Answered step by step

Verified Expert Solution

Question

1 Approved Answer

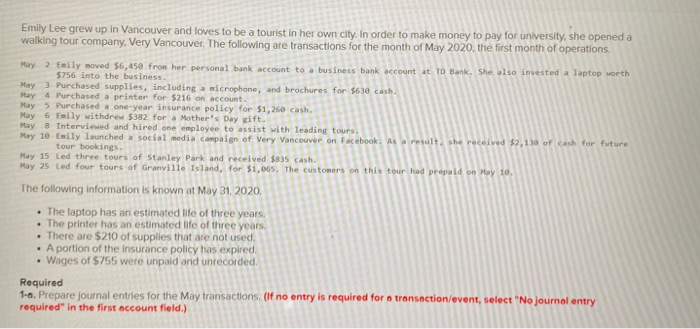

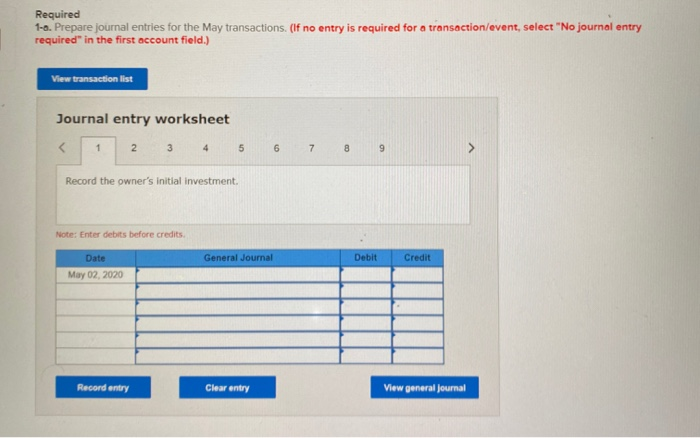

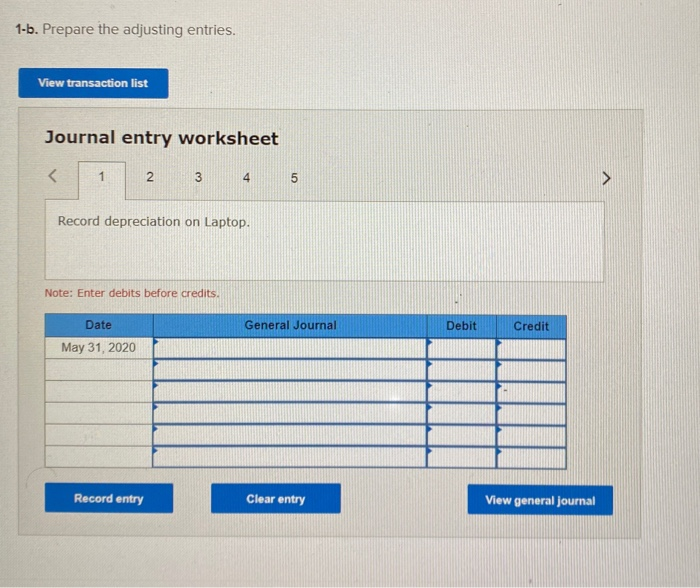

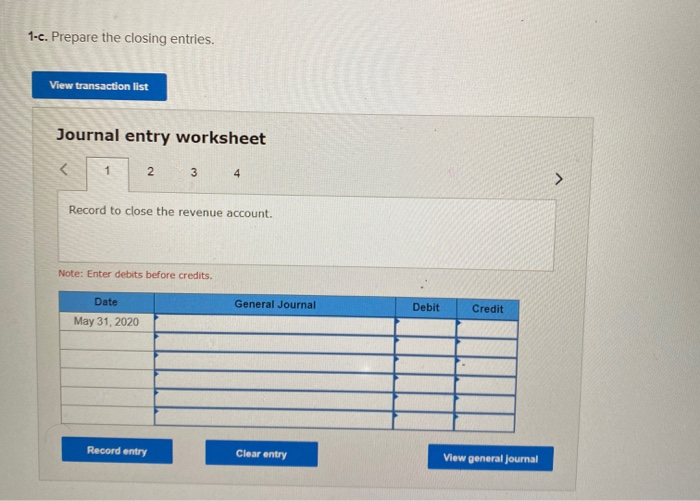

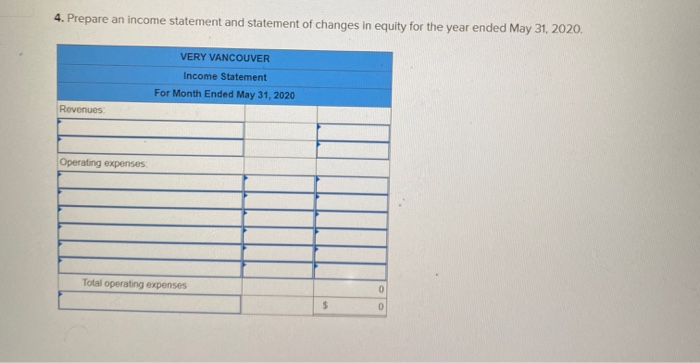

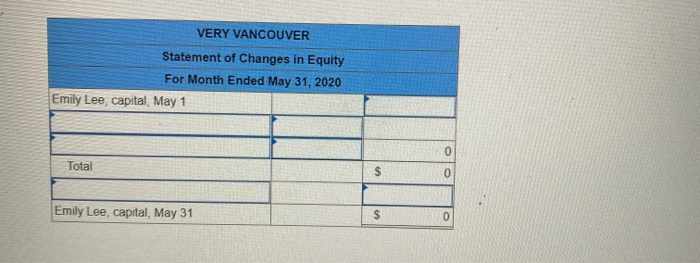

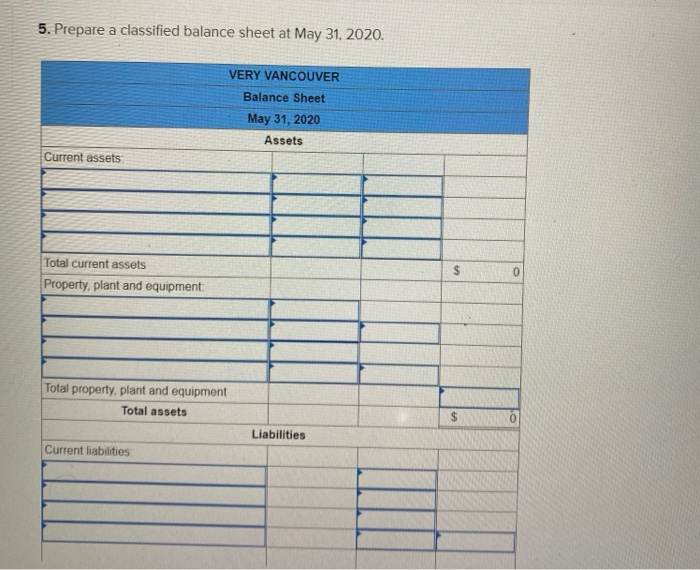

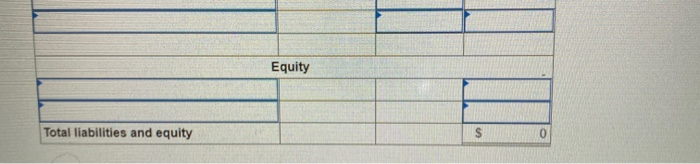

