Question

Emirates NBD, the leading banking group in the region, was formed on 16 October, 2007 when the shares of Emirates NBD were officially listed on

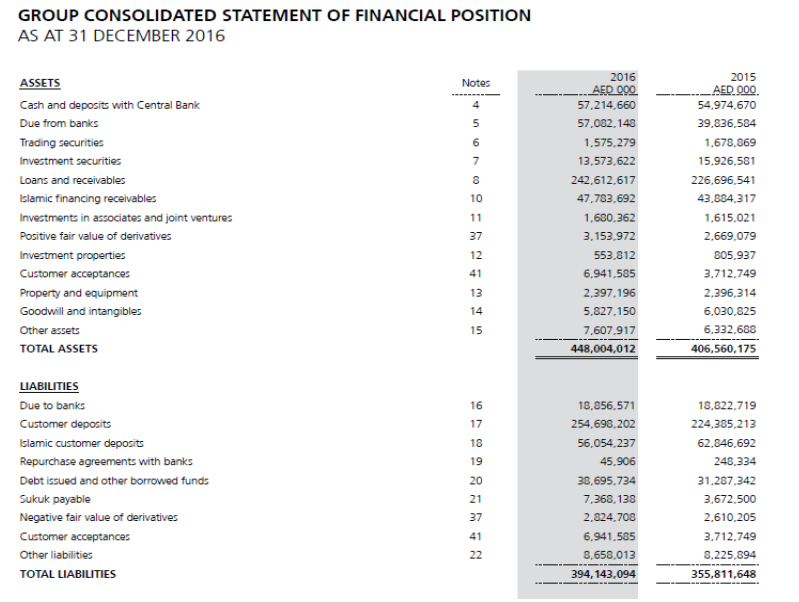

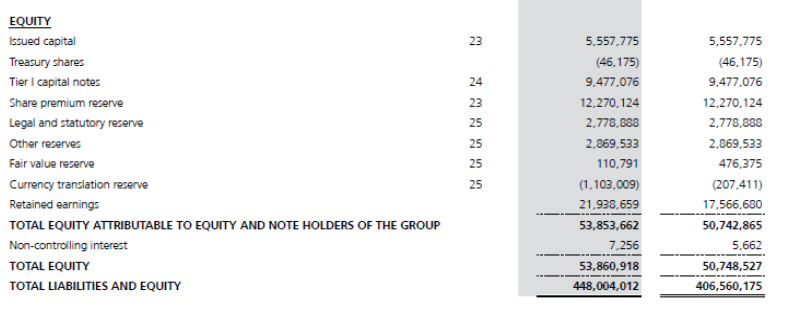

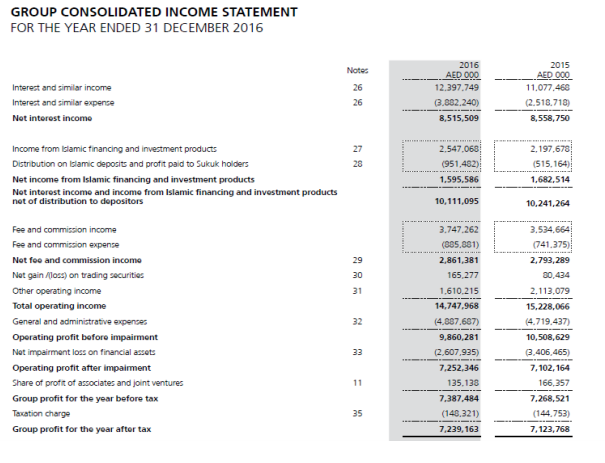

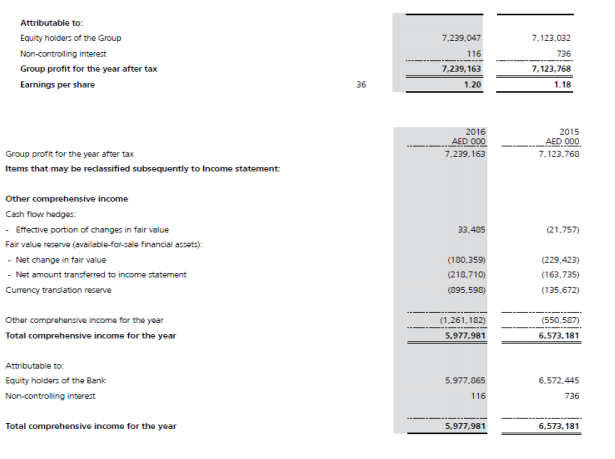

Emirates NBD, the leading banking group in the region, was formed on 16 October, 2007 when the shares of Emirates NBD were officially listed on the Dubai Financial Market (DFM). The Emirates NBD 2007 merger between Emirates Bank International (EBI) and the National Bank of Dubai (NBD), became a regional consolidation blueprint for the banking and finance sector as it combined the second and fourth largest banks in the United Arab Emirates (UAE) to form a banking champion capable of delivering enhanced value across corporate, retail, private, Islamic and investment banking throughout the region. In 2013, Emirates NBD celebrated its 50th anniversary, marking the Group's outstanding achievements while highlighting the bank's solid historical and financial foundations as well as its promising future. The Group is also a major player in the corporate banking arena. With fast-growing Islamic banking affiliated entities, strong investment, private banking and Global Markets & Treasury services and a leadership in the field of asset management products and brokerage services, Emirates NBD is well positioned to grow and deliver outstanding value to its shareholders, customers and employees. From the financial information available to you, calculate the following to access the annual picture of Emirates NBD. A. Horizontal Analysis (3 marks) B. Vertical analysis (3 marks) C. Calculate the following ratios (0.5 x 14 =7) 1. Working capital 2. Current ratio 3. Current cash debt coverage 4. Debt to assets ratio 5. Cash debt coverage Spring- 2017-2018 Individual Assignment Page 3 of 7 6. Times interest earned 7. Free cash flow 8. Earnings per share 9. Price-earnings ratio 10. Profit margin 11. Return on assets 12. Asset turnover 13. Payout ratio 14. Times interest earned

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started