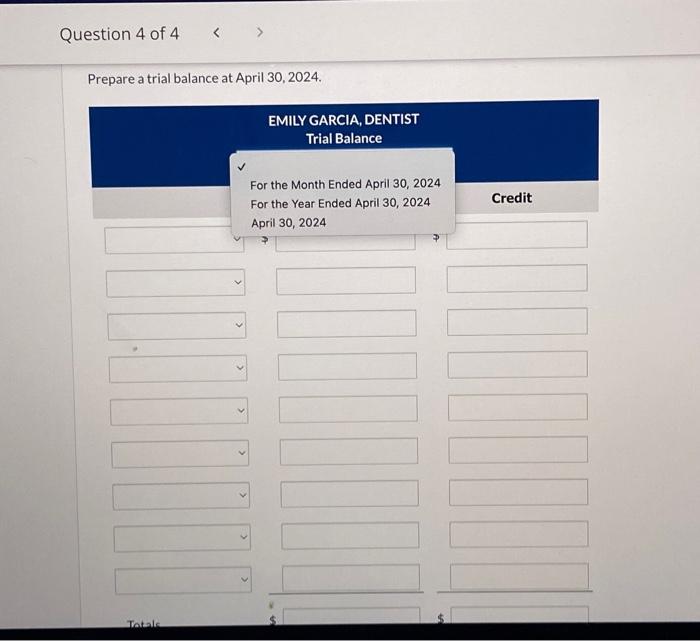

Emily Garcia is a licensed dentist During the first month of operation of her business, the following events and transactions occurred. Apr: 1 Invested $22,000 cash in her business: 1 Hired a secretary-receptionist at a salary of $3,080 monthly. 2. Paid office rent for the month of $1,200. 3 Purchased $4,400 of dental supplies on account from Dazzle Company. 10 Performed dental services and billed insurance companies $5,600. 11 Received $1,100 cash advance from Leah Mataruka for an implant. 20. Recelved \$2,300 cash from Michael Santos for services performed. 30 Paid secretary-receptionist $3,080 for the month 30 Paid $2,600 to Dazze for accounts payable due. Jeurnalise the transactions. (Credit occount tities are outomotically indented when amount is entered, Do not inderit monually. If no entry is required, select "No Entry" for the occount titles and enter Ofor the amounts. Record foumal entries in the order presented in the problem (ist all debit entries before credit entries) Journalize the transactions. (Credit account titles are automatically indented when amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record joumal entries in the order presented in the problem. List all debit entries before credit entries) Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter O for the amounts. Record joumal entries in the order presented in the problem. List all debit entries before credit entries) Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter ofor the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries) Question 4 of 4 14 (Paid rent for the month) (Purchased supplies on account) (Performed services on account) (Received cash in advance from customer) Question 4 of 4 (Performed services for cash) (Paid secretary-receptionist salary) (Paid Dazzle on account) Post the journal entries to the ledger accounts. (Post entries in the order of Journal entry presented in the previous part)) Question 4 of 4 14 Question 4 of 4 eTextbook and Media Prepare a trial balance at April 30, 2024