Emily Lee grew up in Vancouver and loves to be a tourist in her own city. In order to make money to pay for university,

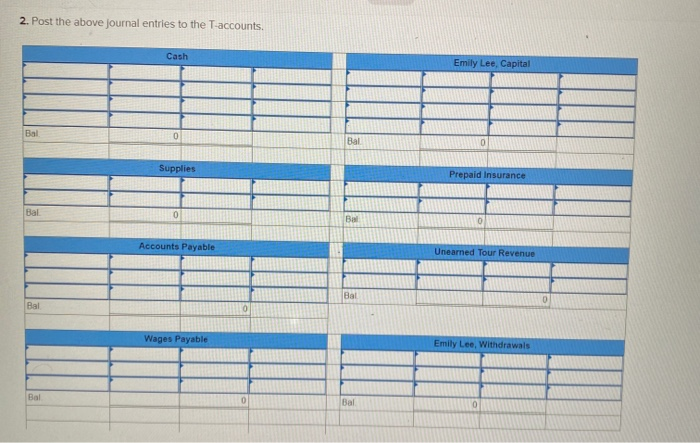

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

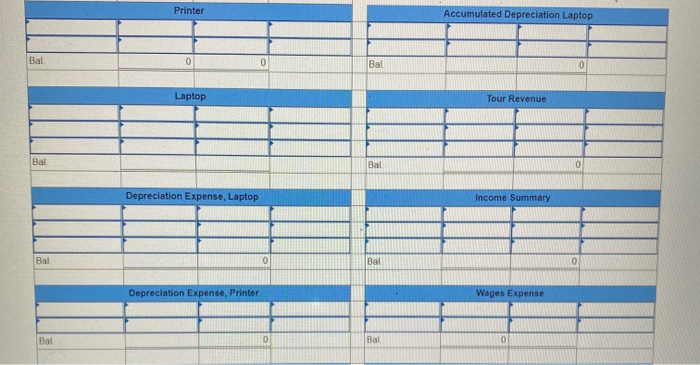

Step: 2

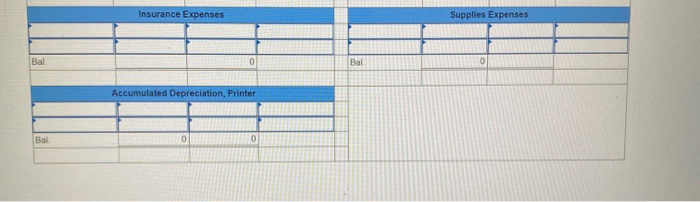

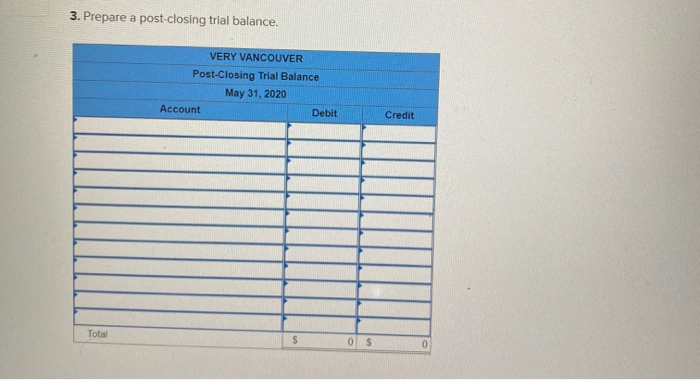

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started